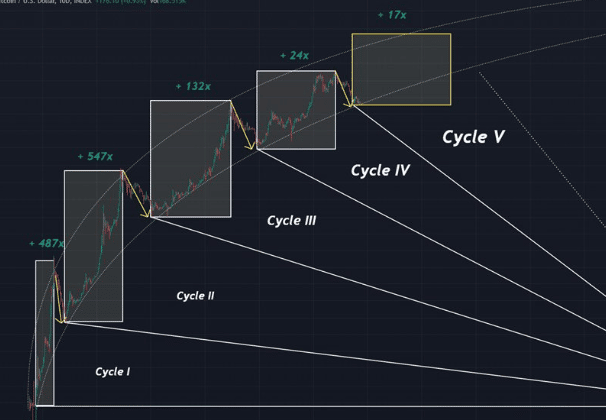

During the Asian session, Bitcoin’s price fell 2.03% to $19,069.30, indicating that it is still in a bearish trend. Despite a bearish bias, the BTC/USD pair appears to be entering its 5th Bitcoin super cycle bull market. A super cycle occurs when a positive increase in the price of a market asset leads to an increase in the price of that asset. The term “super cycle” refers to a long-term commodity bull market. However, several financial experts have begun to use it to represent Bitcoin.

Since the COVID-19 epidemic in 2020, Bitcoin has become even more popular than it was in the previous decade and it’s about to test a significant trend that has been stable for the past five years. Volatility is expected to rise over the next week and into the second half of November.

What is Bitcoin Super Cycle Bull Market?

A super-cycle is five years of consistent and sustained price increases, typically driven by strong demand. Bitcoin Super Cycle Bull Market refers to the period when Bitcoin prices experience a dramatic rise in value after a long downturn. The term was first used by Trace Mayer in 2014 when he predicted that Bitcoin would reach $27,395 by 2020. Bitcoin has been on a downward trend for the past few months, but it is finally showing signs of a bull market.

Is the Bitcoin Price About to Enter its 5th Super Cycle Bull Market?

The Bitcoin market is unlike the stock market, where you can predict what will happen next. Bitcoin is a much more volatile asset, meaning the price can go up or down in minutes. However, some indicators can help us predict when the bitcoin bull run will end and what could happen next.

The first cycle occurred from 2009 to 2011, the second from 2012 to 2015, the third was from 2015 to 2019, and finally, the fourth started in 2019. The current 5th Bitcoin Super Cycle began at the end of 2022 and is predicted to last until 2028-29.

Cycles are divided into two main phases:

- Speculative phase

- Accumulation phase

During the speculative phase, Bitcoin is seen as a high-risk investment. During the accumulation phase, investors hold on to their coins for a period of time to realize gains as market prices increase.

Bitcoin Super Cycle V – What to Expect?

#Bitcoin soon pic.twitter.com/xfE1E0gWwY

— Stockmoney Lizards ⚡️ (@StockmoneyL) October 2, 2022

Related news:

- Bitcoin Price Prediction 2022 – 2030

- Best Beginner Crypto to Invest in 2022

- Why Bitcoin Price Calm Should Cheer the Bulls – Time to Buy BTC

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption