British EV (electric vehicle) startup Arrival (NYSE: ARVL) has received $300 million in funding from Westwood Capital which would help it fund its cash-burning operations. However, the company still flagged a “going concern” risk.

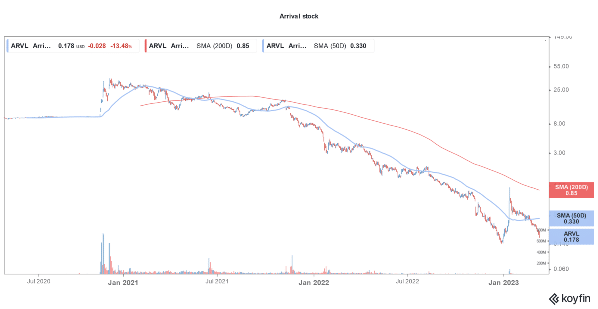

Arrival stock fell 13.5% yesterday and is getting near its all-time low of $0.14. The company went public in a SPAC reverse merger in 2021. The SPAC IPO price was $10 and at its peak, it surpassed $30 even before the merger amid the euphoria towards EV stocks.

Given the slump in its stock where it is trading below $1, it is in non-compliance with Nasdaq listing policies and is proposing a reverse stock split ranging between 30:1 to 50:1.

Many of the other companies including Paysafe that went public through a SPAC reverse merger have also done a reverse stock split, and given the current macro environment, many others might follow suit.

Arrival wanted to build its “microfactories” across the world. Fast forward to 2023, and the company is battling for survival amid the continued cash burn. It reported a cash burn of $126 million for the fourth quarter of 2022 and ended the year with total cash and cash equivalents of $205 million.

Arrival has taken several measures to transform the business and lower the cash burn rate. It has exited its business in Britain and is focusing on the US market and also laid off many employees.

Arrival Gets $300 Million but Still Faces Going Concern Risk

Arrival is working towards lowering its cash burn to less than $35 million per quarter and expressed optimism that it would be able to achieve the goal in the back half of 2023. The $300 million funding from Westwood Capital is nothing short of a lifeline for Arrival.

Last year, Arrival raised concerns over its ability to continue as a going concern. In its release, the company said, “Despite mitigating factors taken to date, there remain material uncertainties about the Company’s ability to continue as a going concern primarily due to the fact that further capital raises are required to fund the company to a break even point.”

A breakeven might not come anytime soon for Arrival. Other EV companies like Rivian, Lucid Motors, NIO, Xpeng Motors, and Lordstown Motors are also posting losses.

Rivian is currently posting gross losses and also expects to post a negative gross margin in 2023, although it is forecasting positive gross margins for 2024.

Things are no different for most other EV companies as they continue to burn cash.

Tesla is an exception as the Elon Musk-run company has turned sustainably profitable and is generating positive free cash flows despite ongoing capex.

EV Companies Are on a Capital-Raising Spree

Over the last year, many EV companies – including Nikola, Arrival, Li Auto, Xpeng Motors, and Lucid Motors – have raised cash. The cash burn and losses for startup EV companies are not expected to come down anytime soon.

Earlier this month, Rivian also announced a $1.3 billion convertible note offering – and joined the ranks of fellow EV names that have raised cash.

The stock crashed after the news of the capital raise. It has since continued to fall and hit a record low yesterday. Many might find the stock undervalued at these prices as its market cap is now only slightly ahead of the nearly $12 billion cash that it held on its balance sheet at the end of 2022.

Even Arrival’s market cap is below the cash that it reported at the end of 2022. However, given the continued cash burn, markets have been apprehensive about loss-making names even if their valuations appear on the lower side.

Also, recession worries are rising and bond guru Jeffrey Gundlach believes that the steepening of the US yield curve following the SVB debacle is a sign of an “imminent recession.” A recession might only make things more complicated for loss-making companies like Arrival.

Related stock news and analysis

- Most Undervalued Crypto to Buy in 2023

- How to Invest in Green Energy in 2023

- Musk Touts Lower-Priced Tesla Model after Disappointing Investor Day

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops