DocuSign (NYSE: DOCU) stock is trading lower in US premarket price action today despite posting better-than-expected revenues and profits for its fiscal fourth quarter of 2023.

The company separately announced the departure of its CFO Cynthia Gaylor.

DocuSign reported revenues of $659.6 million in the quarter that ended in January – the revenues rose 14% YoY and were ahead of the $641 million that analysts were expecting.

The company’s Subscription revenues rose 14% YoY to $643.7 million while Professional Services revenues fell 5% over the period to $15.9 million.

DocuSign’s billings rose 10% YoY to $739 million. Its GAAP gross margin improved by 2 percentage points to 79% in the quarter.

It reported a GAAP EPS of $0.02 while the adjusted EPS came in at 65 cents—ahead of the 52 cents that analysts were expecting.

The company generated free cash flows of $113 million in the quarter and ended the fiscal year with cash and cash equivalents of $1.2 billion.

Looking at the full fiscal year number, DocuSign’s revenues rose 19% YoY to $2.5 billion and it posted an adjusted EPS of $2.03.

In his prepared remarks, DocuSign’s CEO Allan Thygesen said: “We finished the year strong, delivering across our key financial metrics and making tangible progress on our strategic priorities.

“Looking ahead, we aim to drive profitable growth at scale by executing our mission of smarter, easier, and trusted agreements.”

DocuSign Posted Better Than Expected Earnings

DocuSign guided for revenues between $639 million to $645 million in the fiscal first quarter of 2024. The midpoint of guidance implies a YoY growth of around 9%. For the full fiscal year, DocuSign forecast revenues between $2.695 billion-$2.707 billion, which turns out to be a YoY growth of just around 8%.

Like other former so-called stay-at-home companies, DocuSign is also witnessing a terrible growth slowdown. Take for instance, its revenues rose 45%, 49.2%, and 38.9% in the fiscal year 2022, 2021, and 2020 respectively.

However, the growth fell below 20% in the last fiscal year and the guidance for the current fiscal year implies growth rates falling to single digits.

Growth Stocks Have Crashed amid Rising Interest Rates

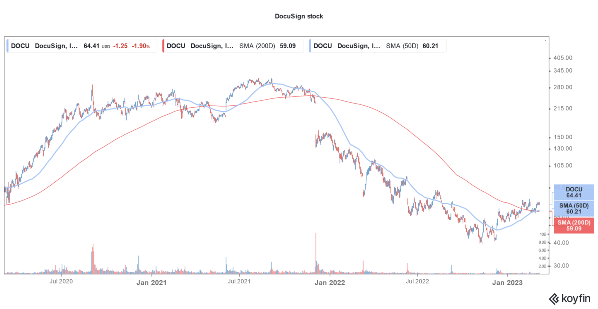

Like other former market darlings, DOCU stock also trades at a fraction of its all-time highs.

Tech stocks underperformed the markets in 2022 and the tech-heavy Nasdaq Composite lost around 33%, which was wider than S&P 500’s nearly 20% drawdown.

Growth stocks have faced the heat amid rising interest rates. Higher rates lower the current values of future cash flows.

There is no respite from rising rates in the short term and after Fed chair Jerome Powell’s recent Congressional testimony, analysts expect the Fed to raise rates by another 50 basis points later this month.

US inflation has turned out to be a lot stickier than the Fed previously envisioned. After the Fed’s most recent meeting, Powell used the word “disinflation” for the first time in the current cycle.

However, the monthly rise in both consumer and wholesale inflation for January somewhat punctured the disinflation narrative.

High inflation is invariably negative for risk assets like growth stocks. However, some investment strategies can outperform during high inflation.

DocuSign Announced the Exit of Its CFO

Coming back to DocuSign, the stock is trading lower in premarkets despite better-than-expected earnings.

The likely reason could be the announcement of the planned exit of its CFO Cynthia Gaylor who held the position since September 2020.

The company has started the process of identifying the next CFO and said that Gaylor would continue in the position until it announces the earnings for the current fiscal quarter.

DocuSign tried to allay concerns over her departure and said “Gaylor’s planned departure is not a result of any disagreement regarding the company’s financial statements or disclosures.”

That said, it is yet another high-profile C-suite exit at the company. In June, its CEO Dan Springer resigned after dismal earnings.

After his exit, Maggie Wilderotter became the interim CEO until September when Allan Thygesen, a former Google executive took over the position.

Incidentally, DocuSign stock had risen on news of Springer’s exit as well as later on Thygesen’s appointment. However, the stock is down today likely on the announcement of Gaylor’s departure.

Related stock news and analysis

- How to Buy DocuSign Stock in 2023

- Uber Stock Rises on Reports of Freight Logistics Business Spinoff

- How to Invest $25k – Best $25k Investments Compared

What's the Best Crypto to Buy Now?

- B2C Listed the Top Rated Cryptocurrencies for 2023

- Get Early Access to Presales & Private Sales

- KYC Verified & Audited, Public Teams

- Most Voted for Tokens on CoinSniper

- Upcoming Listings on Exchanges, NFT Drops