Over the last few weeks, there was a massive rally in meme stocks including GameStop, AMC Entertainment, and Bed Bath & Beyond. The rally in Bed Bath & Beyond has come to a grinding halt after activist investor Ryan Cohen abruptly sold his entire stake in the company.

Cohen is estimated to have made a cool profit of almost $60 million on the trade, thanks to the short-squeeze-driven rally triggered by mostly retail traders. Cohen was sitting on big losses on the investment in July as Bed Beth & Beyond stock plunged to a 52-week low.

However, there was a massive short squeeze in the stock which led to a massive rally. While Cohen exited in time, many retail traders risk getting struck in the Bed Bath & Beyond stock. Cohen’s exit from Bed Bath & Beyond stock is triggering a meme stock slump today.

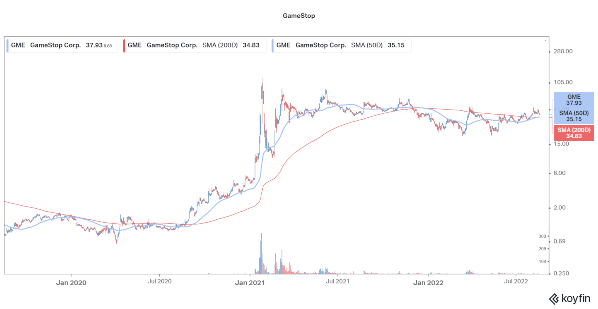

GameStop is trading sharply lower in US premarket price action today. Notably, Cohen’s firm RC Ventures is the biggest stockholder of GameStop. It was among the top stockholders of Bed Bath & Beyond also before he decided to exit, at a massive profit of course.

Will Cohen Exit GameStop Also?

Cohen’s firm holds an almost 12 percent stake in GameStop. Cohen is actively involved with the company and also took over as the chairman. GameStop was among the list of stocks Reddit traders recommended in 2020 and 2021. The company has been trying to turn around the business and many retail traders were supportive of the turnaround.

GameStop has rejigged its top management team and has hired executives from tech giants like Amazon. It has also been trying to increase in target market while lowering its retail footprint. GameStop has been focusing on e-commerce. While the pivot started even before Cohen joined as the chairman, the pace has increased under his stewardship.

GameStop Launched NFT Marketplace

GameStop has also launched an NFT marketplace. It said, “The Company’s NFT marketplace is a non-custodial, Ethereum Layer 2-based marketplace that enables parties to truly own their digital assets, which are represented and secured on the blockchain.”

Many fear that Cohen would also exit GameStop. However, he bought more shares earlier this year and continues to remain invested in GameStop. Meanwhile, while Bed Bath & Beyond is saddled with a lot of debt, GameStop capitalized on the meme stock rally and raised enough cash to repay its debt. At the end of April, it had over $1 billion as cash on the balance sheet. Many other companies capitalized on the meme stock fest to raise cash.

Sundial Growers deserves a special mention. The company was facing trouble with the massive debt, which was compounded by its perennial losses. However, the cannabis company capitalized on the meme stock surge and raised enough cash to not only repay its debt but has since turned into a lender for struggling cannabis companies.

Meme Stock Trade Redefined Markets in 2021

Meanwhile, Wall Street analysts were mostly unimpressed with the meme stock surge and continued to maintain bearish forecasts for these companies. Bed Bath & Beyond also saw a flurry of downgrades over the last two weeks as even the bullish analysts found it hard to justify the valuations.

Even in GameStop’s case, the company’s business continues to burn cash. It has been trying to transform the business but the results would only show up in the long term. In the meanwhile, GameStop has relied on the NFT platform launch and stock split to keep investors happy.

The situation at fellow meme stock AMC Entertainment is even dire. While its revenues have rebounded from the pandemic lows, it still has plenty of debt on its balance sheet. It is issuing preferred stocks to keep the retail investors, many of whom like to be called “Apes” happy.

That said, a lot of funds lost billions betting against “Apes” and other Reddit traders in 2021. The same rulebook is playing out in 2022 as many funds realize that shorting meme stocks is among the riskiest traders on the planet.

Related posts

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption