Tesla’s CEO Elon Musk has said that he is “open” to buying SVB and converting Twitter into a digital bank. Regulators shut the bank yesterday amid falling deposits and its failure to raise capital.

Razor CEO Min-Liang Tan suggested Twitter should buy SVB and become a digital bank. Musk responded by saying “I’m open to the idea.” Notably, Musk has a flair to remain in the news and seldom shies away from commenting on important events.

I’m open to the idea

— Elon Musk (@elonmusk) March 11, 2023

Discussing the SVB failure, it marks the largest bank collapse in the U.S. since the 2008 Global Financial Crisis. Things happened fast when the bank declared a $2.25 billion capital raise on Thursday. Of that amount, $1.25 billion was set to come from an underwritten common stock offering, while $500 million would be from a mandatory convertible preferred stock.

SVB also announced that General Atlantic, a US-based growth equity firm, would invest another $500 million at the same terms at its common stock offering.

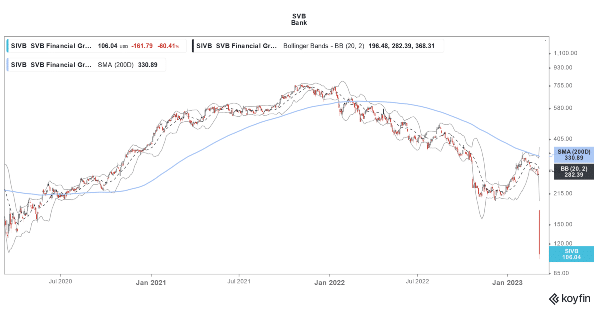

However, after falling over 60% on Thursday, SVB Financial stock was down over 60% in US premarket price action on Friday also. Trading was halted in the stock and soon the regulators stepped in and shut the bank.

Regulators Shut Down SVB After It Faced a Run

Regulatory filings show that depositors withdrew a massive $42 billion from SVB on Thursday and it had a negative cash balance of around $958 million at the end of the day.

The filing stated, “The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due, and the bank is now insolvent.”

The California Department of Financial Protection and Innovation closed SVB and put it under the control of FDIC (Federal Deposit Insurance Corporation).

The FDIC meanwhile covers only deposits upto $250,000 per depositor. At the end of 2022, over $151 billion of deposits at SVB, which was 89% of the total deposits, were above the FDIC insurance limit. These depositors, assuming they haven’t yet pulled out their money from the bank, face an uncertain future and recovery would depend on how much SVB’s assets yield.

The FDIC would issue a “receivership certificate” to uninsured depositors even as it said that the total number of uninsured deposits is “undetermined.”

In the past bank failures, including during 2008 shutting down of Washington Mutual, the FDIC found a buyer who took over the troubled bank’s assets and as part of the process honored all the deposits.

Musk Bought Twitter in 2022 and is Trying to “Fix” the Company

Last year, Musk bought Twitter for $44 billion. It wasn’t a smooth transaction and Musk pulled out from the deal, apparently over pricing. However, amid the legal battle, where experts gave him little chance, Musk eventually agreed to buy the social media company.

During Tesla’s Q3 2022 earnings call, Musk did admit that he overpaid for Twitter. Ever since he took over Twitter, Musk has been trying to transform the company and make it sustainably profitable. He has fired most of the employees, closed some offices, and also started charging for the blue tick verification.

However, there are frequent reports of glitches at Twitter and not many agree that Musk has turned around the company even though he said last month that Twitter was approaching breakeven.

Would Musk Buy SVB and Bail Out the Company?

Meanwhile, it remains to be seen whether Musk is actually serious about buying SVB. In the past also Musk has joked about buying companies ranging from Coca-Cola and Manchester United.

Through his tweets, Musk has influenced the price actions of many assets including cryptocurrencies in the past. Doge-themed cryptos like Dogecoin rallied recently after Musk tweeted a picture of his dog working as Twitter CEO-read our guide on how to buy Dogecoin in 2023.

Meanwhile, even if Musk is serious about buying SVB, buying a bank is a lot more complex than buying a social media company like Twitter. Banking is among the most regulated industries globally unlike tech which is typically loosely regulated.

Banking is Lot Complex Business than Twitter

Even Berkshire Hathaway, whose chairman Warren Buffett has a flair for banking and financial companies, has strived to keep the conglomerate’s stake in banks below 10% to escape regulatory scrutiny.

The Oracle of Omaha did make an exception for Bank of America and increased the stake above 10%. The bank is now the second largest holding for Berkshire with Apple being the largest.

In 2022, Buffett bought Apple shares in all the quarters barring Q3 and increased Berkshire’s already humongous stake in the iPhone maker.

As for Musk buying SVB, even if he is serious, it remains to be seen if regulators would be interested in handing over the bank’s reins to the mercurial billionaire.

Related stock news and analysis

- Best Twitter Crypto – Cryptocurrency Trending on Twitter

- Watch Out for Inflation Data Next Week after the SVB Debacle

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops