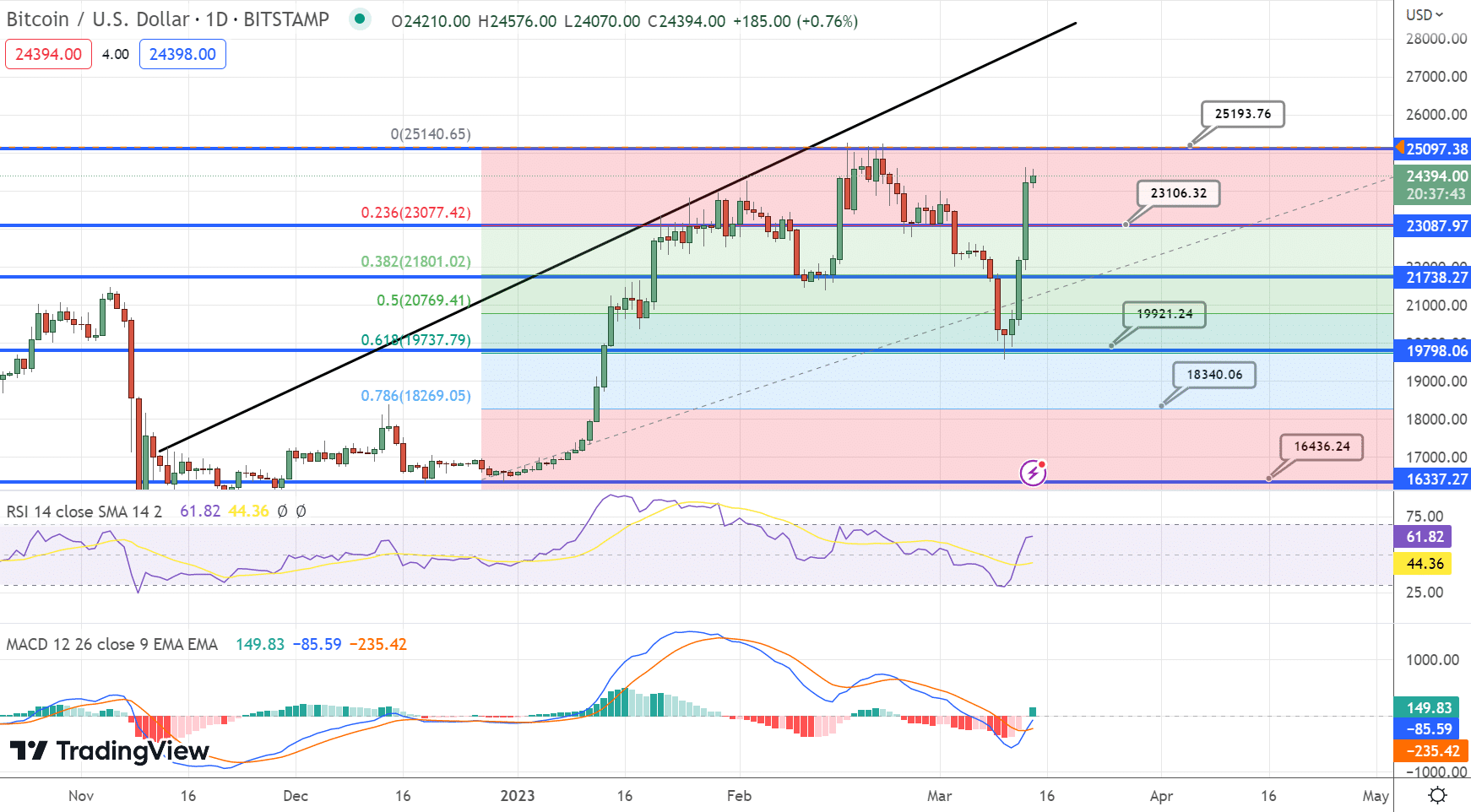

Bitcoin, the world’s most popular cryptocurrency, has experienced a turbulent ride over the past few months. The digital currency dropped significantly to around $19,000 by March 10. However, BTC has shown signs of recovery this week, and many investors wonder whether it will continue to push higher.

On Monday, Bitcoin (BTC) managed to reclaim the $24,000 level, signaling stability in the cryptocurrency market. Nevertheless, this positive turn of events was largely influenced by the government’s recent efforts to safeguard all Silicon Valley Bank depositors.

#ETH rallied over 10%, broke $1,600 resistance against US Dollar. Could continue rise if stays above $1,580 support. ETH started increase above $1,565 resistance. Price is trading above $1,580, 100 hourly SMA.-was break above crucial bearish trend line resistance near $1,480. pic.twitter.com/duQj2oeEDi

— BTC (@btc1crypto) March 13, 2023

Conversely, the market sentiment’s upward trend was amplified by the weakening of the US dollar. It’s worth noting that the February labor statistics revealed a slower pace of pay growth, which suggested that inflationary pressures had eased.

⚠️BREAKING:

*U.S. DOLLAR SLUMPS, MARCH RATE HIKE IN QUESTION AS FED LIMITS SVB FALLOUT – https://t.co/fEwFe4TLLR$USD pic.twitter.com/db1Z2sJUgO

— Investing.com (@Investingcom) March 13, 2023

Consequently, the Federal Reserve might maintain a cautious approach toward interest rate hikes, which could dampen the dollar’s attractiveness.

Crypto Market Cap Bounces Back with Bitcoin and Altcoin Gains

The global value of the crypto market rebounded and reached $1.02 trillion over the weekend after a sharp decline. However, the government’s recent announcement to protect all depositors’ money in Silicon Valley Bank was considered a significant factor that positively impacted the entire crypto market.

Bitcoin, Ether Show Signs of Recovery, Crypto Reclaims Trillion-Dollar Market Cap #TechNews

— NIDE India (@nideindia) March 13, 2023

The recovery of the crypto market cap and the surge of Bitcoin and other altcoins demonstrate the industry’s resilience. However, the market’s future hinges on regulatory clarity and stability. The absence of clear regulations and oversight has created uncertainties and risks that can undermine the industry’s growth and adoption.

Therefore, the crypto industry must collaborate with regulators to establish a framework that ensures the market’s safety and stability. This framework should address investor protection, market manipulation, money laundering, and cybersecurity concerns.

The industry can attract more investors and businesses by implementing clear regulations and oversight, driving innovation and growth.

Silicon Valley Bank and Circle Face Significant Challenges

It’s worth noting that two major US financial institutions have encountered significant obstacles in the crypto industry. Silicon Valley Bank, which offers banking services to numerous crypto companies, recently experienced restrictions on withdrawals and transfers due to concerns about its liquidity position.

However, after the government’s announcement to protect all depositors, account holders were granted full access to their funds on Monday.

Ok.

Bank runs of FRB, Circle, and contagion fears picking up in light of Silvergate and Silicon Valley banks going under.

Lots of rumors. Who knows what is true.

Fed has emergency meeting Monday.

I still think “cascade” doubtful, but this isn’t slowing yet.

We are 72 hrs in. pic.twitter.com/gVrbtkkh9y

— Luke Broyles (@luke_broyles) March 12, 2023

On the other hand, Circle, a peer-to-peer payments technology company, is currently encountering difficulties following the failure of its critical banking partner, Signature Bank.

This incident has exposed the stablecoin ecosystem’s reliance on centralized entities, highlighting the risks and vulnerabilities within the cryptocurrency sector. It emphasizes transparent laws and regulatory oversight to ensure market stability.

Nevertheless, the absence of specific laws and regulations has left the sector vulnerable to fraud, money laundering, and other illicit activities. Consequently, the crypto industry must cooperate with authorities to establish a framework that ensures the market’s safety and stability.

Bitcoin Bulls Fueled by Weaker US Dollar

The prevailing bullish sentiment towards the US dollar has also been recognized as a significant factor driving the BTC price. The cryptocurrency market witnessed a positive trend as the dollar weakened considerably against a basket of currencies.

Traders anticipate that the Federal Reserve will only raise interest rates by 25 basis points, leading to a decrease in the US dollar’s value.

Gold futures jump 23 dollars per ounce, to $1,890 as the US dollar slumps amid SVB's fallout.

— CMC Markets SG (@CMCMarketsSG) March 12, 2023

Investors are purchasing cryptocurrencies such as Bitcoin (BTC) as a hedge against inflation as they anticipate that the Federal Reserve may adopt a more cautious approach due to mounting economic challenges.

This trend of investors purchasing cryptocurrencies is expected to persist as they aim to safeguard their assets against the impact of inflation.

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops