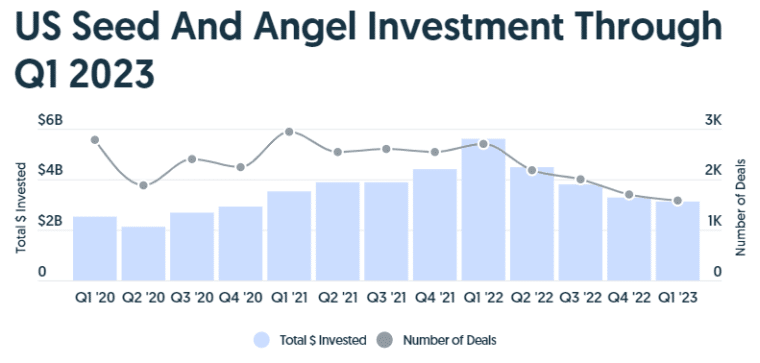

Seed funding and angel investment to US start-ups continued their decline in the first quarter of 2023, falling 45% YoY to $3.1 billion, according to Crunchbase data.

After a blockbuster period of growth from 2020 into early 2022, fuelled by low-interest rates, high equity valuations and a post-pandemic reopening fuelled boom in economic growth, seed funding started to fall off a cliff in Q2 2022.

That coincides with when the US Federal Reserve started aggressively lifting interest rates in order to tame a red-hot economy that had sent inflation well above the central bank’s 2.0% inflation target.

Versus Q4 2022’s $3.3 billion in seed and angel funding raised, Q1 2023 funding was down 6%.

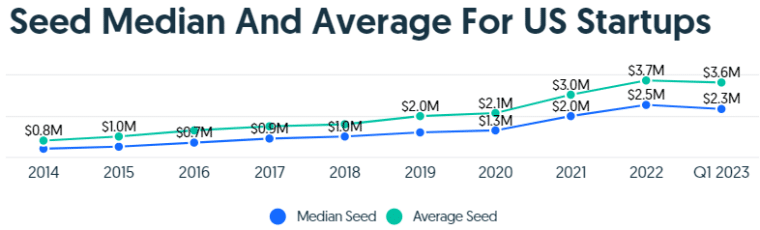

Unsurprisingly, the decline in industry-wide seed and angel funding has gone hand in hand with a decline in the size of each seed round for a typical company.

The median seed and angel funding round was $2.5 million, down from $2.5 million a year earlier.

The mean seed and angel funding round size was $3.6 million, down slightly from $3.7 million a year earlier.

The number of deals was also down around 42% to 1,574 from 2,704 in Q1 2022.

Venture Capital Also Declining

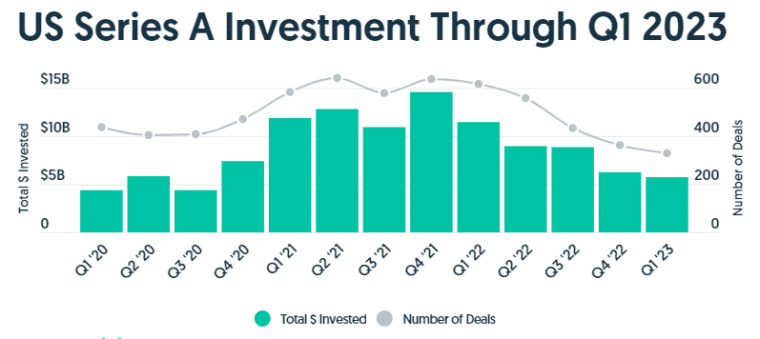

Series A financing, which is often referred to as the first round of funding raised from venture capital firms by a start-up after seed and angel funding rounds have been completed, is also in decline.

Since peaking at $14.5 billion in Q4 2021, Series A financing has dropped a staggering 60% to $5.7 billion.

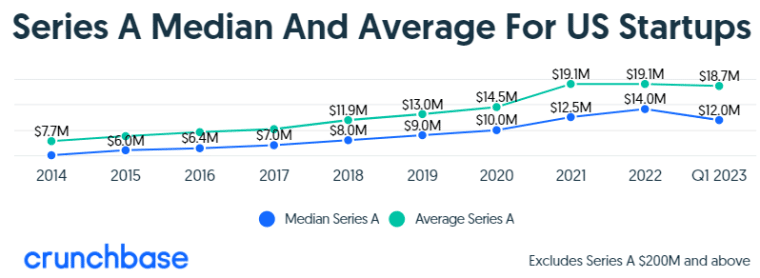

Median and mean deal sizes have also dropped from $14 billion to $12 billion and from $19.1 billion to $18.7 billion respectively.

And with many betting that, amid the dual headwinds of the Fed’s aggressive rate hiking cycle of 2022 and early 2023 plus a contraction in bank lending amid the ongoing crisis amongst regional banking names, the US economy is headed towards recession later this year, angel and series A funding is probably set to continue its decline throughout 2023.

Related Articles

- US Government to Invest in Cultivating Tech Hubs Across the Country With $500 Million

- E-Commerce Funding Startup 8fig Raises 9 Figure Series B ($140 Million)

- Best Yield Farming Crypto Platforms 2023 – How to Yield Farm Crypto

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards