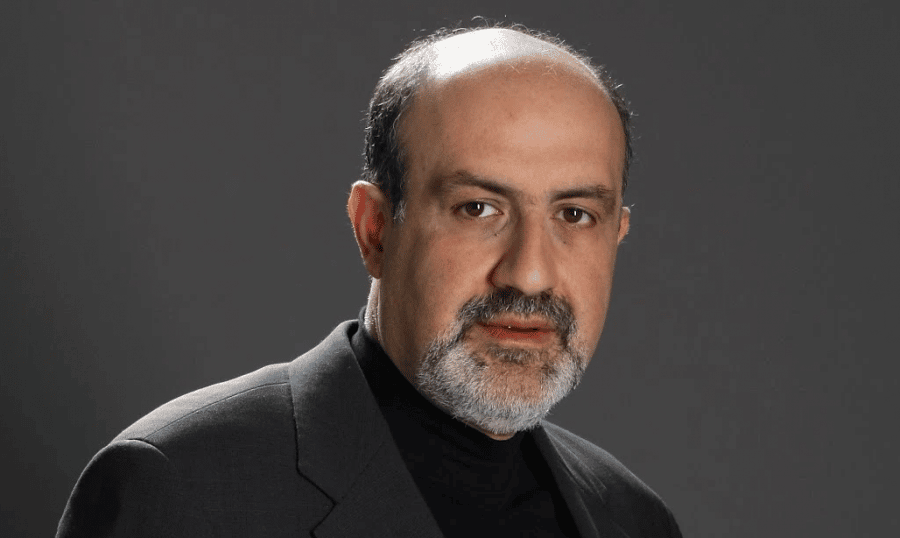

Nassim Taleb, the author of “The Black Swan” and a risk-management expert, has called Bitcoin a “tumor.” In an interview with CNBC “Squawk Box,” Taleb also likened Bitcoin to the real estate market.

Risk-management expert calls Bitcoin a “tumor”

During the CNBC interview held on Thursday, Taleb addressed a wide range of issues, including the latest decision by the Federal Reserve to ease the monetary policy, saying that the move had created “tumors” in the Market.

Taleb said that the actions of the Federal Reserve had misled some investors into overestimating the ease with which people can make returns by investing in stocks. He referred to Bitcoin as an example of how misguided investors were.

According to the expert, Bitcoin, which has lost nearly two-thirds of its value, was one of the “tumors.” He also mentioned real estate following the appearance of the CEO of Starwood Capital in the same show, who is also pessimistic about the real estate market.

The Black Swan author explained that the current breed of investors was yet to understand the impact of a recession. A recession can result in high-interest rates, and the Federal Reserve is currently raising these interest rates to tame inflation. It is the first time that the Federal Reserve is raising the interest rate since the 1980s.

He also explained that what was happening in the economy would result in people discovering that there was time value in money. This was in reference to an early belief that the value of a dollar today was worth more than the value of that dollar at some point in the future.

He also had some advice for new investors, saying that they needed to learn what the economic policy should and should not be, adding that while the interest rates would be normalized, they would not vary much.

Taleb believes that the normal interest rates are around 3% or 4%, which is also around where futures traders expect them to be towards the end of the year, according to the estimates provided by the CME FedWatch tool.

Stocks, cryptos plunge amid bear market

The stock market dropped significantly in 2022 amid the rising inflation and the tightening of the monetary policy by the Federal Reserve. The S&P 500, Dow Jones Industrial Average, and the Nasdaq composite have all witnessed sharp drops since the year started.

The crypto market has also witnessed a rise in volatility this year. Bitcoin is usually touted as a hedge against inflation because of its capped supply of 21 million coins. However, the coin has plunged significantly this year, losing two-thirds of its value.

The correlation between Bitcoin and the stock market has increased this year. The correlation comes as institutional investors continue to buy Bitcoin and gain exposure to the asset class. The correlation has hindered Bitcoin from outperforming the stock market, as in previous years.

Taleb has also cautioned the Federal Reserve against turning back on its monetary policy. The expert believes that “a generation of people” have made numerous profits by using the wrong methods of investing because of the low-interest rates.

Related

- How to Buy Bitcoin in 2022 – Safely & With Low Fees

- Why Bitcoin Prices Could Be in Bottom Forming Territory if This Ratio Is Right Again

- Bitcoin Investment, Trading & Mining: The Ultimate Guide for Beginners

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption