The latest LUNA updates are new allegations that Do Kwon withdrew $2.7 bn from the Terra network before LUNA dropped, lowering liquidity.

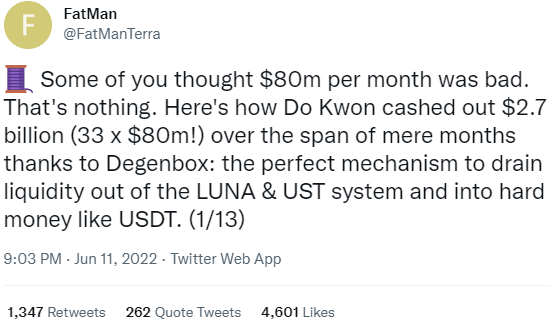

The anonymous Twitter account @FatManTerra, who goes by FatMan on the Terra research forums, posted a thirteen tweet thread on how he alleges Do Kwon used Abracadabra’s Degenbox, a crypto borrowing protocol, to cash out funds despite the risk it would pose to the former Terra (LUNA) and TerraUSD (UST).

He also credited @fozzydiablo who on January 29th noticed that almost $3 billion of the stable coin UST had been dumped on the market. The LUNA crash took place May 5th – 12th.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

LUNA Price Now

LUNA price chart

The price action of the new LUNA 2.0 coin has been bearish as all Terra news updates have been negative and no real LUNA recovery has materialized. The new LUNA was created by a hard fork and listed for trading May 28th – 31st depending on the crypto exchange.

Currently the LUNA price is trading sideways at around $2.57 and the old LUNA, now Terra Classic (LUNC) is trading at $0.000067.

LUNC still also has a circulating supply of over 6.5 trillion LUNC coins – no significant amount was burnt, and LUNC inflation is still ongoing.

Cryptoassets are a highly volatile unregulated investment product. Your capital is at risk.

Both Terra coins are in the red double digits this week although partly that is due to Bitcoin and Ethereum dropping over new worries that institutions like Alameda Research are withdrawing Ethereum from Celsius, causing staked ETH (stETH) to become depegged from ETH.

There are fears a lack of liquidity in crypto lending platforms like Celsius and Lido and a ‘run on the banks’ type situation could cause a liquidation cascade of Ethereum. As a result ETH dropped 20% this week to a current low of $1,420 before bouncing.

The total cryptocurrency market cap has retraced to $1.1 trillion, down 8% in the past 24 hours, with most of the sell-off in altcoins – Bitcoin is down just 6.5% trading at $27,500, seen as a ‘flight to safety’ asset alongside cash and stablecoins.

The latest LUNA updates follow on from reports that Terraform Labs employees confirmed to the SEC that Do Kwon withdrew $80 million a month prior to the LUNA and UST crash. As Fatman Terra points out $2.7 billion would be just over a month of those daily withdrawals.

The US Securities and Exchange Commission is also now investigating Do Kwon.

The SEC is reportedly aware of dozens of crypto wallet addresses and a trail of transactions of Terra company funds being sent elsewhere, investigating the withdrawals as money laundering and a violation of the securities act.

The investigation is ongoing and Do Kwon hasn’t been charged yet – he also denies the allegations.

DeFi Coin (DEFC) - Undervalued Project

- Listed on Bitmart, Pancakeswap

- Native Token of New DEX - defiswap.io

- Up to 75% APY Staking

- Whitepaper and DeFi Tutorials - deficoins.io