The embattled cryptocurrency exchange FTX has been granted permission by its bankruptcy judge to sell some of its assets in order to repay its creditors.

Green Light to Sell

According to a court filing shared recently, Delaware Bankruptcy Court Judge John Dorsey has given the green light for embattled crypto exchange FTX to sell several key divisions. The move is intended to assist the exchange in raising enough funds to repay its creditors, many of whom have demanded priority treatment in the exchange’s bankruptcy and insolvency process.

The court filing lists some of FTX’s primary subsidiaries – including FTX Europe, FTX Japan, notable crypto derivatives platform LedgerX, and stock trading service Embed. Interested bidders will now be free to contact Perella Weinberg Partners — the New York-based investment bank and financial services company — tasked with overseeing the sale process.

Approximately 117 parties have expressed interest in purchasing the FTX assets for sale. These parties are free to contact the investment bank to inquire about the assets as part of their due diligence process.

The move brings an end to a month-long process where FTX has been seeking permission to offload some of its assets in order to repay several of its customers and investors.

FTX’s lawyers began seeking approval to sell these businesses in December, with many arguing that the businesses in question had been dormant and would benefit from new ownership.

As the lawyers explained at the time, FTX Japan had already been hit with business suspension and improvement orders from Japan’s Financial Services Agency (FSA), while FTX Europe had lost its licenses and ability to do business. The lawyers also pointed to the loss of businesses and employees, with customers looking to distance themselves from anyone with even a small link to FTX.

As for LedgerX and Embed, the lawyers argued that both businesses had recently been acquired by FTX and operated relatively independently of the failed exchange. As a result, selling these operations would be a significantly less difficult course of action.

FTX Funds Come Running Back

The decision to sell its assets appears to be the most prudent course of action for FTX, which has over a million creditors to repay. It also brings yet another note of progress for these creditors, many of whom have had to endure two agonizing months of losses.

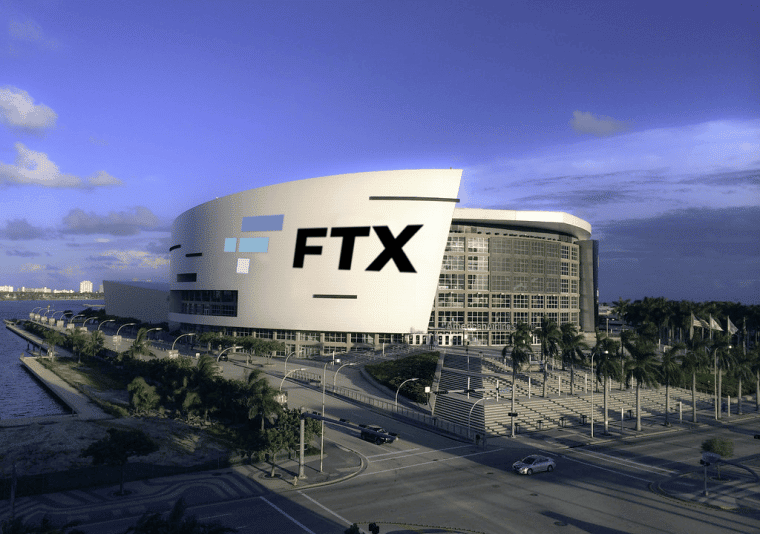

Earlier this week, bankruptcy attorney Andy Dietderich reported that the troubled cryptocurrency exchange had recovered up to $5 billion in liquid crypto and cash assets. Speaking to the Delaware bankruptcy court, Dietderich explained that FTX would also be looking to sell up to $4.6 billion worth of non-strategic investments, including the abovementioned subsidiaries. In addition, FTX plans to end its sponsorship deal with the popular battle-royale game League of Legends and the NBA professional team Miami Heat.

It should be noted that FTX still has a long way from making everyone happy. The bankruptcy attorney stated that the exchange is working to rebuild transaction history and that the total customer shortfall is still unknown. Nevertheless, they are working on a plan to return customer funds, and they hope to have something concrete soon enough.

Fight Out - Next 100x Move to Earn Crypto

- Backed by LBank Labs, Transak

- Earn Rewards for Working Out

- Level Up and Compete in the Metaverse

- Presale Live Now - $4M+ Raised

- Real-World Community, Gym Chain