Data released yesterday showed that the headline CPI rose at an annualized pace of 5% in March which is the lowest in almost two years. Despite cooling inflation, markets expect the Fed to raise rates by 25 basis points next month.

The headline March CPI was lower than expected and economists expected the metric at 5.2%. The core CPI – which excludes the volatile food and energy prices – rose at an annualized rate of 5.6% in the month.

The CPI peaked at 9.1% in June last year and at one point it seemed that the US economy is headed for double-digit inflation.

However, since then it has fallen every month – as measured by the annualized CPI. More often than not, inflation data has been lower than expected since then.

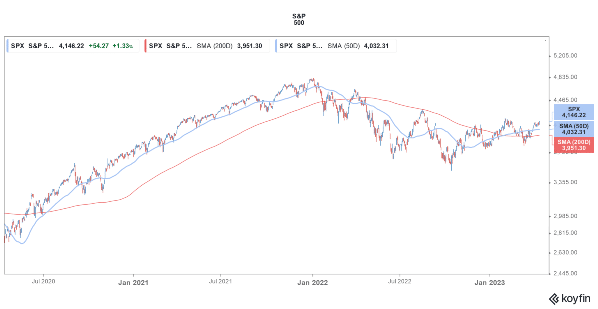

Multi-decade high inflation took a toll on US markets last year and growth stocks especially crashed.

Energy was meanwhile the best-performing sector in 2022 and saw double-digit gains – becoming the only S&P 500 sector to end the year in green.

- Read our guide on investing during inflation

Meanwhile, amid soaring inflation, Fed resorted to steep rate hikes and raised rates by 75 basis points at four consecutive meetings before slowing down to 50 basis points in December.

The US central bank has raised rates by 25 basis points twice this year which brings the Fed funds rate to 4.75%-5.0% – the highest since October 2007.

Markets Expect Fed to Raise Rates by 25 Basis Points in May

Meanwhile, the Fed might still not be done with the rate hikes and the CME Fed Watch tool shows that over two-thirds of traders see a 25 basis point rate hike in May.

Notably, while US inflation has dipped significantly and is now at the psychological threshold of 5%, it is still over twice the 2% that the Fed targets.

The Fed’s March dot plot showed that FOMC members see one more 25 basis point rate hike in 2023.

Powell meanwhile ruled out rate cuts in 2023 even as many market participants believe that slowing growth would force the Fed to cut rates in the second half of 2023.

Markets meanwhile misread Fed’s resolve to fight inflation last year also and far from the “pivot” that many expected, the US central bank raised rates to the highest level since 2007.

Recession Fears Rise Amid Banking Crisis

Meanwhile, recession fears have risen amid the banking crisis and the Fed’s March minutes show that even FOMC members now fear a recession.

The minutes said, “Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.”

- Read our guide on investing in recession-proof coins

Some of the recent data points – including the March nonfarm payroll data – have shown that the economy is slowing down.

A slowing economy and repercussions from the banking crisis might force the Fed to rethink its priorities. Indeed, some brokerages like Goldman Sachs believe that the US central bank would not raise rates next month.

Related stock news and analysis

- 8 Potentially Recession-Proof Stocks to Watch in 2023

- Best TikTok Crypto – Cryptocurrency Trending on TikTok

- Redesigned Tesla Model 3 Images Appear on Reddit Ahead of Q3 Earnings

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops