Analysts are predicting another surge in crypto prices this week amid more bad news in the US and global economies.

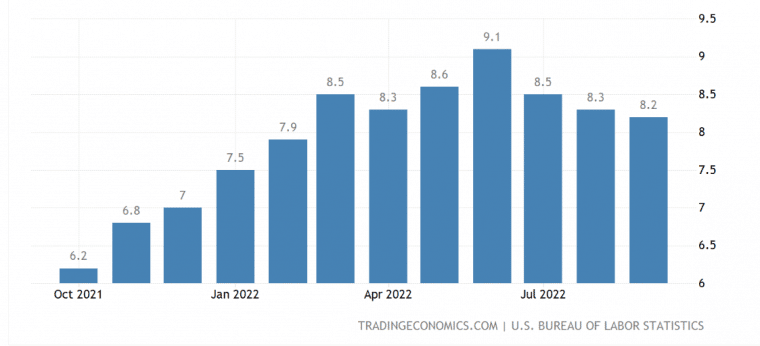

Last week, the latest US Consumer Price Index (CPI) data was released and revealed that inflation sat at 8.2%.

That figure prompted a sharp sell-off in crypto coins before an unexpected rally on Thursday and Friday.

Some coins have since retracted in price but the total market cap is creeping back toward $1 trillion and volume is again over $200 billion after a slow weekend.

Analysts and traders are now predicting an upswing in price this week.

Empire State Manufacturing Index Decline

For the third consecutive month, manufacturing activity in New York state shrunk.

The Empire State Manufacturing Index decreased to minus-9.1 in October, down from minus-1.5 in September and way below the minus-5 forecast from economists polled by the Wall Street Journal.

Based on a survey of manufacturing companies in the state and conducted by the Federal Reserve Bank of New York, the indicator signals factory activity fell at a sharper pace than the previous month and shows demand for goods has dropped.

🔥 – BREAKING:

Empire State Manufacturing Index;

Previous -1.5

Forecast -4.3

Actual -9.1Way worse than expected and, again, shows the weakening in the economy.

Top on Yields & $DXY on the horizon.#Bitcoin to rally.

— Michaël van de Poppe (@CryptoMichNL) October 17, 2022

It is used as a barometer for the wider manufacturing and production industries in the US with the survey result offering a more real-time view of the state of play that lawmakers will be able to grasp.

The slowdown has been taken as a signal that the US economy remains in a poor position.

Dutch crypto trader and financial analyst Michael van de Poppe wrote on Twitter that the results were “Way worse than expected and, again, shows the weakening in the economy.”

Van de Poppe added that “Bitcoin to rally” because of the news.

Crypto the Inflation Hedge

Although crypto has long been branded as a hedge against inflation, the reality is that is yet to happen, with crypto tokens being affected by market forces and economic movement as much as any other asset.

However, as Business2Community reported last week, that may be starting to change.

Despite the ongoing bear market through much of 2022, projects have continued to build with Ethereum and Cardano – with the Merge and the Vasil hard fork – just two projects that have completed sizeable upgrades to their protocols.

Those upgrades will only help drive mass and institutional adoption in the coming months and years.

The Ripple court case against the US Securities and Exchange Commission (SEC) is also drawing to a close after two years, with many in the space believing Ripple will win.

Furthermore, big steps in the development of central bank digital currency (CBDCs), decentralized finance protocols, and even GameFi projects, will help drive mainstream adoption and take the market away from traditional market trends.

The crypto bear market has been long and brutal but, like all market cycles, it will eventually end and a new bull run will start.

Writing specifically about Bitcoin (BTC), an article in the financial advice column the Motley Fool said Bitcoin’s base traits – decreasing supply and increasing demand – mean it will inevitably become an inflation hedge sooner or later.

The article read:

“If current trends keep going, there will likely be more demand for the world’s most valuable cryptocurrency. With supply growing slowly, that price rise should beat inflation. So, while Bitcoin hasn’t been a strong hedge against inflation in the short term, the story changes when we look at a longer timeframe.”

“Bitcoin’s inherent characteristics help drive its value over the long term. When considering the Fed’s recent approach to monetary policy, some of the primary reasons behind Bitcoin’s creation become more obvious: to sidestep currency debasement and ensure your hard earned money holds its value.”

Asset management guru Larry Lepard is even more bullish on Bitcoin’s long-term value, believing BTC can still deliver 100x from its current price. He said:

“I’m not saying that anyone should invest all their money into these things, but I strongly believe that anyone without any investment in them is taking on more risk than necessary due to the potential for gains.”

“Bitcoin could go to zero but I personally believe Bitcoin’s going to go up 100X.”

Asked whether a single Bitcoin could be worth $2 million, Lepard replied “yeah, easily, easily” and suggested a timeframe of five to six years.

Traders prepare for BTC Upswing

A number of Twitter and social media traders are now preparing for a breakout in the price of BTC in the coming days and weeks – which usually signals price increases in the wider market.

Twitter trader Il Capo of Crypto, who came to prominence after successfully calling the November 2021 top, believes BTC will reach $21,000 in the short term before a drop to a local bottom of $14k and then a rally by the end of the year.

$BTC mid tf

The wick of the other day was a bullish move. It deviated below a key level and after the bounce, fundings remained negative, showing that there's fuel to keep squeezing shorts.

Target = 21k pic.twitter.com/mQfn0VlTVZ

— il Capo Of Crypto (@CryptoCapo_) October 17, 2022

In a thread, he concluded: “Main trend is bearish and the main target for a potential local bottom is 14k. We shouldn’t expect an instant dump to this level, since current ltf PA is bullish.

“21k is a very strong resistance. Altcoins could have scam pumps during this BTC move. Lock profits.”

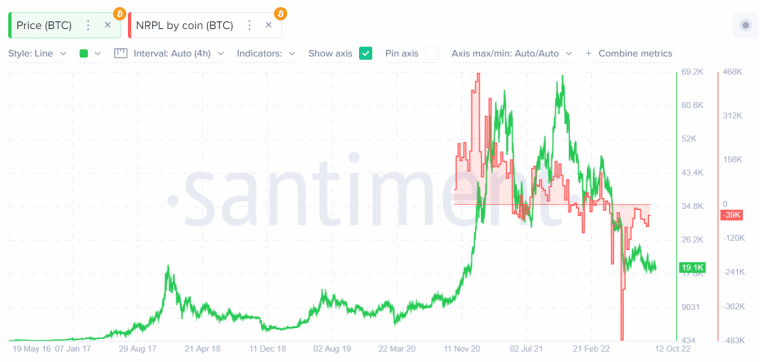

Business2Community also reported on another analyst, Mtkachuk on Santiment, providing a range of indicators that Bitcoin will break out again in the mid-term.

He references the MDIA + MVRV three-year chart, Social volume + weighted sentiment, and NRPL (above) charts as all showing bullish in 2023.