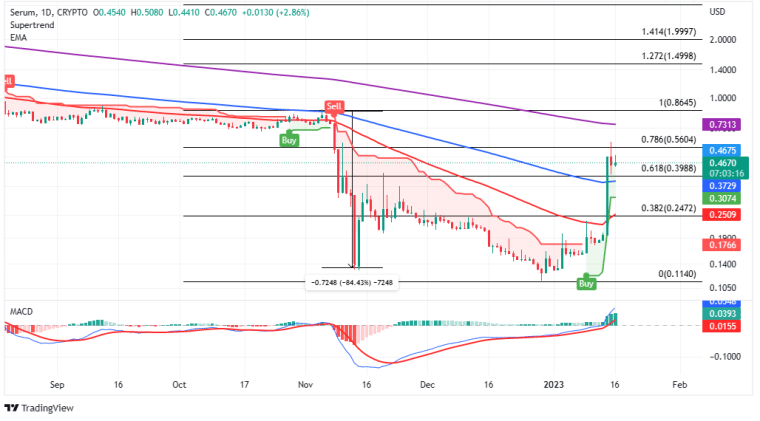

Serum price is at the helm of crypto recovery in 2023, having rallied 178%, and 253% in 14 days. SRM was among the most sold tokens following the implosion of Sam Bankman-Fried’s FTX exchange in November, with the price plummeting by 84% in less than seven days to $0.1336.

Although Serum price pushed higher immediately after the crash, momentum faded around $0.41, which opened the door to more downside action in December. SRM probably bottomed at $0.1140, a move that could explain the blazing upswing to $0.50.

1. Serum Price Explodes Alongside Solana

Serum is a decentralized exchange (DEX) on the Solana blockchain, built to enhance high-speed trading using an on-chain order book to keep fees low. SRM was caught up in the messy collapse of FTX and its sister company Alameda like many other projects within the Solana ecosystem.

According to a new report on the state of the Solana ecosystem by Messari, a leading crypto analytics platform, “there is no doubt now that FTX/Alameda supported total value locked (TVL), transactions, and token values throughout the Solana ecosystem, they were only a piece of the broader puzzle.”

The report cut through the noise that the Solana ecosystem is dying using key on-chain metrics and solid fundamentals. It is worth mentioning that “the Solana ecosystem still has a network of builders, an ecosystem of applications, and a war chest of capital, as strong as almost any other L1,” Messari affirmed.

As Solana price rallied, piggybacking on these metrics, investors expounded their bullish scope to include tokens like Serum, whose trading volume has been on an upward trend. Over $777 million in volume was recorded on January 14, $911 million on January 15, and $237 million at the time of writing.

2. Serum Price Bottoms Ahead of the 2023 Bull Market

Serum price appears to have completely exhausted the downtrend in favor of a bullish 2023. This bullish move has been welcomed by investors who suffered a great deal during the 2022 bear market run that saw SRM lose nearly 100% of its value.

Despite Serum’s 178% breakout over the last seven days, the token is trading at 96.6%, down from its all-time high of $13.78 in September 2021. SRM’s value is still a pale reflection of its peak levels in the previous bull run.

Several technical indicators affirm the bullish outlook for Serum price, starting with a buy signal from the SuperTrend indicator. The indicator overlays the chart, like a moving average, but incorporates the average true range (ATR) to gauge market volatility.

The bullish momentum behind Serum price soared as the SuperTrend flipped to trail the token on the daily chart. Demand for the token increased significantly, with investor interest peaking among Solana-based projects.

For now, the path with the least resistance will stay to the upside as long as the Super Trend indicator trails Serum, keeping the buy signal intact. Cementing the bulls’ presence in the market and their grip on SRM is another buy signal from the Moving Average Convergence Divergence (MACD) indicator.

Serum price flipped immensely bullish as the MACD (line in blue) crossed above the signal line (in red). As long as the MACD holds above the mean line while trending north, SRM will ignite the second phase of the rally for highs beyond $1.00.

For now, the main challenge for the bulls is to crack through resistance at the 78.6% Fibonacci level. Such a move would see investors change their tune to hold Serum longer while anticipating a rally back to the all-time high of $13.78.

3. Post-FTX Comeback Hype Triggers Serum Price Rally

Many in the crypto industry quickly concluded that Serum would not survive the FTX crush, including its team. Various projects that were executing on the protocol quickly moved to other blockchains like Jupiter Exchange and Raydium Protocol.

Discussions surrounding the token throughout November revealed a “community-wide effort to fork Serum.” According to Cointelegraph, a community-led fork of the Serum version 3 program went live on Solana, attracting a daily volume of over $1 million daily at some point. The impact of FTX was so damaging that “Serum’s volume and liquidity has dropped to near-zero,” the team said via Twitter.

It appears the Serum DEX situation has not changed significantly between now and November, in spite of the spike in Serum price. Over the last 24 hours, the platform recorded slightly above $12.6k in trading volume, from only 41 open markets.

Despite the dismal performance of the Serum DEX, the optimistic outlook for Serum price could eventually bring attention back to the once-thriving Solana-based platform. There is a high probability demand for Serum DEX will continue increasing as Serum price climbs the ladder to $13.78.

Interested traders can buy Serum and take advantage of the rally likely to reach $13.78 in a few months. However, investors might want to look at Meta Masters Guild (MEMAG) for its better risk-reward potential. For more details on MEMAG, follow the link below.

New presale project: Meta Masters Guild – $MEMAG.

Related Articles:

- Here’s Why The Bitcoin Price Has Pumped 23% in 7 Days And Can Reach $25k in Next Week

- Solana Crypto OUTRAGEOUS Pump – Will SOL Reach $30? Bitcoin and Altcoins Surging – YouTube

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain