Crude oil prices have steadied amid reports that OPEC+ (Organization of Petroleum Exporting Countries) is considering a production cut at its October meeting. The bloc controls the global energy supply and its production cut decisions impact prices.

Earlier this month, OPEC surprised markets with a 100,000-bpd (barrel per day) production cut. Markets were expecting OPEC+ to hold its production at previous levels only.

Over the last few years, OPEC+ members, especially Saudi Arabia, have given up their insistence on protecting market share.

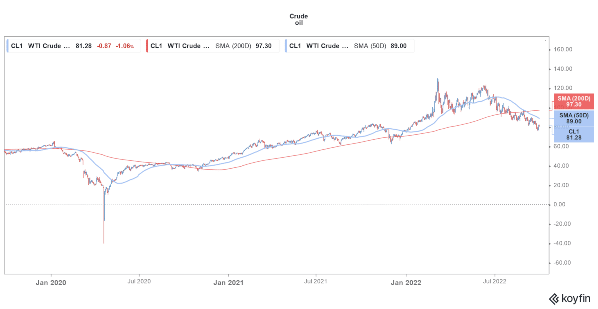

In 2021, Saudi Arabia announced a unilateral production cut. Notably, crude oil prices were still low in January 2021 when Saudi Arabia announced the production cut.

OPEC Reportedly Looking at Oil Production Cut

Citing sources, Reuters reported that the OPEC+ has begun discussions for an oil production cut at the upcoming meeting on October 5. The report added that Russia might propose a 1 million bpd production cut.

To lessen the effects of rising gas prices, US President Joe Biden announced a significant release of 1 million barrels of oil from the country’s Strategic Petroleum Reserve (SPR) for six months. If OPEC+ decides to cut production, it could tighten the market and potentially drive energy prices higher.

Crude oil prices have whipsawed this year. While prices rose to their highest level since 2008 following the Russian invasion of Ukraine, they have since come down. There are concerns over global oil demand which is taking a toll on prices.

Earlier this month, global logistics giant FedEx, as well as the World Bank, warned of a global recession. The US dollar has also strengthened amid the Fed’s rate hikes. Commodities in general have a negative correlation with the greenback as a stronger US dollar makes them expensive in other currencies. We have a guide on how to trade commodities.

Warren Buffett Continues to Load Up on Energy Stocks

As many feared, Russia did weaponize its energy exports. While for now, concerns over oil demand are outweighing supply concerns. Energy stocks have come off their 2022 highs amid the fall in oil and gas prices.

That has however not deterred fund managers like Warren Buffett and Stanley Druckenmiller to increase their exposure to the energy sector. Buffett has invested billions of dollars in buying oil stocks this year. He has added 5.99 million Occidental Petroleum which has lifted Berkshire Hathaway’s stake in the company to 20.9%.

In 2019, Berkshire Hathaway chairman Warren Buffett invested $10 billion in Occidental Petroleum to finance its acquisition of Anadarko Petroleum. In the typical Buffett way, he invested the money in preferred stocks which carry an 8% yield. The preferred stocks also have convertible warrants attached to them.

Oil Price Forecast: JPMorgan Sees Brent Rising to $100 per Barrel

JPMorgan meanwhile remains bullish on energy prices and has predicted that oil prices would rise above $100 per barrel amid tight supplies. However, some brokerages have a bearish view of oil. Citi previously said that oil prices would fall to $85 per barrel by the end of 2022. In its bear case scenario of a recession, it expects oil at $65 per barrel in 2022 and $45 per barrel in 2023. We have a guide on how to trade in oil.

Over the long term though, analysts expect global oil demand to taper down as countries transition to electric vehicles. Global EV (electric vehicle) sales have been rising and many analysts believe that we would hit peak oil demand by 2025.

Related stock news and analysis

- Popular Energy Stocks to Watch in 2022

- How to Invest in Clean Energy in 2022

- Tesla Looks Set for Record Third Quarter Deliveries after the Q2 Slump

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption