Bitcoin’s recent price action has been firm yet rangebound, with the cryptocurrency hovering around the $23,000 level. While some traders and investors may see this as a cause for concern, it could actually be a positive sign for bullish investors.

In this article, we will explore why Bitcoin’s current rangebound state is a good sign for bulls and examine various factors that could potentially impact its price movement in the coming days and weeks.

Bitcoin Mining Difficulty: Factors, Impact, and Future Projections

On February 24, 2023, the mining difficulty of Bitcoin reached an all-time high (ATH). According to on-chain data, the mining difficulty increased to 43.05 at block 778,323 in the most recent recalculation. In the past two weeks, the difficulty of mining Bitcoin has increased by 9.95%, reaching a new all-time high. This suggests that more miners are joining the network to take advantage of the rising Bitcoin price.

The mining difficulty of Bitcoin represents the number of iterations required for miners to obtain a block’s hash. As the number of iterations increases, the difficulty of solving a block also rises, resulting in a decline in mining profitability. Although an increase in mining difficulty does not directly impact Bitcoin’s price, it leads to a higher energy cost of mining one BTC, making it more expensive for miners to maintain profitability.

The current firm and rangebound trend of BTC is a positive sign for bulls. Despite the recent dip in Bitcoin’s price, the asset has the potential to recover, as indicated by miners’ bullish sentiment regarding a rebound in the BTC/USD price.

Rising Interest Rates in the US and Its Potential Impact

On February 24, the Bureau of Economic Analysis (BEA) released the Personal Consumption Expenditures (PCE) report, revealing that inflation had increased by 5.4% in January compared to the previous year. The report also showed that core inflation, which is a preferred tool of the Federal Reserve for measuring inflation, had risen by 4.7% since January 2022.

As a result, the US Dollar Index (DXY) received a significant boost, rising to 105.26, which was its highest level since January 6.

In January, the personal consumption expenditures (PCE) price index—a measure of U.S. inflation—was up 5.4% from a year earlier. The core PCE index, which excludes food and energy costs, posted a year-over-year increase of 4.7% https://t.co/v513XyyDb6 pic.twitter.com/ZJzB5AW8ba

— St. Louis Fed (@stlouisfed) February 25, 2023

The Personal Consumption Expenditures (PCE) report, which is the preferred inflation indicator of the Federal Reserve, was released on February 24. It revealed that inflation had risen to 5.4% in January compared to the previous year, with core inflation up by 4.7% from January 2022. As a result, the US Dollar Index (DXY) saw a significant boost, reaching its highest level since January 6 at 105.26.

Given the increase in inflation, the majority of the market believes that the Federal Reserve will continue to raise interest rates. Federal Reserve Chairman Powell aims for an overall inflation rate of 2%. This could impact the price of bitcoin, which fell after the release of the PCE report indicating the inflation jump to 5.4% in January.

Big week ahead for economic events!

Monday:

9am – MPC Member Broadbent Speaks

1:30pm – Core Durable Goods Orders m/m

1:30pm – Durable Goods Orders m/m

3pm – Pending Home Sales m/mStay updated with the latest financial news and events! #forex #economics #trading

— Arslan B. (@forex_arslan) February 26, 2023

Watch out for the upcoming high-impact economic events that may drive volatility in the market.

IMF’s Cautious Stance on Cryptocurrency

During the G20 conference held in Bengaluru on February 25, Kristalina Georgieva, the Managing Director of the International Monetary Fund (IMF), suggested that banning private cryptocurrencies should be considered as an option.

In a report released by the IMF on February 23, the agency proposed new guidelines for regulating cryptocurrencies for its member countries.

The nine-point action plan suggested by the IMF includes tightening regulations on virtual currencies to enhance financial stability, as well as avoiding designating cryptocurrency assets as official money or legal tender.

The IMF’s cautious stance on cryptocurrencies may result in greater scrutiny and regulation, potentially affecting the acceptance and value of BTC/USD.

Bitcoin Price Prediction

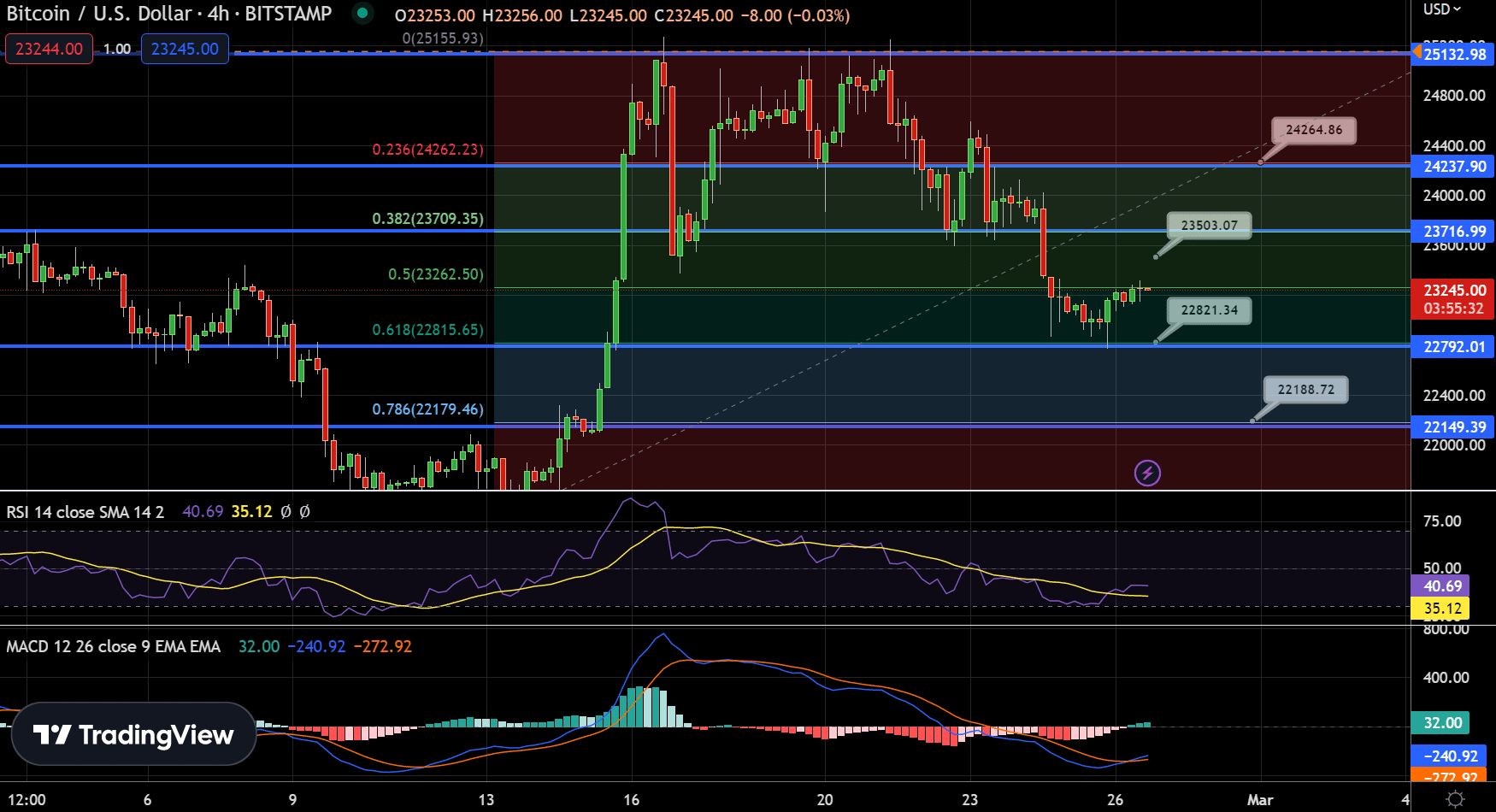

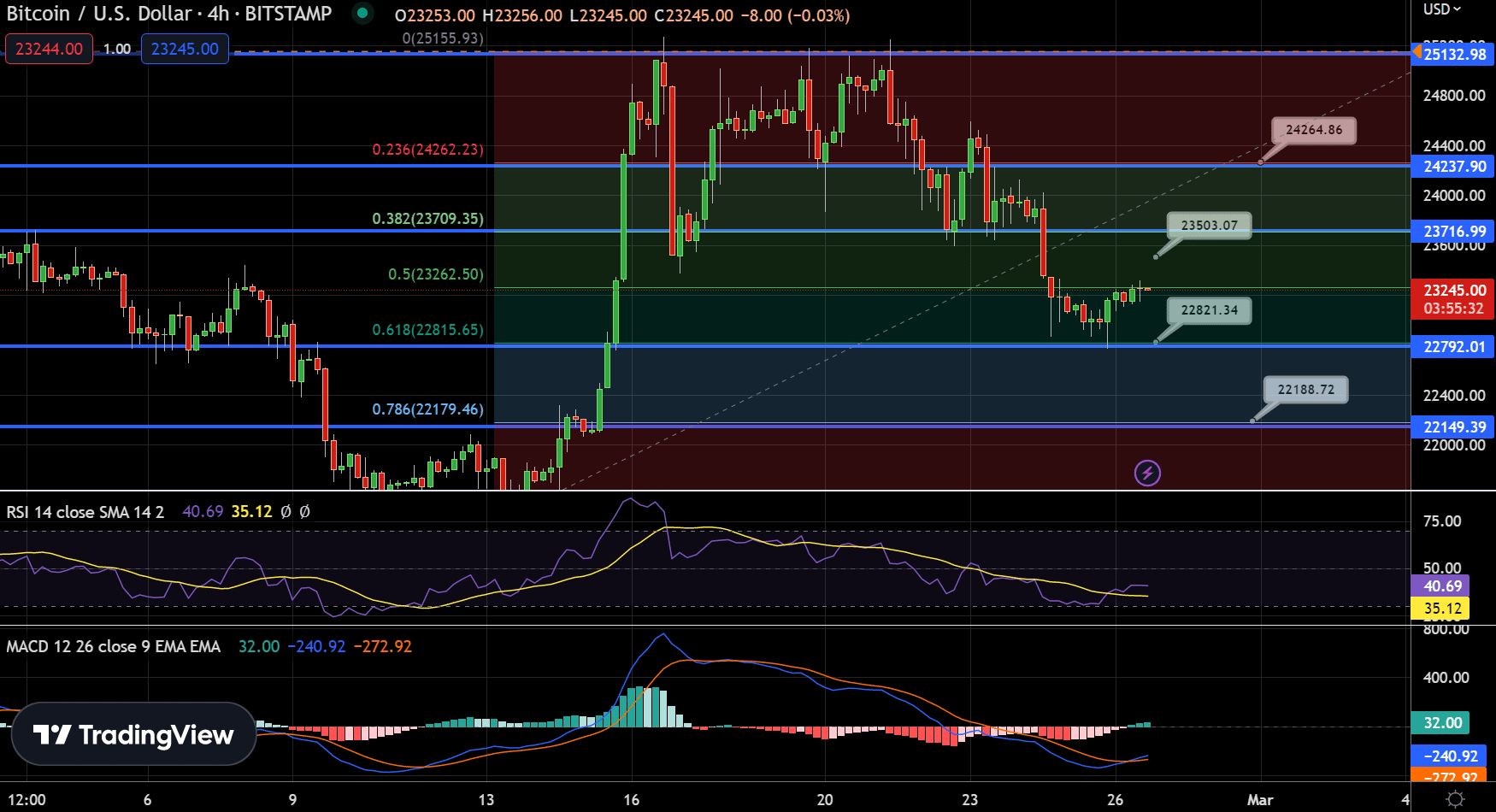

On February 26, BTC/USD began trading at $23,177.00 and has risen by 0.78% in the last 24 hours, currently trading at $23,245.00. BTC/USD has fluctuated between a high of $23,302.00 and a low of $23,083.00. However, its value has dropped by more than 5.5% in the past week.

On the technical front, Bitcoin’s immediate support level is currently situated at $22,800, and if the BTC/USD pair breaks below this level, it could potentially expose the price of BTC to the next support area at $22,150.

In the 4-hour timeframe, Bitcoin has completed a 61.8% Fibonacci retracement at the $22,800 level, and a close above this level has the potential to drive an uptrend in BTC.

On the positive side, Bitcoin’s immediate resistance level remains around $23,500. However, with the BTC/USD pair now in the oversold zone, there is a possibility that BTC may bounce off and break through the resistance level at $23,500, which could lead to a price of $24,250.

Top Crypto Alternatives to Bitcoin for Today’s Investments

In addition to BTC and ETH, there are several altcoins in the market that show significant potential. The B2C team has conducted a thorough analysis and compiled a list of the top cryptocurrencies to watch for in 2023.

See Best Crypto to Invest in 2023

Related

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain