The cryptocurrency market has been relatively calm recently, with crypto prices mostly bearish. Most of the calm in the cryptocurrency market is due to a lack of financial developments and economic events. As a result, cryptocurrencies continue to trade sideways.

The current week, however, is jam-packed with high-impact economic events from the United States, which can potentially drive some price action in the forex and cryptocurrency markets.

Let’s take a closer look at these fundamentals and their potential impact on the crypto market.

US CPI and PPI to Impact Crypto Prices

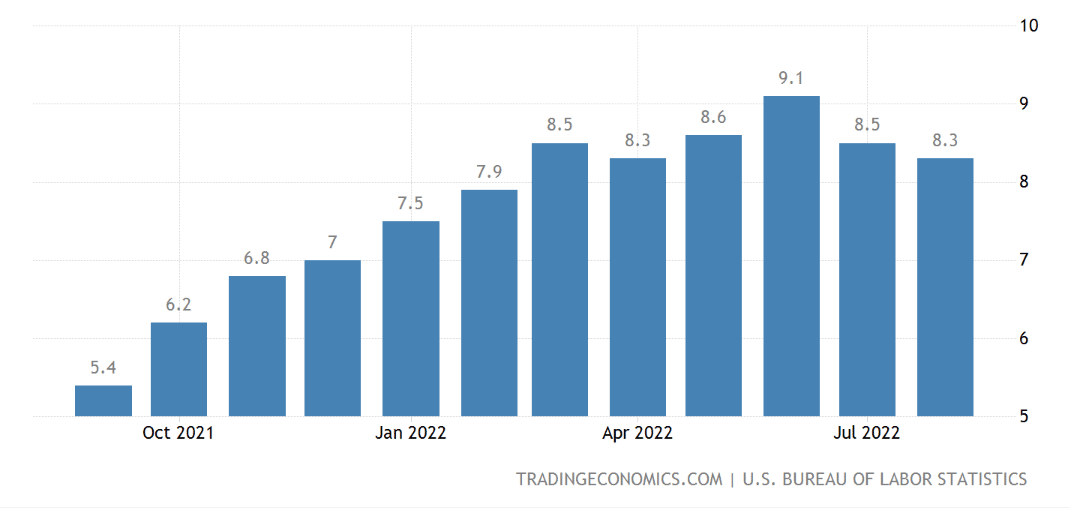

The annual inflation rate in the United States fell for the second month in a row to 8.3% in August 2022, the lowest in four months, from 8.5% in July but above market expectations of 8.1%.

US Inflation Figures Source: Tradingeconomics

On October 12, they will release the September US producer price index at 12:30 GMT, and Fed Governor Bowman will speak at 22:30 GMT. The consumer price index (CPI) for September in the United States is scheduled for 12:30 GMT on Thursday, October 13.

The CPI figures will be released a day after the Federal Reserve’s September meeting minutes are released. The recently released economic events may influence market forecasts for the Fed’s November meeting.

Crypto Prices: Economists’ Forecasts for US CPI and PPI Rates

Crypto prices may rise next week if US CPI inflation falls below 8.3% on Thursday and the producer pricing index PPI falls below 7.3% on Wednesday. In the United States, inflation rose slightly slower in September than in the previous month, owing to a decrease in energy costs.

Many key events will take place in the coming week:

Oct. 12th : #FOMC meeting minutes

Oct. 13th : #CPI dataThese are two important events to focus on next week.

I expect a pump on the market!— BIBI (@Bibilovescrypto) October 9, 2022

In one week, several macroeconomic data releases will be made public. These findings could cause changes in the financial and digital asset markets.

In addition, investors will once again learn how the country’s financial authorities handle inflation and whether more monetary policy tightening is required from CPI statistics.

If #CPI on Thursday 13th comes in at 7.9 that would be back to February 2022 levels https://t.co/CWuG7iDz5h pic.twitter.com/tVRU8ouQwR

— SAITAREALTY MILLIONAIRES (@SAITACOMMUNITY) October 10, 2022

According to Reuters polled economists, the headline US consumer price index will be 8.1% in September, up from 8.3% in August. Experts predict that the CPI will rise by 0.2% this month, up from 0.1% in August. In September, the CPI may increase from 6.3% and 0.6% in August to 6.5% year over year and 0.5% month over month.

Cryptocurrency Prices May Rise Upon Weaker US Figures

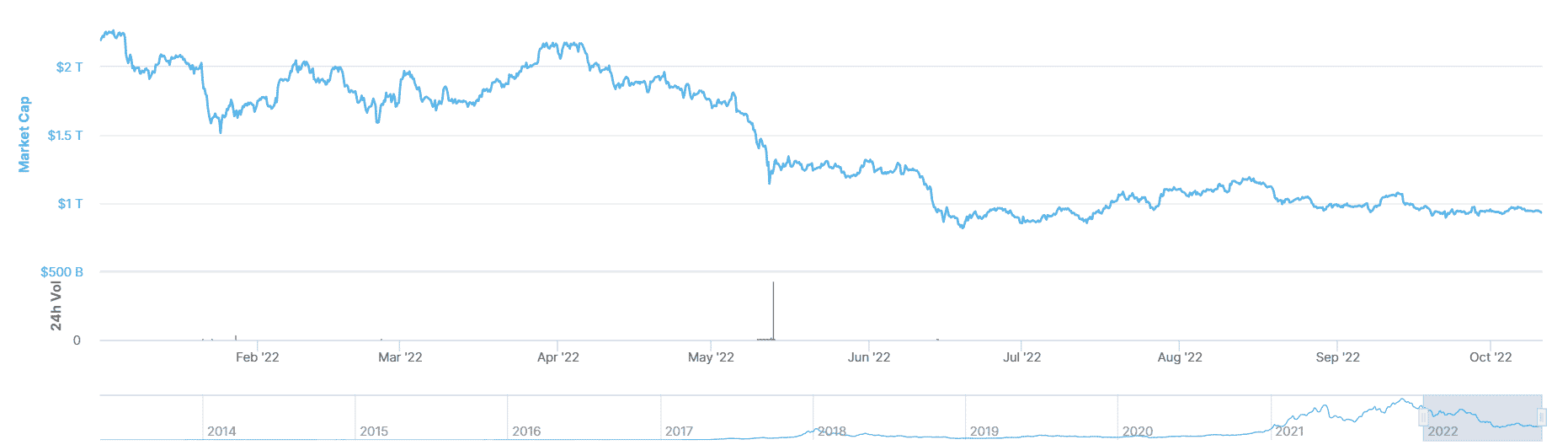

After reaching a value of $3 trillion last year, the Bitcoin and cryptocurrency market has dropped a staggering $2 trillion in just 12 months, dubbed the “new crypto winter.” The cryptocurrency industry has experienced boom and bust cycles, with the most recent crypto winter lasting from late 2018 to late 2020.

A cryptocurrency entrepreneur predicted how long the current crypto winter would last.

In an email, William Marsters, senior sales trader at Saxo, stated that we would need to see some continuous economic weakening indicators before the Fed-pivot trade becomes active. The following week’s CPI figures and FOMC minutes will help shape the forecast even more.

The FOMC meeting minutes should provide investors with more information on how regulators decided to raise the basic interest rate in the United States.

This upcoming week is gonna be a fun one: PPI, FOMC minutes, CPI, Initial jobless claims, and retail sales pic.twitter.com/AAmEPS919Q

— Will Clemente (@WClementeIII) October 8, 2022

Depending on the financial regulators’ narrative, the crypto market will respond with increased volatility and price increases. However, the recent CPI report’s lack of impact on inflation leads most investors to bet on maintaining the Fed’s strict monetary policy. Furthermore, despite current market uncertainty in the United States, Bitcoin has avoided a crash.

It is the first indication that there is less selling pressure and that traders are hesitant to sell their holdings at lower prices. However, returning to a risk-on mindset will require Bitcoin to experience a sustained recovery. With several cryptocurrencies offering trading opportunities, volatility may remain range-bound until then.

Related news

- Can Bitcoin Eventually Replace Real Estate as Asset of Choice to Fight Inflation?

- Does Bitcoin’s Strengthening Correlation With Stocks and Bonds Mean a Longer Crypto Winter?

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption