Executives of crypto network company Helium have been accused of enriching themselves “at the expense of everyday people who bought hotspots thinking they were going to bring value.”

An investigation by Forbes has alleged that 30 wallets digital wallets connected to executives, employees, friends, family, and early investors mined nearly 50% of HNT tokens in the first three months of the launch in August 2019.

The wallets, which have been confirmed and verified by blockchain security firm Certik, mined 3.5 million HNT tokens – which would have been worth $250 million when the token hit its all-time high in November 2021 and are still worth $21 million today.

Forbes claims to have reviewed hundreds of leaked internal documents, analyzed blockchain data, and also interviewed five former Helium employees.

Helium co-founder says revelations not “unreasonable to me or egregious in any way”

It is not untypical for crypto startups to compensate early investors and founders who put forward the risk to kickstart a project.

However, Forbes claims that while Helium publicly discussed Helium Security Tokens – which would guarantee about a third of Helium tokens would be diverted to investors and executives – the additional windfall from the public token sale was not discussed.

They allege that when Helium hotspot mining was at its most profitable, just 30% of rewards were distributed to the community, with insiders claiming a majority of the tokens.

Lee Reiners, Policy Director at the Duke Financial Economics Center, told Forbes:

“This is a recurring pattern in the crypto economy. This thing was set up to enrich the founders and early supporters at the expense of everyday people who bought hotspots thinking they were going to bring value.”

In response, Helium co-founder and CEO Amir Haleem said that half of the hotspots were distributed to employees, their family and friends and that he doesn’t feel believe the additional windfall should have been disclosed to the community. He told Forbes:

“None of those numbers feel unreasonable to me or egregious in any way… I don’t know why we would be asked to be in a position to reveal anything about these people… They took an enormous risk and a huge chance on paying money to build something.”

Forbes claim to have tracked a hotspot linked to Haleem’s wife to a California address owned by the couple where five hotspots mined a combined 250,000HNT – worth $25 million at its peak and $2 million today. It is not known if the tokens were sold or held, with Haleem declining to comment.

A wallet connected to COO Frank Mong received nearly a dozen payments in HNT from two other wallets connected to him in under two hours in August 2021, with those payments – valued at just shy of $1 million – then sent to centralized exchange Binance.

Neither Mong or Binance commented, and it is unclear what happened to the tokens.

Helium ‘Cluster Closets’ and cheating allegations

Three former employees also accused other employees of setting up ‘closet clusters’ of hotspots – where multiple hotspots would be set up in one home to improve mining rate but have their location masked and manipulated to hide it.

One anonymous employee said: “When you see customers doing it, it’s like, well, what am I doing working?

“Why aren’t I just minting money by putting hotspots in a closet?”

Helium now has a blacklist of 70,000 hotspots and Haleem told Forbes he was not aware of staff cheating the network.

The company was also previously accused of lying when it was forced to remove mentions of ride share company Lime and software firm Salesforce from its website.

Helium had to remove the two logos from their site after the two companies said they had no relationship with the crypto firm.

HNT down nearly 90% from peak as miners complain of diminishing returns

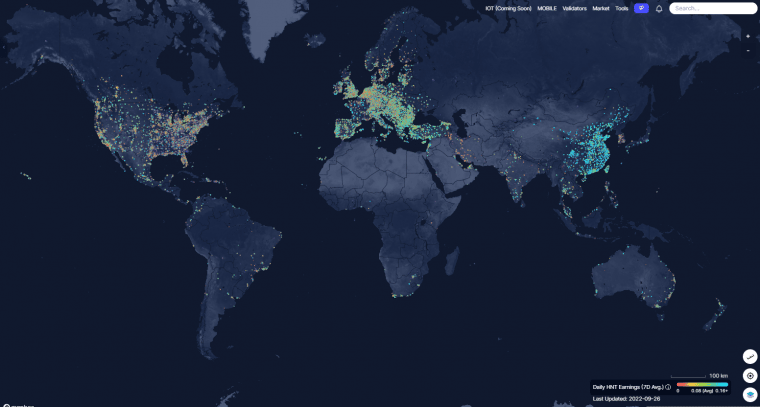

Helium’s HNT token is down nearly 90% from its November 2021 high of $55 amid the wider crypto bear market and complaints from miners.

Posters on Reddit and numerous Twitter accounts have complained about lengthy waiting times for their hotspots to arrive, while miners return only around 2HNT per month mining, compared to a peak of 33,000HNT per month in August 2019.

The Californian city of San Jose has now ended a pilot scheme with Helium after a “decline in the amount of HNT generated per miner”.

The article also shows that more than 99% of Helium’s revenue has been generated by customers buying and registering new hotspots ($53.3 million) compared to data being transferred on the network ($92,000).

Say hello to @Helium_Mobile! The world’s first cryptocarrier, bringing the power of #ThePeoplesNetwork right to your phone in partnership with @TMobile!

Read more here: https://t.co/SAO1OpzjWP pic.twitter.com/oWfOBKqYbr

— Helium (@helium) September 20, 2022

Last week, Helium announced it has secured a partnership with two global mobile network providers, DISH and T-Mobile, and is now building its own 5G network.

A new token, MOBILE, will be distributed for hotspot owners who help build the ecosystem – with upgraded hotspots costing from $1,000 to $2,600.

There is not yet any information available on token distribution on the Helium website or press release.

Related

- This Crypto Coin Might Explode 100x By 2023 After Initial Exchange Offering

- Quant Price Pumps 12.5% to $119.16 – Is QNT Interoperability Token Headed to $150 Next

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption