All crypto investors know that even the top tokens on the market such as Bitcoin and Ethereum can suffer huge swings in price and face consistent volatility.

This time last year, BTC was priced at more than $40,000, before dropping all the way to $16k before returning back over $30k in an extremely bullish start to 2023.

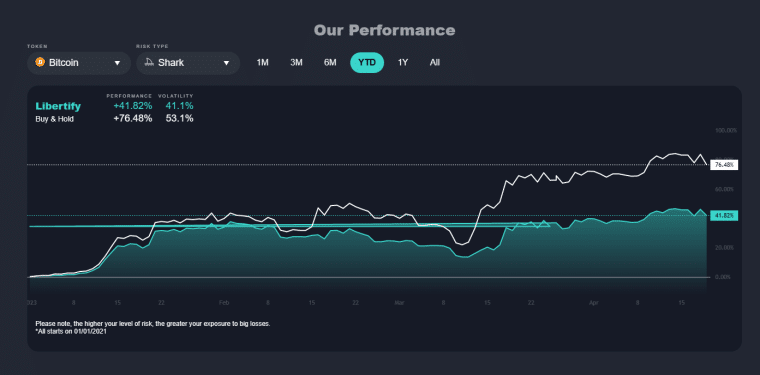

AI crypto investment solution Libertify has introduced a feature allowing users to manage that volatility – and their own risk appetite – more closely.

Dubbed the Crypto Seatbelt, Libertify puts its users in total control of their holdings.

What is the Crypto Seatbelt?

The Crypto Setablet is a concept that allows users to make a daily assessment of their portfolio, allowing them to leave a certain amount in and take a certain amount out in cash in the event of a decline.

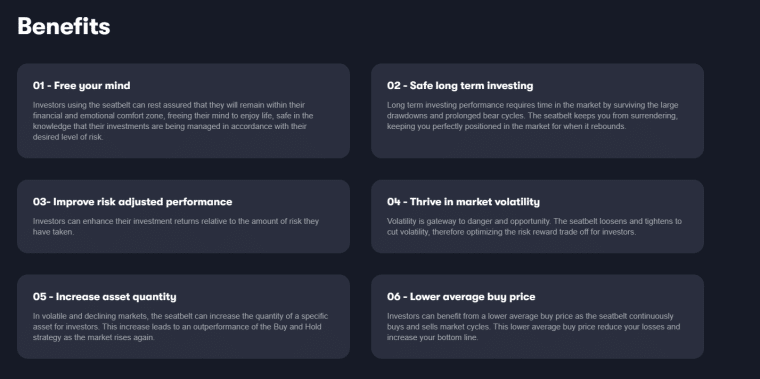

It is a dynamic allocation of assets and can be adjusted based on a user’s personal risk profile.

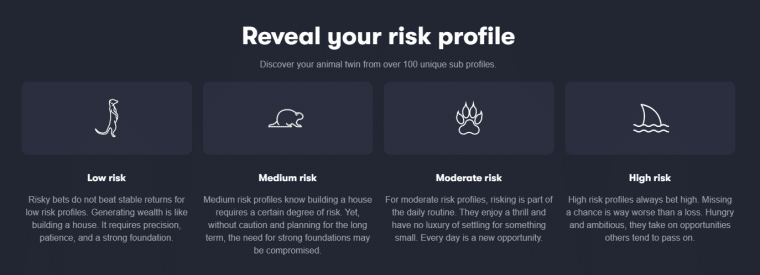

Libertify attaches one of four risk levels – Meerkat (low), Beever (medium), Shark (moderate) and Tiger (high) – on each user from over 100 unique sub-profiles and then continually monitors them through advanced data analysis and proprietary financial techniques.

This allows the exchange to provide trading recommendations specifically tailored to each investor’s needs, risk tolerance and objectives.

Libertify combines cutting-edge technology – including the use of Artificial Intelligence (AI) – with years of industry expertise to allow investors to make emotionless decisions and reach their financial goals.

Libertify CEO Steve Rosenblum has described the Crypto Seatbelt as aiming to “reduce the risks associated with crypto investment and securely accompany the investor to build wealth safely.”

- Read our full Libertify review.

How Does the Crypto Seatbelt Work?

The technology combines three pillars, a risk-scoring engine, a financial market algorithm and an AI nudging engine that motivates users to take action.

All new Libertify customers undergo a risk assessment when they join the exchange, with the risk-scoring engine feeding in a number of unique data points and individual characteristics to create a risk profile.

These include:

- An investor’s portfolio content and composition

- Token characteristics

- Market context and sentiment

- An investor’s interactions with Libertify advice

- Lookalike/clustering methods

The risk score then fluctuates over time based on a user’s behavior on the platform, with the algorithm determining a daily position for each of a user’s assets and providing individualized suggestions based on that profile.

The recommendations algorithm is based on following trends, momentum and a mean reversing/contrarian strategy, three well-established methodologies in hundreds of years of trading.

A core belief is that the markets are not completely efficient and prices only reflect the current situation. Therefore, with many moving parts and active participants, it leads to a huge level of randomness that investors must act upon and react to.

It is extremely difficult for most traders and investors to keep on top of every bit of news or financial detail in both a micro and macro sense, making it impossible to predict future price action.

However, Libertify takes a probabilistic approach to the evaluation of future events and provides them within a suitable timeframe for most retail investors, which is on a daily basis.

The exchange uses the financial algorithm to examine each asset and provide the signals into risk-adjusted recommendations that are custom and specific for each user and their risk appetite.

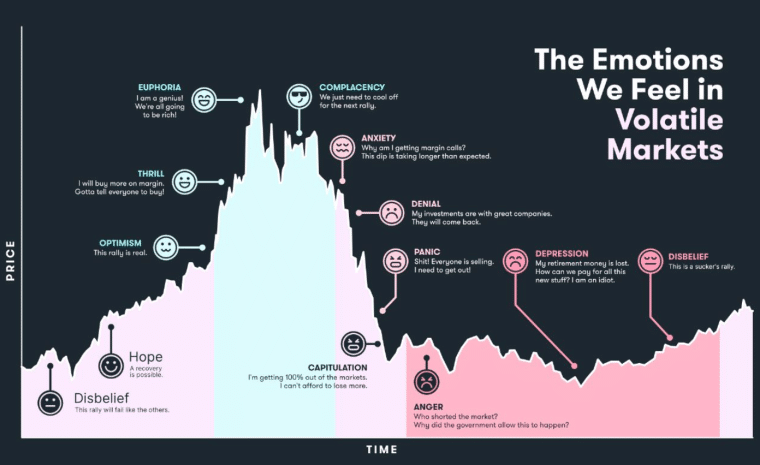

Finally, the AI-powered nudging engine is designed to motivate investors to take action by reducing bias and emotion that can lead to inertia and/or irrational decision-making.

For example, many investors choose to hold after making a loss on a certain token, despite this being a sub-optimal strategy for certain projects that may never again reach the same price level.

The AI nudging engine is the core element of Libertify’s Crypto Seatbelt and seeks to improve an investor’s position by allowing them to continually and consistently react to the markets without emotion, with the backing of a large set of data to lean upon.

The exchange has developed its own Natural Language Processing (NLP) model to automatically analyze a huge amount of data and translate that into precise and actionable language.

The more users interact with the nudges, the more accurate the risk profile gets as it learns about an investor’s tolerance for risk, their investment psychology and how they view certain tokens.

- Read a full and detailed explanation on how the Crypto Seatbelt works from CEO Steve Rosenblum.

Other Features

Libertify can be integrated with hundreds of different crypto exchanges, including tier one CEXs such as Binance, Coinbase and Kraken, as well as leading crypto wallets such as MetaMask and Ledger.

All users need to do is connect the platform with the exchange or wallet of their choosing – or multiple ones.

The app also provides data reporting to give the user an insight into performance, with a financial dashboard, profit and loss calculator and both short and longform stories on trends, token analysis and more.

For customer support, Libertify has an AI-powered ‘Digital Banker’ which will answer any questions a user may need such as general investment advice, their risk profile and long-term investment horizon or performance history.

Related News

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops