Cryptocurrency lender Celsius Network is on a sharp bullish streak, having gained over 100% in seven days. Celsius price prediction suggests a strong chance of breaking through the next major resistance level of $2.80.

CEL was able to extend its upward rally to the $2.37 mark as Ripple expressed interest in the Celsius Network. In this update, we are going to Celsius price prediction and key fundamentals driving a sharp uptrend in CEL price.

CEL Price Pumps 100% Despite Bankruptcy Petition

The cryptocurrency lender Celsius (CEL) has continued its upward trend, getting some extra bids around the $2.37 mark. Despite the fact that Celsius Network recently filed for Chapter 11 bankruptcy in the Southern District of New York, the token from the struggling crypto lending platform has been moving higher.

Due to deteriorating market conditions, the company decided to halt withdrawals, swaps, and transfers on its platform in June. Nonetheless, things appear to be changing in light of the recent comeback, as Celsius has risen to a high of $2.37, gaining over 100% in the last seven days.

Some positive reports suggest that the blockchain payments firm Ripple Labs, which created XRP, is interested in purchasing assets from the bankrupt cryptocurrency lender Celsius.

CEL Price Review & Tokenomics

Celsius’s current live price is $2.37, with a 24-hour trading volume of $34 million. CEL made a sharp upward movement and rose by 30.35% in 24 hours.

Currently, Celsius is ranked #79 in the market, with a live market capitalization of $566 million. It has a total supply of 696 million CEL coins and a circulating supply of 239 million CEL coins.

CEL Soars as Ripple Expresses Interest in Bankrupt Crypto Lender

According to reports, Ripple Labs Inc., a blockchain payments company, is interested in Celsius Network, a defunct cryptocurrency lending network. Ripple has expressed interest by requesting to be represented in the current Celsius bankruptcy court.

The application was approved earlier this week, allowing Ripple to learn firsthand about the company’s current obligations and how it might profit from a partnership or buyout. It is also worth noting that the Securities and Exchange Commission (SEC) of the United States and Ripple have been involved in a long legal dispute over the marketing of XRP currency as securities.

Although experts believe Ripple will eventually succeed in the SEC, the issue has significantly slowed the company’s growth and commercial expansion in the US over the last two years. As a result, this issue has no bearing on Ripple’s collaboration with or acquisition of bankrupt cryptocurrency lender Celsius Network.

Goldman Sachs Expressed Interest in Celsius Network

In addition to Ripple, Goldman Sachs is another major corporation that expressed interest in Celsius Network in June 2022. However, there had been no official bids for the platform at the time of writing.

Why Ripple Might Buy Celsius Assets

According to Reuters, the payment company Ripple is considering buying the assets of the insolvent cryptocurrency lender Celsius Network. This collaboration will allow the payment company to increase consumer acceptance of their key offerings, such as XRP-based On-Demand Liquidity.

Furthermore, the payment provider has pledged millions of dollars to environmental and “carbon market modernization” organizations. Ripple also stated that the crypto industry has long-term growth potential, particularly for initiatives that provide people with practical benefits.

Nonetheless, Ripple’s report asserts that Celsius could compete with them if its management changes.

Risk-on Sentiment & Bullish Crypto Market

This week, the crypto market is trading exhibiting a risk-on sentiment and has been flashing green, which tends to boost all crypto coins. Cryptocurrencies have risen in value in the 24 hours since the release of US CPI data on Wednesday.

According to CoinMarketCap data, the total market capitalization of all cryptocurrencies was $1.15 trillion, up 6.69% in the previous 24 hours. As a result, the price of Bitcoin increased by 6.41%, surpassing the $24,000 mark.

Meanwhile, Ethereum gained 12.72% due to the Goerli testnet merger and positive market signals following the release of CPI data. According to the Bureau of Labor Statistics, consumer prices increased 8.5% year on year in July, down from a 9.1% year-on-year increase in June.

Weaker US Dollar Underpins CEL

The drop in the value of the US dollar boosted the Celsius price even more. The US dollar fell sharply after July inflation data came in lower than expected. This gave people hope that the Federal Reserve would raise interest rates more slowly than anticipated.

As a result, the bullish crypto market and weaker US CPI were regarded as one of the primary factors driving Celsius prices higher.

Celsius Price Prediction: Technical Outlook

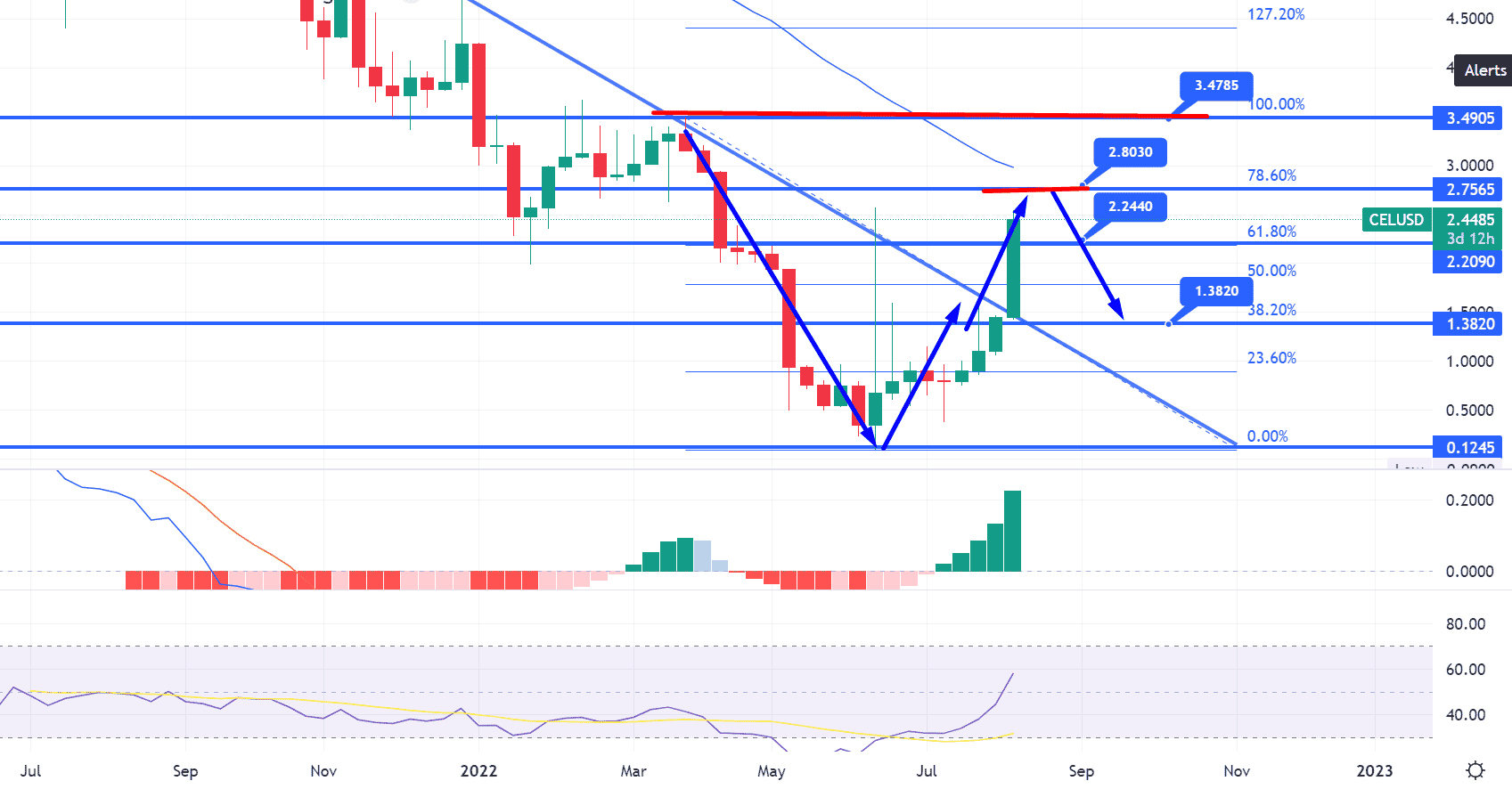

On a weekly timeframe, the CEL/USD pair has soared to a 61.8% Fibonacci retracement at $2.24. The weekly bullish engulfing candle indicates that there is a lot of demand, causing the $2.24 level to break out in a bullish direction.

With this, CEL has a strong chance of breaking through the next major resistance level of $2.80. A break above $2.80 could push Celsius’s price up to $3.47. The 50-day exponential moving average (EMA) may encounter a stumbling block at $3.01.

Looking at the leading technical indicators, such as the RSI and MACD, both are in the buying zone. However, the most recent MACD histogram indicates that CEL is about to enter the overbought zone. This could eventually lead to profit taking, causing a minor correction in CEL.

CEL’s immediate support and resistance levels remain at $2.24 and $1.79, respectively. A further bearish breakout could push CEL’s price down to $1.39.

Celsius Price Prediction – Daily Technical Levels

Support Resistance

1.4952 2.7088

0.7888 3.2160

0.2817 3.9223

Pivot Point: 2.0024

Tamadoge Catching a Bid Too

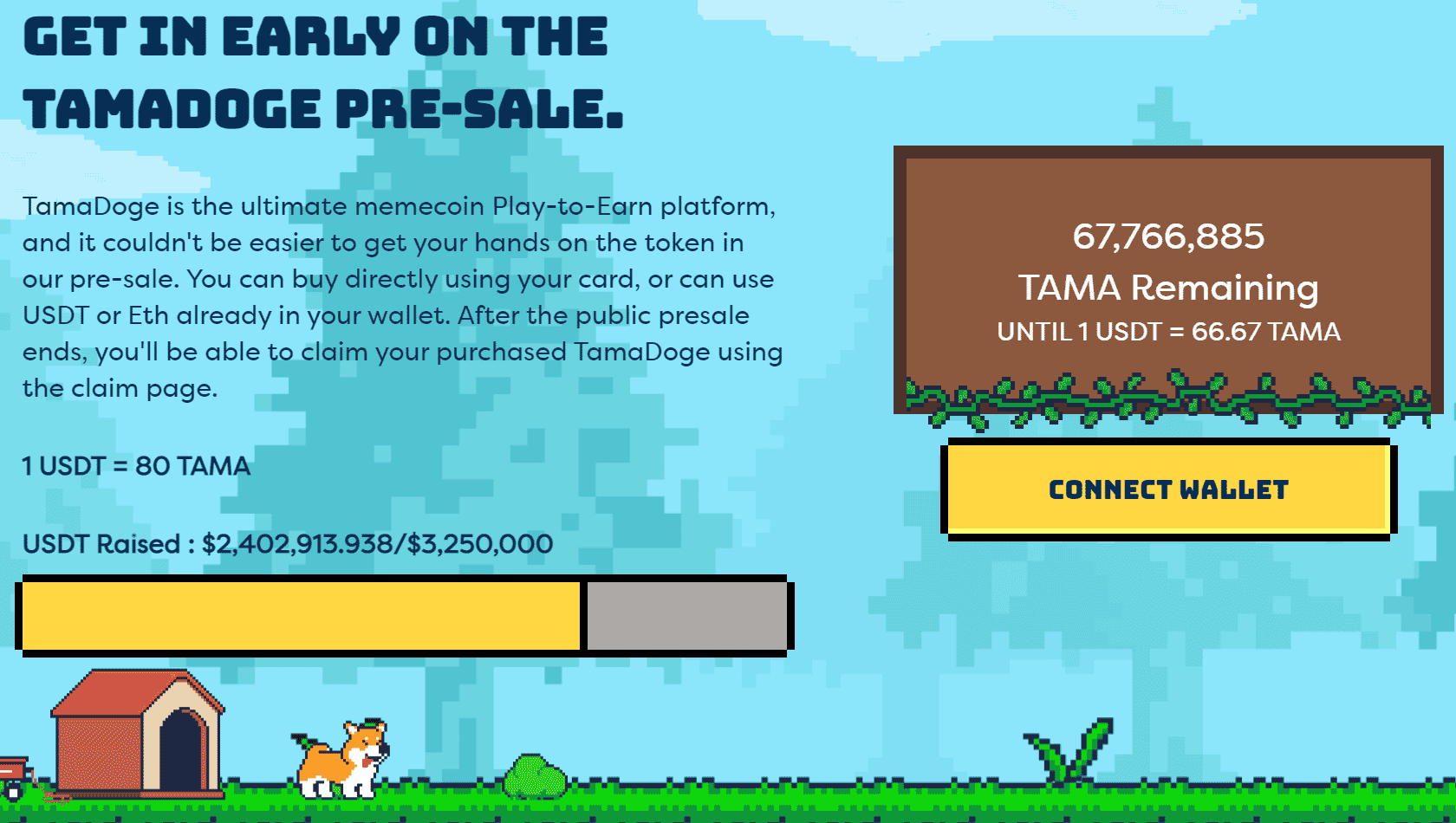

In addition to Celsius, the meme coin TAMA has recently gained traction. Tamadoge, the Play-to-Earn (P2E) metaverse meme coin, has raised $2.4 million in less than two weeks since its beta sale began.

In the beta sale phase, 200 million tokens were sold, raising $2 million – 1 TAMA sold for 0.01 USDT (Tether stablecoin, which is equal in value to 1 USD).

The Tamadoge beta sale, which is essentially a private sale but is available to everyone, is time-limited, with only 23 days remaining to fund $2 million before the token price raises by 25%. The project’s presale goal is to raise $10 million in total.

TAMA Will be Listed on LBank

Tamadoge will be listed on HK based LBank exchange, and other CEX listings are in the works.

To participate in the presale, visit buy.tamadoge.io.

The Tamadoge contract address is: 0x12b6893cE26Ea6341919FE289212ef77e51688c8

Related

- How to Buy Tamadoge in 2022

- Best Crypto Games to Play Right Now

- Where to Buy Ethereum – Beginner’s Guide

Tamadoge - The Play to Earn Dogecoin

- '10x - 50x Potential' - CNBC Report

- Deflationary, Low Supply - 2 Billion

- Listed on Bybit, OKX, Bitmart, LBank, MEXC, Uniswap

- Move to Earn, Metaverse Integration on Roadmap

- NFT Doge Pets - Potential for Mass Adoption