Jamie Dimon of JPMorgan has joined the recession bandwagon and has said that the US economy might slip into a recession over the next six to nine months.

Dimon admitted that the US economy is still healthy. He however warned, “But you can’t talk about the economy without talking about stuff in the future — and this is serious stuff.” Dimon listed several headwinds including rising interest rates, high inflation, as well as the escalation in the Russia-Ukraine war.

He added, “These are very, very serious things which I think are likely to push the U.S. and the world — I mean, Europe is already in recession — and they’re likely to put the U.S. in some kind of recession six to nine months from now.”

To be sure, this is not the first time that Dimon has warned of a recession. In August also he made similar observations and said that there is a 20-30% probability that “something worse” than a recession could be coming.

Jamie Dimon Joins Recession Bandwagon

Over the last few weeks, several market observers have raised their odds of a US recession. Commenting on recession risks, Paul Tudor Jones said, “I don’t know whether it started now or it started two months ago.” He added, “We always find out and we are always surprised at when recession officially starts, but I’m assuming we are going to go into one.”

Notably, the US economy contracted in both the first and second quarters of 2022. While that would meet the widely accepted definition of a recession, the NBER (National Bureau of Economic Research), which calls out economic cycles in the US, uses a different yardstick.

Along with the GDP growth, it also looks at personal income and employment levels. The US job market is still strong and the unemployment rate is at 3.5%, a 50-year low. However, amid the slowing economy, the unemployment rate is also expected to rise.

The Fed expects the unemployment rate to rise to 4.4% by the end of next year. The median projections of FOMC members call for a PCE (personal consumption expenditure) inflation of 5.4% by the end of 2022. Members expect inflation to gradually fall to 2.8%, 2.3%, and 2.0% in 2023, 2024, and 2035 respectively.

Cathie Wood of ARK Invest believes that the US economy is headed for deflation. Bond guru Jeffrey Gundlach has echoed her views and believes that bonds are an attractive investment option. Gundlach also said that the Fed is making the mistake of “overtightening.”

Wood Says the Fed is Making a Mistake

In an open letter to the Fed, Wood said that it is making a mistake by raising rates aggressively which could push the US economy into a recession. Fed’s rate hikes are only adding to the slowdown in the US economy.

On multiple occasions, Powell has said that the rate hikes might lead to recession. He also however emphasized that the Fed is not trying to force a recession. However, he did talk about the “pain” from the rate hikes.

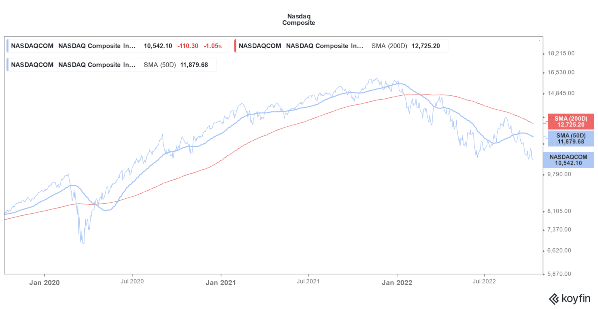

Brokerages have been lowering their S&P 500 predictions amid the worsening macro environment. Morgan Stanley, which is among the most bearish brokerage on US stocks, believes that an S&P 500 bottom could come between 3,000-3,400.

Brokerages Have Lowered S&P 500’s Target amid Recession Fears

Citi has lowered its 2022 S&P 500 target from 4,200 to 4,000. However, even the new target price implies a decent upside in the last quarter of the year. While many would fancy the chances of a rebound in US stock markets in 2023, Citi said that it expects the S&P 500 to end 2023 at 3,900.

Citi has put a 20% probability of a severe recession. If that were to happen, it expects the S&P 500 to fall to 3,250 by the end of 2023. Even Apple, whose stock held off well after June, has felt the pressure from the economic slowdown.

Apple is still the best-performing FAANG stock of 2022. Berkshire Hathaway, which is the second largest Apple stockholder added more shares in the first half of 2022. While Berkshire already has a humongous position in the company, Warren Buffett capitalized on the fall and bought more Apple shares.

Related stock news and analysis

- DWAC’s Outlook Dampened by Merger Delay, Slow Growth, Musk’s Twitter Acquisition

- How to Invest During Inflation – Best Investment Strategies Revealed

- How to Invest $1,000 – Best $1k Investments Revealed

IMPT - New Eco Friendly Crypto

- Carbon Offsetting Crypto & NFT Project

- Industry Partnerships, Public Team

- Listed on LBank, Uniswap

- Upcoming Listings - Bitmart Dec 28, Gate.io Jan 1st