Microsoft (NYSE: MSFT) stock is trading sharply lower in US premarket price action today. While the company’s fiscal first quarter 2023 earnings were better than expected, it spooked markets with the guidance for its cloud segment.

In the quarter that ended September, Microsoft reported revenues of $50.1 billion, a YoY rise of 11%. In constant currency terms, the revenues increased by 16%. While the revenue growth was the slowest in five years, the metric came in ahead of the $49.61 billion that analysts were expecting.

Microsoft’s EPS came in at $2.35 which was higher than the $2.30 that analysts were expecting. The EPS however fell 13% on a YoY basis.

Microsoft posted an operating income of 21.5% which was up 6%. Its operating income increased by 15% in constant currency terms. The relentless rise in the US dollar has been a headwind for all US tech companies and Microsoft is no exception.

Looking at the different business segments, Productivity and Business Processes segment posted revenues of $16.5 billion, 9% higher than the corresponding quarter last year. Within the segment, Office Commercial products and cloud services revenue increased by 7% while LinkedIn revenues increased by 15%.

Microsoft’s Intelligent Cloud segment posted revenues of $20.3 billion which is 20% higher than the first quarter of the fiscal year 2022. Azure revenues increased 35% YoY in the quarter.

Microsoft Reported a Fall in Windows Revenues

Microsoft’s More Personal Computing segment posted revenues of $13.3 billion which were slightly below the corresponding quarter last year. Windows OEM revenues fell 15% in the quarter. The fall in revenues is not surprising though as the PC industry is witnessing its worst slump in years.

Global PC sales surged in 2020 and 2021 amid the lockdowns. However, the industry is now witnessing a slowdown in sales. Analysts expect global PC shipments to fall by double-digit this year.

Over the last two months, almost all the chipmakers have warned of slowing sales amid the slowdown in PC sales. PC makers are saddled with excess inventory and have streamlined production in line with the weak demand.

Microsoft Spooks Markets with Azure Guidance

In the fiscal first quarter, Azure’s topline growth of 35% trailed analysts’ estimates. In the current quarter, the company expects Azure’s revenues to rise by about 37% in constant currency terms, which is below the 39.4% that analysts were expecting.

Guiding for LinkedIn’s fiscal second quarter performance, Microsoft said “we expect continued strong engagement on the platform, although results will be impacted by a slowdown in advertising spend and hiring, resulting in mid to high single-digit revenue growth or low to mid-teens growth in constant currency.”

Microsoft becomes the latest company to warn of a slowdown in ad spending. Alphabet, which also released its earnings yesterday also missed sales estimates. YouTube’s performance especially disappointed, as the business reported a YoY drop in sales.

In the fiscal second quarter, Microsoft expects Windows OEM sales to decline in the high 30s, reflecting the ongoing slump in the PC market.

Global Slowdown Taking a Toll on MSFT

Microsoft’s CEO Satya Nadella began the earnings call by outlining “principles that are guiding us through these changing economic times.” He said that the company would continue to invest in areas that are witnessing secular growth.

Secondly, he said, “we’ll prioritize helping our customers get the most value out of their digital spending, so that they can do more with less.” He added that the company would be “disciplined” in managing costs.

Amid slowing growth, tech companies are now clamping back on expenses. Alphabet is cutting down on hiring and warned of an even more pronounced hiring slowdown next year.

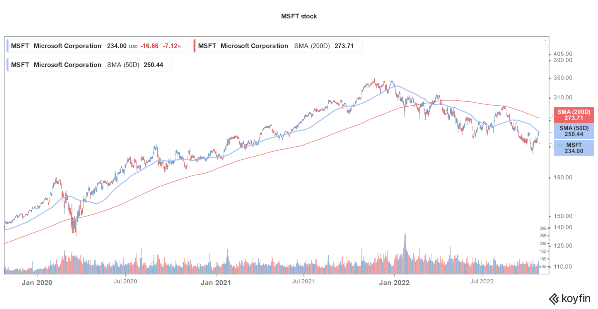

Microsoft Stock is Underperforming Markets in 2022

During Microsoft’s earnings call, CFO Amy Hood said, “you should expect to see our operating-expense growth moderate materially through the year while we focus on growing productivity of the significant head-count investments we’ve made over the last year.”

She emphasized, “While we continue to help our customers do more with less, we will do the same internally.”

Microsoft stock is down 26% so far in 2022 and is underperforming the markets. However, most analysts have a buy rating on Microsoft stock and believe that the company’s long-term outlook is quite bullish. But, as the recent earnings from Alphabet and Microsoft show, even the Big Tech companies are not fully immune to the economic slowdown.

Related stock news and analysis

- 8 Potentially Recession-Proof Stocks to Watch in 2022

- Xpeng Motors Touts Robotaxi Capabilities, Stock Sags Near All-Time Lows

- How to Buy Alphabet Stock for Beginners

Dash 2 Trade - New Gate.io Listing

- Also Listed on Bitmart, Changelly, LBank, Uniswap

- Collaborative Trading Platform Token

- Featured in Bitcoinist, Cointelegraph

- Solid Proof Audited, CoinSniper KYC Verified

- Trading Community of 70,000+ Members