The crypto market has been shaping up since the beginning of the year, with the largest cryptocurrency, Bitcoin price reaching $24,320 – a level not seen since mid-August 2022. This positive outlook across the market comes after a disastrous 2022 owing to the collapse of TerraUSD (UST), an algorithmic stablecoin in May, and the messy implosion of Sam Bankman-Fried’s FTX exchange in November.

According to the head of the Bank for International Settlements (BIS), the new wave in the crypto space will likely push innovation to the next level, especially in the area of central bank digital currencies (CBDCs). BIS is popularly known as the global central bank for other central banks around the world.

Despite its optimistic outlook, BIS believes CBDCs would face immense pressure from geopolitical limitations. It would be prudent for stakeholders to pay attention to the head of BIS ‘Innovation Hub’ because most of the bank’s warnings and criticism on cryptocurrencies came to pass last year thanks to the collapse of FTX exchange – its sister company Alameda Research, Three Arrows Capital and Celsius Network among others.

The new head of BIS ‘Innovation Hub’, Cecilia Skingsley hopes the crypto industry is ready to learn from the many failures seen in 2022. “I would assume that the industry will learn from these failures and they will come up with new things,” Skingsley said during an interview with Reuters.

A New Wave Of CBDCs Set To Emerge After The 2022 Crypto Turmoil

The head of the ‘Innovation Hub’ at BIS reckons that the mayhem in the crypto market does not seem to have stifled efforts channeled into CBDCs. Skingsley foresees swathes of central bank-backed currencies in the coming years to support transfers for use by the public or bank-to-bank payments.

Since BIS is a central bank for other central banks, it has been facilitating several targeted experiments on the viability of CBDCs. Skingsley affirmed that all the banks with similar projects have no plans of stopping in spite of the messy events of last year.

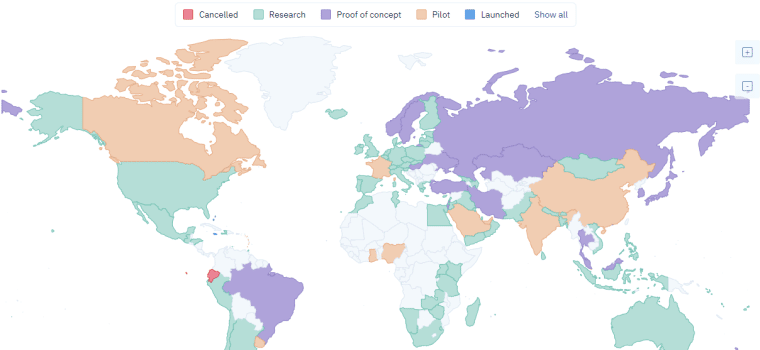

So far, 11 countries are working with CBDCs in addition to more than 100 of all the central banks around the world studying and exploring similar issuances. 2023 will mark key milestones for the 95% of global central banks mulling over these digital assets.

China continues to make admirable progress with its digital yuan and is looking forward to expanding the pilot program to reach over 1.4 billion of its population. If allowed the European Central Bank expects to scale efforts on its digital currency in 2023.

The United States Federal Reserve (Fed) is also not lagging, with many developments likely to take shape over the next few years. Other notable countries focusing on studying and launching digital currencies include Brazil, India, Russia, Australia, and South Korea.

What’s Driving The CBDC Agenda In Global Crypto Space?

CBDCs are being sold as the next best step in the innovation of money and financial systems because they are virtual and have come at a time when the world is digressing toward cashless economies.

Reports have shown that the use of physical cash has been going down drastically around the world. Moreover, central banks must act fast to stay ahead of the curve, especially with pressure mounting from cryptocurrencies like Bitcoin.

Some countries are preferring the move to CBDCs to circumvent sanctions imposed on them by the United States like Russia and Venezuela. Russia is facing dire sanctions by the US and other NATO members for its aggressive attack on Ukraine. On the other hand, some US allies in Europe hope that CBDCs will reduce reliance on companies like Mastercard, Visa, and Swift Networks.

“You need be resilient enough when it comes to defense when it comes to the food supply, but it also becomes important when it comes to payment systems,” Skingsley said, adding that she “can understand the rationale for any country to ask, all right, how resilient are we? Which countries can be our friends, our allies?”

Challenges CBDCs Should Be Preparing To Face

Skingsley believes the developments and milestones countries are making in CBDCs mark the much-needed innovation from traditional international money transfers. However, she reckons that the transition may not be as smooth as many would think. It is plausible that CBDCs will only work for countries that are aligned geopolitically amid new “tectonic plates.”

Although the goal for CBDCs is to ensure seamless interoperability of money transfer between countries without high transaction costs, “we will never have full interconnectedness,” Skingsley said.

The process will not be smooth with countries likely to push their agendas, which could quickly escalate potential conflicts. Others may simply refuse to cooperate with the rest despite being in sync geopolitically for reasons best known to themselves.

Skingsley chimed in on the low uptake of CBDCs from the 11 countries, citing skepticism from the public and other central banks. The Bank of England (BoE) Chair, Andrew Bailey reckoned earlier this month that CBDCs could be a solution searching for a problem.

Cash usage will drop to zero in the future in some countries but this only paves the way to “the question of how do you maintain public policy objectives that we think are important – namely trust in the money system.”

For now, innovation is the way to go but such challenges suggest every central bank must deliberately investigate the reasons for wanting to release a digital currency and how it hopes to use it to support the financial system within and outside of its jurisdiction.

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain