The OPEC+ block, which includes countries like Saudi Arabia and Russia, has announced a small production cut. While the cut is mostly symbolic, oil prices are nonetheless trading higher today as markets expected the cartel to hold its production at current levels.

The block has come a long way over the last decade. Saudi Arabia, which is the largest crude oil exporter, historically focused on protecting its market share. Its reluctance to give up on market share led to a crash in energy prices in late 2014.

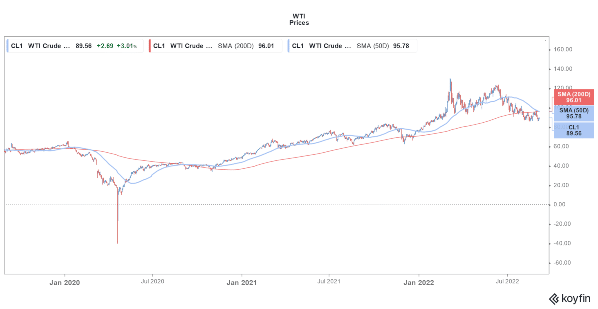

Even in 2020, then US President Donald Trump had to cajole OPEC members to agree on an oil production cut. There was a global oil glut in 2020 and WTI futures briefly turned negative, for the first time in history. Notably, Saudi Arabia listed its state-owned energy company Aramco in 2019, months before the COVID-19 pandemic.

Over the last year, OPEC+ members, especially Saudi Arabia, have given up their insistence on market share. In 2021, Saudi Arabia announced a unilateral production cut. Notably, crude oil prices were still low in January 2021 when Saudi Arabia announced the production cut.

OPEC Raised Production Gradually Since 2020

As global oil demand started to rise following the easing of COVID-19 lockdowns, OPEC+ started to gradually raise production. Oil importing countries including the US, China, India, and Japan, called upon the bloc to increase production significantly amid the rise in crude oil prices.

Global oil prices surged to their highest level since 2008 earlier this year after Russia invaded Ukraine. US President Joe Biden also unsuccessfully tried to cajole OPEC to raise production. Oil importing countries released oil from their strategic reserves to put pressure on OPEC. Biden also announced a historic 1-million-barrel oil release from the country’s SPR (Strategic Petroleum Reserves) for six months.

However, none of these measures had much impact on oil prices. Prices have fallen in recent weeks though on fears of a global slowdown. The US economy contracted in the first half of 2022 while the Chinese economy grew at an annualized pace of only 2.5%, which is less than half of what the country is targeting.

OPEC Surprises Markets with Production Cut

OPEC+ increased production by 100,000 bpd (barrels per day) last month. While markets expected the cartel to hold on to the current levels of production, it surprised markets with a 100,000-bpd production cut. Unsurprisingly, oil prices are trading higher today. To make things worse, natural gas prices are also rising as Russia is weaponizing its energy exports by choking off Europe’s gas supplies.

Notably, oil prices have come off their highs amid concerns over global demand. That has however not deterred fund managers like Warren Buffett and Stanley Druckenmiller to increase their exposure to the energy sector.

Warren Buffett is Loading Up on Oil Stocks

Buffett has invested billions of dollars in buying oil stocks this year. Berkshire Hathaway has added to the positions in Occidental Petroleum and Chevron and recently it received permission to increase the stake in Occidental to 50%.

The conglomerate had invested $10 billion in Occidental to finance its acquisition of Anadarko Petroleum. It invested in preferred shares of Occidental which had attached warrants.

Apple is by far the largest holding for Berkshire Hathaway and Buffett has praised the company on multiple occasions. Buffett bought $600 million worth of Apple shares in the first quarter of 2022, which was his first purchase of the iPhone maker since the third quarter of 2018.

Buffett bought 3.9 million shares of Apple in Q2 2022 which took the total stake to 895 million. Berkshire is the second-largest stockholder in Apple, the world’s largest company by market cap.

Buffett, who mostly stays away from tech stocks, sees Apple as a consumer product company and has appreciated its products as well as its leadership. Apple is the best-performing FAANG stock of 2022.

Coming back to oil stocks, after OPEC+’s surprise production cut, we could see some traction in energy stocks. However, brokerages are mixed on the outlook for energy prices. While JPMorgan expects them to surpass $300 per barrel in the worst-case scenario, Citi expects prices to fall irrespective of a global recession.

Related stock news and analysis

- How to Trade Oil – A Beginner’s Guide

- Warren Buffett Adds More Apple Shares in an Otherwise Muted Q2

- How to Buy Shares in the UK – Best Stock Brokers Reviewed

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption