Pakistan is on the brink of imposing a blanket ban on crypto with the country’s Minister of Finance stating in a recent announcement that the asset class “will never be legalized.”

Was the Pakistan Crypto Ban Ordered by the FATF?

Local media platforms reporting on the potential crypto ban say that the State Bank of Pakistan (SBP) and the Information Technology Ministry were instructed by the Financial Action Task Force (FATF), the intergovernmental agency established by the G7, to implement a complete ban on crypto.

According to the Finance Minister of State for Finance and Revenue Aisha Ghaus Pasha, to exclude Pakistan from the “grey list” of countries deemed to have inadequate Anti-Money Laundering and Counter-Terrorist Financing records, the FATF set the crypto ban as a requirement that had to be met.

Therefore, she believed that the proposed ban was crucial in ensuring that Pakistan complied with international standards on measures to combat money laundering and terrorist financing.

However, according to another recent report by CoinDesk on the soon-to-be-imposed crypto ban, the FATF refuted Pakistan’s claims saying the agency did “not require countries to indiscriminately ban virtual assets and virtual asset service providers.”

The anti-money laundering watchdog’s “grey list” is often viewed as a warning to regimes that are not aligning with the internationally agreed practices for countering terrorist financing and money laundering.

Pasha’s pronouncement before the Senate Standing Committee last week was immediately interpreted as a fresh blanket ban on cryptocurrencies. Moreover, there were reports of orders from the Finance Ministry for authorities to start the process of banning digital assets in Pakistan.

The country’s economy is in turmoil partly due to the volatile political situation that has taken long to resolve.

This is not the first time Pakistan declared a total crypto ban. In January 2022, the central bank took a strong stand against digital currencies, CoinDesk reported at the time.

Providers of virtual asset services must adhere to the same guidelines as financial institutions, FATF maintains. This includes conducting know-your-customer (KYC) procedures, maintaining records, and submitting suspicious transaction reports.

Providers must also adhere to the travel rule by collecting and sharing transaction information above a certain threshold relating to crypto.

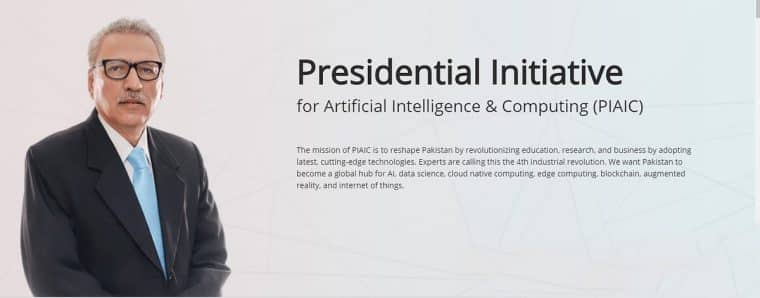

Pakistan Exploring Artificial Intelligence (AI)

Although dealing with a potential blanket ban on crypto, the South Asian nation isn’t set on eliminating all of fastest-growing industries. It is planning to train more than one million IT graduates in AI and allied technologies. The country hopes to achieve this milestone by 2027.

“To achieve this, at least 10,000 new trainers will be required to impart high-impact AI & Allied Technologies education,” the National Artificial Intelligence Policy said in a written statement.

According to a study carried out by the Ministry of Information and Telecommunication, a majority of Pakistan’s workforce in the computing and IT industry have little to no skills in AI and allied technologies.

The mission to train IT graduates in disruptive AI technology aligns with the ministry’s broader plan to invest in not less than 1,000 AI-enabled research and development (R&D) programs in addition to funding private sector initiatives by 2026.

Recommended Articles:

- How to Buy AiDoge Token – Easy Guide

- 82% of Gig Workers Happier Working on Their Own – Here’s How to Succeed Freelancing in Web3

AiDoge (AI) - Meme Generation Platform

- Create & Share AI-Generated Memes

- Newest Meme Coin in the AI Crypto Sector

- Listed on MEXC, Uniswap

- Token-Based Credit System

- Stake $AI Tokens to Earn Daily Rewards