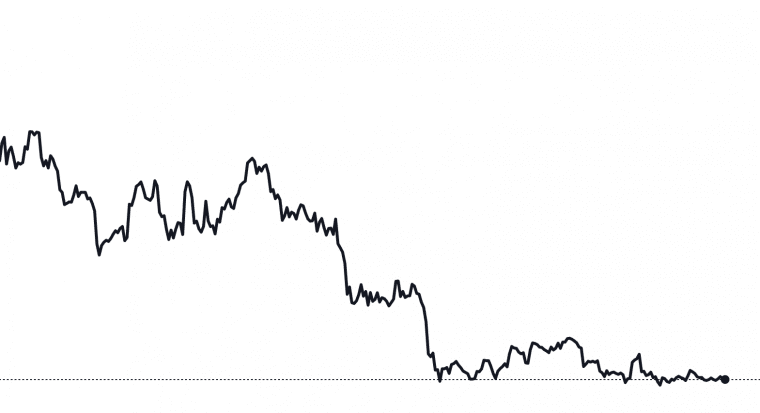

The Bitcoin price has continued to stay underwater despite repeatedly challenging the $19,600 resistance – could it challenge it once more to try and successfully break through again?

No respite in the bear market

The Bitcoin bear market has been disastrous for holders since November, who are now more than 70% underwater if they bought at the absolute top (although the overwhelming majority of market participants didn’t).

There have been very few rallies during this period, with the decline from $69k being a fairly smooth line downwards.

Over the last few weeks, the price of Bitcoin has been oscillating in a narrower and narrower range, and the price is currently resting at just above $19,000.

Can Bitcoin break above $19,600?

Over the last few days, “risk on” assets such as those in the Nasdaq have fared fairly well, and have made a small recovery as the market continues to bet on the probability of a Fed pivot.

There has been no confirmation from the Fed that this is what will happen going forward despite letters from industry leaders pleading with them not to lead the economy into a deflationary bust,

Over the past few days Bitcoin has tried to challenge the resistance at $19,600 three times, but each time has failed and retraced further, despite the success of other “risk on” assets.

Bitcoin proves far more censorship-resistant than Ethereum

The debate over whether or not capital allocators should choose to invest in Bitcoin or Ethereum (if not both) has once more been heating up given the recent news that Ethereum’s recent issues with censorship-resistance.

Many feared that the move from proof of work to proof of stake would dramatically damage Ethereum’s qualities of censorship resistance, which is one of the most important features of the blockchain in the first place.

These fears were primarily borne out of the fact that the main validators are extremely centralised in Ethereum: only four entities now have control of over 50% of the validators.

Almost all blocks since The Merge

(~210,000)red = censoring block

(left to right = time) pic.twitter.com/dcSDGHFdto

— Takens Theorem (@takenstheorem) October 15, 2022

Currently, 53% of Ethereum blocks are OFAC compliant, meaning that wallets blacklisted by OFAC and contracts such as Tornado Cash are being censored.

When validators mine blocks they have three sources of income: the transaction fees (although some of this is burned after EIP-1559), the block reward, and Maximum Extractable Value (MEV).

MEV is a huge problem for Ethereum, and is only going to grow worse. Validators are incentivised by those who delegate to them to take as much advantage of MEV opportunities as possible, since this helps them to attract as much capital as possible.

I’m a solo home validator in Country A. We are at war w Country B, and I decide that I’m not going to include donations to their military when it’s my turn to make a block. This validator should:

— latetot.eth (@latetot) October 16, 2022

When one compares the two largest coins in crypto, BTC and ETH, the myth of decentralisation in Ethereum will drive asset allocators to choose the least risky asset, and the one that is the most difficult to manipulate; a politically-governed blockchain struggles to reach the same level of consensus, which is problematic for the chain going forward if it seeks to be a provably neutral store of value.

I’m a solo home validator in Country A. We are at war w Country B, and I decide that I’m not going to include donations to their military when it’s my turn to make a block. This validator should:

— latetot.eth (@latetot) October 16, 2022

Bitcoin as an inflation hedge

One of the main narratives that could push the Bitcoin price higher in the coming months is the fact that inflation continues to rise around the world.

Outside the US, where the dollar continues to gain relative strength in the foreign exchange markets despite their own inflation, rising prices are crippling economies.

African countries in particular are suffering, which has given new credence to the idea that Western governments may have to once more consider a policy of “debt forgiveness”.

Even in more developed Western European countries inflation is proving to be extremely problematic: the Bank of England’s latest figures show that inflation in the UK has now reached 10.1%, and inflation in the Eurozone has now reached 9.9%.

Bitcoin’s scarcity means that there is huge value to be found in this regard, and it may well have a strong chance of growing to such a size that it is no longer a “risk on” asset, but instead grows to become a “risk off” asset over time – if it can achieve this, then it could replace the bond market, as predicted by economists such as Saifedean Ammous.

Relevant news:

- How to Buy Bitcoin – A Beginner’s Guide

- 11 Best Altcoins to Invest in – Which New Altcoins to Buy?

- Green Crypto Presale Accelerates as it Closes in on $6m – What is IMPT?

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st