A lot of newly listed tech companies are going private again amid the slump in stock markets. Most of these companies now trade well below their listing prices.

2020 and 2021 were red-hot years for the US IPO market. There was an almost unending appetite for tech companies and many opted for SPAC reverse merger to go public quickly and capitalize on the market boom.

After Airbnb and DoorDash soared on the listing in late 2020, Roblox and Affirm delayed their IPO to 2021. Both bumped up the valuations and still spiked on the listing day. In 2020, in a rare move, Unity Software seized control over IPO pricing from investment bankers.

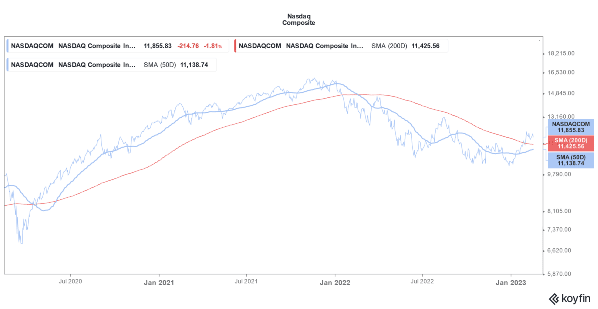

2020 became the record year for US IPOs and 2021 turned out to be even bigger. However, as tech stocks started to crash in 2022, the fortunes of newly listed names also nosedived.

While the Nasdaq Composite lost a third of its value last year, the Renaissance IPO ETF (NYSE: IPO) tumbled over 50%. Around half of the ETF holdings are tech companies.

Tech Companies Go Private amid the Slump in Stock Markets

Meanwhile, amid the slump in newly listed tech stocks, many companies have either gone private or are rumored to do so. Citing data from Dealogic, the Wall Street Journal reported that 10 companies that went public in 2020 and 2021 have agreed to sell themselves to private equity companies.

Sumo Logic, Weber, and Trian Insurance Group are going private at a valuation that is below what they sought while going public.

There are exceptions though and KnowBe4 Inc is going private at a valuation that is higher than the IPO price.

There were rumors that Saudi Arabia’s PIF (public investment fund) which owns the majority stake in Lucid Motors, is contemplating taking the company private.

Lucid Motors went public through a reverse merger with Churchill Capital IV in 2021. The company priced the PIPE (private investment in public equity) at $15—a 50% premium to the SPAC IPO price.

Notably, while Lucid Motors was trading below $10, it rebounded amid rumors of the Saudi buyout.

Retail investors usually buy into a company after the IPO. We however have a guide on how to invest in startup companies.

Newly Listed Growth Stocks Have Slumped

Most newly listed tech stocks have slumped and in many cases are fighting a survival battle. Electric Last Mile eventually filed for bankruptcy and Mullen Automotive bought the company’s assets.

Multiple newly listed tech companies were accused of fraud, and some like Nikola and Lordstown admitted to wrongdoings. Both these companies saw an exodus of their top management after Hindenburg Research accused them of defrauding investors.

A lot of tech stocks, especially which went public through SPAC reverse mergers are in non-compliance with the minimum exchange listing requirements as their stock price trades below $1. Some like Paysafe have already gone for a reverse stock split in order to meet exchange listing requirements.

SPACs Wind Off amid Slump in Growth Stocks

Many SPACs dissolved last year amid the slump in tech stocks, which was the largest target pool for them.

Chamath Palihapitiya dissolved Social Capital Hedosophia Holdings IV (NYSE: IPOD) and Social Capital Hedosophia Holdings VI (IPOF) which had raised $460 million and $1.15 million respectively in the IPO. IPOF was among the few SPACs that had raised over $1 billion from the IPO.

He listed the high valuations of target companies as one of the reasons. Palihapitiya admitted that it is difficult to find companies that have a decent valuation and margin of safety.

Bill Ackman also dissolved his maiden SPAC which had raised over $4 billion and was the biggest SPAC IPO of all time. Ackman admitted that a lot of SPACs were hunting for merger targets which meant that the competition for quality assets is quite high.

Unlike most other SPACs which were hunting for fast-growing tech companies, Ackman was hunting for mature companies.

Fed’s Rate Hikes and a Slowing Economy Took a Toll on Tech Stocks

Fed’s rate hikes and a slowing economy took a toll on tech stocks in 2022. The Fed’s accommodative monetary policy led to a lot of easy money which eventually found its way into stocks, mostly growth names.

Now, with the Fed raising rates to the highest in years, the supply of easy money which was nothing short of a lifeline for stocks of loss-making growth companies is choked.

Also, many startup tech companies have fared poorly on execution, and many overhyped their capabilities. As these newly listed tech companies struggled with their 2022 plans, markets questioned whether they can really deliver on the long-term forecasts which were the basis for their high valuations.

The macroeconomic slowdown hasn’t helped the cause for tech companies either. Over the next two years, it would be the proverbial separating the wheat from the chaff.

We saw something similar two decades back when multiple tech companies failed and only a handful survived the dot com bust.

Related stock news and analysis

- Best New Stocks to Buy in 2023

- 10 Best Crypto ETFs to Invest in 2023

- Tesla Car Crashes into a Firetruck amid Growing Autopilot Scrutiny

Fight Out - Next Big Train-to-Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $5M Raised

- Real-World Community, Gym Chain