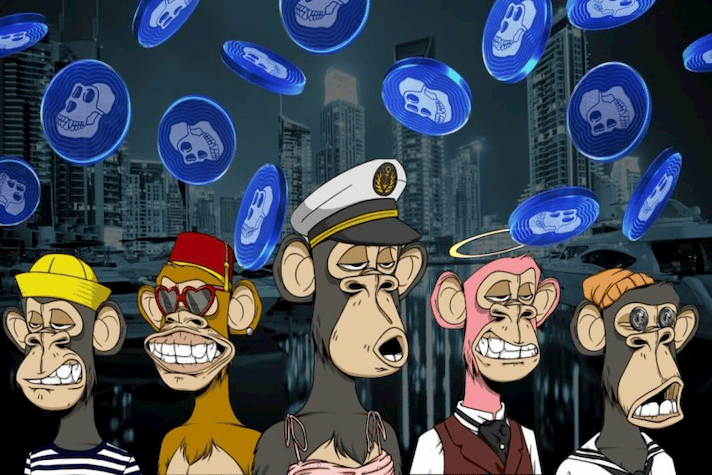

The United States Securities and Exchange Commission (SEC) has launched new investigations against Yuga Labs, the creator of the popular Bored Ape Yacht Club (BAYC) non-fungible token (NFT) collection, over offering unregistered securities.

Yuga Labs Under Probe Over Illegal Offerings

According to a Bloomberg report published on October 12, the regulatory commission has begun investigating Yuga Labs to determine whether its Bored Ape Yacht Club non-fungible tokens (NFTs) and ApeCoin are unregistered securities.

The new reports claim that the regulatory commission has dived deeper to explore whether the crypto startup violated federal laws by issuing NFTs that serve as stocks and digital assets. Moreover, the agency is also investigating the distribution of ApeCoin, which was launched last year.

Nonetheless, in a short statement to Bloomberg, Yuga Labs confirmed that the regulatory commission had not accused it of any law violation. Yuga Labs has promised to offer the commission maximum cooperation during the investigation process. Yuga Labs noted:

“It’s well-known that policymakers and regulators have sought to learn more about the novel world of Web3. We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem. As a leader in the space, Yuga is committed to fully cooperating with any inquiries along the way.”

Crypto Sector Sees Intense SEC’s Scrutiny

The SEC has increased its scrutiny over the crypto and NFT markets in the past few months. Since he was appointed in April 2021, SEC chair Gary Gensler has shared sentiments suggesting that nearly any other digital token apart from Bitcoin could be a security.

In July 2022, the SEC denounced nine tokens listed on the crypto exchange Coinbase as securities. At the time, the commission alleged that these tokens contained the “hallmarks of the definition of a security,”

Last week, the commission charged Kim Kardashian, one of the most famous women in the world, for allegedly promoting the unregistered crypto token “EMAX” on her Instagram page. The SEC fined Kardashian $1.4 million.

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

— Gary Gensler (@GaryGensler) October 3, 2022

In the meanwhile, ApeCoin has reacted sharply to the new announcements. According to CoinGecko, the token is down about 9% over the past 24 hours.

Related

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st