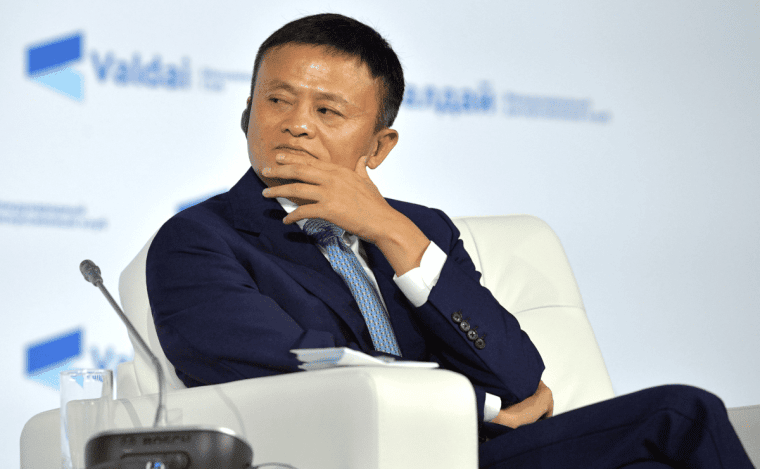

Jack Ma has agreed to cede control of Ant Group, the fintech giant that he co-founded. While the move paves the path for an eventual IPO of the company don’t expect the fintech giant to list in a hurry.

Ant Financial was set to go public in 2020 and received bids above $3 trillion. The company was looking to raise around $34 billion from the IPO which would have valued the fintech giant at around $310 billion.

However, Chinese regulators blocked the IPO at the last moment. Notably, Ma made critical comments against the country’s regulators ahead of the IPO. It is not common for business leaders to criticize regulators or Communist party officials in China.

Ant Financial was set to become the largest IPO ever and beat the record of Alibaba. However, China had different plans and blocked the IPO. Jack Ma was also not seen in public for months after that before reappearing in online interaction in early 2021.

He has since been seen pubic sporadically. Months after Ma’s comments, China imposed a fine of $2.8 billion on Alibaba which was the highest ever for a Chinese company.

Alibaba and DiDi were the face of China’s tech crackdown that began in 2020 and reached its epitome in 2021.

Alibaba Stock Rebounded in 2023

Meanwhile, amid a slowing economy, China has been taking a more reconciliatory approach. Recently, the China Banking and Insurance Regulatory Commission approved Ant Financial’s request to more than double its registered capital for the consumer unit. After the restructuring, Ant Financial would still be the majority stockholder of the unit and would hold over half of the stake.

Ant Financial has been restructuring its business in accordance with the regulators’ demands. Ma is the biggest stockholder of Ant Financial. Commenting on Ma ceding control, Ant Financial said, “As a result, there will no longer be a situation where a direct or indirect shareholder will have sole or joint control over Ant Group.”

Ant Group IPO Might Not Come Soon

While Ma ceding control would remove one more roadblock for Ant Group’s IPO, the company would not list for at least one year. There is a guide on investing in pre-IPOs.

According to the regulations, companies have to wait for three years to list on the country’s domestic A-share market if there is a change in management control.

The wait time is two years for Shanghai’s STAR market and one year for listing in Hong Kong. Notably, when Ant was looking to go public in 2020 it opted for a dual listing in Hong Kong and Shanghai. It ditched the US listing amid soaring US-China tensions.

US investors’ faith in Chinese stock took a beating after the Luckin Coffee accounting scandal. The forced delisting of Didi did not help matters as US investors lost billions of dollars in the botched IPO.

All said Ant Financial is still among the most awaited IPOs even as a listing might not happen anytime soon. We have a list of some of the upcoming IPOs in 2023.

Ant Financial Listing Would Help Alibaba Unlock Value

Ant Financial’s listing would help Alibaba unlock value. Alibaba holds a third of the stake in the fintech company and its stalled IPO was among the reasons BABA stock crashed in 2020.

China has signaled that is now looking to support tech companies. Duncan Clark, chairman of investment advisory firm BDA China. He said, “With the Chinese economy in a very febrile state, the government is looking to signal its commitment to growth, and the tech, private sectors are key to that as we know.”

Clark added, “At least Ant investors can (now) have some timetable for an exit after a long period of uncertainty.”

Meanwhile, Chinese stocks have rebounded in 2023 and many analysts see names like Alibaba and NIO outperforming in the year. There is a guide on buying Alibaba stock.

Related stock news and analysis

- How to Buy Nio Stock for Beginners

- Best China Cryptocurrency Projects to Invest in 2023

- Tesla Stock Rebounds after Hitting 52-Week Lows: Would the Gains Sustain?

Wall Street Memes (WSM) - Newest Meme Coin

- Community of 1 Million Followers

- Experienced NFT Project Founders

- Listed On OKX

- Staking Rewards