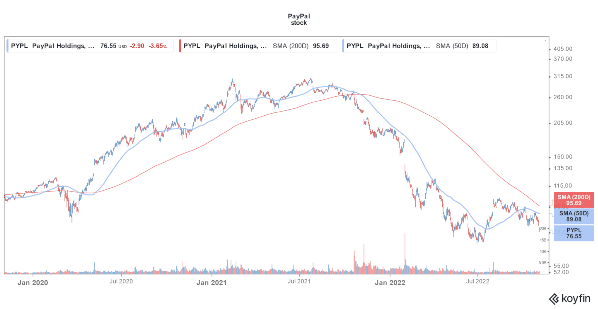

PayPal stock (NYSE: PYPL) is trading lower in premarkets today. While the company posted better-than-expected earnings for the third quarter of 2022, it spooked markets with its guidance.

PayPal generated revenues of $6.85 billion in Q3 2022 which was 11% higher than the corresponding quarter last year. The revenues also came in ahead of the $6.82 billion that analysts polled by Refinitiv were expecting.

The company posted an adjusted EPS of $1.08 which was ahead of the 96 cents that analysts were expecting. Its adjusted EPS in the quarter was however slightly below the $1.11 that it posted in the third quarter of 2021.

PayPal reported a total payment volume of $337 billion which was up 9% YoY. On a currency-neutral basis, the volumes increased by 14%. The relentless rise in the US dollar has been a headwind for multinational US companies.

The Fed is among the most aggressive central bank globally and has raised rates by 375 basis points so far. It raised rates by another 75 basis points earlier this week.

Coming back to PayPal, it generated free cash flows of $1.8 billion in the third quarter, which was 37% higher than the corresponding quarter last year. In the first nine months of 2022, its free cash flows totaled $4.1 billion.

It has returned 78% of free cash flows to the shareholders this year and repurchased $939 million worth of its shares in the third quarter.

PayPal Posted Q3 Earnings Beat but Guidance Disappointed

While PayPal beat on both the topline and the bottomline, it disappointed markets with its guidance. It forecast revenues of $7.38 for the fourth quarter which is below the $7.74 billion that analysts were expecting.

The company sounded circumspect about e-commerce spending. It said that US e-commerce sales grew in the low single digits in the third quarter and the growth decelerated by the end of the quarter, and the trend continued in October. It added that it hasn’t seen an early start to holiday shopping this year as we saw last year.

PayPal also said, “Overall, our expectations for holiday e-commerce are consistent with the recent spending forecasts from Adobe, Mastercard, and Salesforce with growth in the low single digits.”

Amazon posted its Q3 2022 earnings last week and the tepid guidance stoked recession fears. The company also sounded circumspect about the upcoming holiday season. Amazon stock has plummeted this year but most Wall Street analysts see it as a buy. We have a guide on how beginners can buy Amazon stock.

Yesterday, Peloton also provided dismal guidance for the fourth quarter. While the stock initially slumped, it eventually closed higher.

PayPal is Upbeat on Its Partnership with Apple and Amazon

During the earnings call, PayPal sounded upbeat about its partnership with Amazon and Apple. It is working with Apple to enhance its Venmo and PayPal offerings. PayPal said, “This will allow PayPal’s merchant base to easily use their iPhone as a mobile point of sale without the need for a dongle or other payment terminals.”

It is also working on the functionality to let US customers to add PayPal and Venmo branded credit and debit cards to their Apple wallets.

Apple incidentally sees financial services as a key growth driver. The company posted better-than-expected earnings for the September quarter even as other major tech giants failed to impress with their earnings.

The company said that it had 900 million paid subscribers across platforms at the end of the fiscal fourth quarter and it added 155 million subscribers in the last year alone. We have a guide on how beginners can buy Apple stock.

PYPL is Looking to Cut Costs Amid Macro Headwinds

PayPal is looking to cut costs amid macro headwinds. It said that it expects to realize $900 million in cost savings this year and $1.3 billion next year. Next year, it expects its operating profit margins to expand by at least 100 basis points.

While it did not provide quantitative guidance for 2023, it said, the company’s “overall volumes will continue to grow faster than e-commerce across our core markets, and that we will continue to take market share.”

However, it cautioned that inflationary pressures and slowing growth would continue to negatively impact sales of discretionary products. It also predicted an adjusted EPS growth in excess of 15% for 2023.

PayPal meanwhile sees cryptocurrencies as a key driver. While there has been a crypto winter for almost a year now, companies like Coinbase see better days ahead for digital assets.

Related stock news and analysis

- How to Buy Bitcoin with PayPal in 5 Minutes

- Best Tech Stocks to Buy in 2022 – How to Buy Tech Stocks

- Is PayPal (PYPL) Stock a Buy at $70? A Few Things to Consider

- Best Penny Stocks to Watch

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st