General Motors (NYSE: GM) and Hertz have announced an EV (electric vehicle) partnership under which Hertz would order up to 175,000 EVs from GM over the next five years.

The deal is the largest such deal in the EV industry and Hertz would order models across Chevrolet, Buick, GMC, Cadillac, and BrightDrop. The deliveries for Chevrolet Bolt EV and Bolt EUV would begin in the first quarter of 2023.

In her prepared remarks, General Motors CEO Mary Bara said, “Our work with Hertz is a huge step forward for emissions reduction and EV adoption that will help create thousands of new EV customers for GM.”

She added, “With the vehicle choice, technology and driving range we’re delivering, I’m confident that each rental experience will further increase purchase consideration for our products and drive growth for our company.”

Notably, last year Hertz announced that it would place an order of up to 100,000 EVs from Tesla. Tesla stock soared after the announcement and soon went on to hit a market cap of $1 trillion.

Wall Street analysts have been getting bullish on Tesla after President Joe Biden signed the Inflation Reduction Act of 2022 which would restore the EV tax credit for Tesla cars from the next year.

Morgan Stanley advises investors to buy Tesla stock and believes that the Inflation Reduction Act could add $30 billion to the company’s profits by 2030.

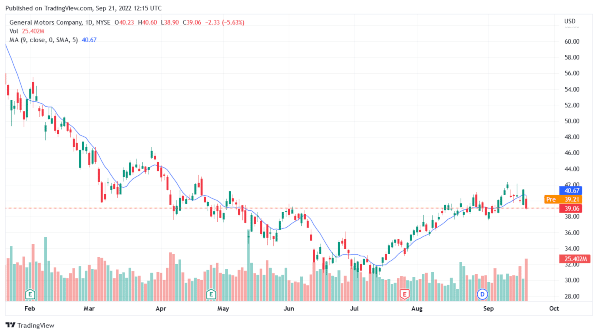

General Motors Stock Fell after Announcing the Hertz Partnership

Meanwhile, General Motors stock tumbled yesterday after announcing the Hertz deal. The crash was due to Ford’s update where the company said that it expects a $1 billion hit to its third-quarter earnings due to higher input costs. Its Q3 2022 earnings guidance was below what analysts were expecting but the company maintained its full-year guidance.

While some Wall Street analysts have turned bearish on F stock amid the recession concerns, billionaire hedge fund manager Ray Dalio bought more Ford shares in the second quarter. Yesterday, Morgan Stanley maintained its equal weight rating on Ford stock but advised investors to buy Ford stock below its target price of $14.

EV Sales are Expected to Soar in Coming Years

EV sales are expected to soar in the coming years as both legacy and pure-play EV companies ramp up production. General Motors expects to sell 400,000 EVs next year and 1 million in 2025. By 2035, the company wants to stop selling ICE (internal combustion engine) cars.

Ford expects its annual EV production run rate to reach 600,000 by the end of 2023 and 2 million by 2026. The company had previously restructured the business between the electric and ICE business.

Starting next year, Ford would start reporting the results for Ford Blue, which is the traditional ICE business, Ford Model e, which is the electric vehicle business, and Ford Pro, which is the commercial vehicle business, separately.

Ford stock has crashed this year but its dividend yield is now a healthy 4.6%. General Motors also restored its quarterly dividend and paid a 9 cents dividend last week only. However, the yield is a paltry 0.92% and is even below that of the S&P 500’s dividend yield.

Related stock news and analysis

- Best Dividend Stocks to Buy in 2022

- How to Buy Hertz Stock in 2022

- Chamath Palihapitiya Dissolves IPOD & IPOF amid the Tech Rout

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption