A DeFi report by Goldman Sachs recently made public gives an insight into how bullish they are on the decentralized finance space.

It includes an interview by the investment bank with former hedge fund manager Mike Novogratz, today the CEO of Galaxy Digital, an asset management firm that acts as a ‘bridge between the crypto and institutional worlds’.

Novogratz was a billionaire prior to the 2008 financial crisis, and then recovered his fortune a second time by deciding to buy Bitcoin early on after its 2009 launch.

Goldman Sachs DeFi Report Link

A redacted version of the Goldman Sachs DeFi report, titled Crypto: A New Asset Class has now been made public, usually only available to paying subscribers. Read their May 2021 crypto and DeFi report.

While it’s now dated, it still has some useful insights from Novogratz and is a long term DeFi forecast looking several years into the future. Parts of a report from closer to 2022 have also made it onto the internet, which we’ll cover below.

Mike Novogratz on DeFi

Across the 41 page report, Novogratz makes references to decentralized finance on these topics:

DeFi Use Case

The years 2017 and 2018 marked the first real global and retail-driven hype in the market. It was a period of blind enthusiasm, and the market cap of crypto dropped by 98.5%. However, from that hype emerged a more informed group of investors who learned valuable lessons and can now better distinguish between various crypto uses, such as stores of value, decentralized finance (DeFi), stablecoins, and payment systems.

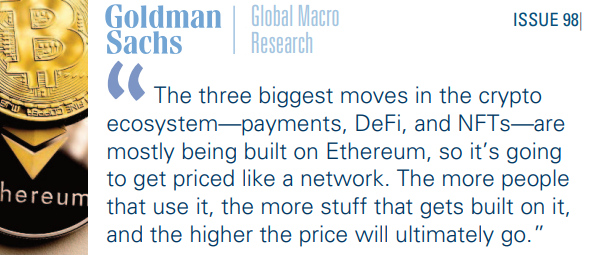

Ethereum DeFi Dominance

The three main areas in the crypto world – payments, DeFi, and NFTs – are largely being developed on Ethereum, which means it will be valued like a network. As more people use it and more projects are created, the price will likely increase.

DeFi for Institutions

‘Institutions have a hard time using DeFi products right now due to uncertainty around how Know Your Customer (KYC) requirements are applied to smart contracts and DeFi companies that are comprised of code. With a little more innovation and regulator understanding over the next few years, DeFi protocols and projects will probably explode. Uniswap could become a bigger exchange than the CME or the NYSE which will pull people in.’

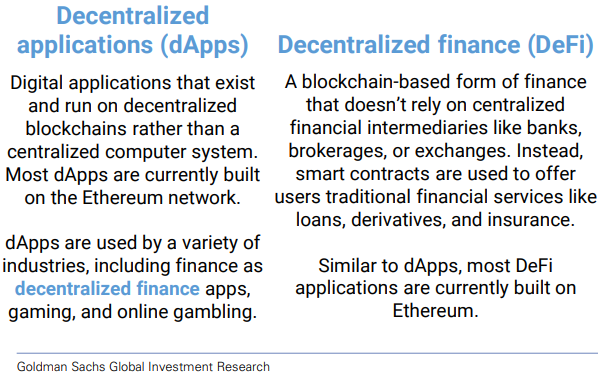

DeFi Definition

The GS report goes to analyze the governance token UNI for Uniswap decentralized exchange (DEX) and its utility, as well as Algorand that supports DeFi applications (dApps).

It also defines the meaning of DeFi:

Page 23 definitions from the Goldman Sachs DeFi Report

Other Goldman Sachs DeFi Reports

More recent Goldman Sachs investment research reports haven’t been released in full, however one reported on in Q4 2021 by Deficoins.io stated:

‘DeFi is easier to access for underbanked populations and provides faster settlements for users. The DeFi market has expanded dramatically since the middle of 2020 – roughly 10x.’

‘The total value locked (TVL) increased 900% from under $10 billion during the first half of 2020 to almost $100 billion today. The growth likely is a product of yield and speculative activity likely also plays a role – but user adoption may also relate to longer-running trends including digitalization, globalization, and declining trust in centralized institutions.’

‘While some products are unique to the DeFi ecosystem, there are many overlaps to traditional finance. The main difference is that the marketplace is almost entirely decentralized: there are no banks, brokers, or insurers, only open source software connected to a blockchain.’

‘The narrative around DeFi has shifted from whether or not these decentralized products can work to how they can continue to grow and scale. Additional structural differences and advantages to DeFi include unique products, faster pace of innovation, higher transparency, more efficiency and lower cost cross-border payments.’

‘Overall, the innovations in DeFi show potential for adoption and disruption in existing financial systems. They also demonstrate a compelling use case for blockchains and cryptocurrency technology that should help support market valuations for these assets over time.’

That more recent Goldman Sachs DeFi report was authored by Isabella Rosenberg, a foreign exchange analyst at the investment bank, and Zach Pandl, co-head of foreign exchange strategy for Goldman Sachs Research.

Update – other parts of that October 2021 DeFi report are now available online via GS Publishing.

The total DeFi market cap opened May 2022 at $111.2 billion according to Tradingview – an 11% increase in the just over six months since that was written.

Goldman Sachs – ‘Bitcoin Could Hit $100,000’

The US bank was once lukewarm on Bitcoin, crypto and DeFi, but warmed to it in 2021 and continues to advocate for it in 2022. In January Zach Pandl made the Bitcoin price prediction that BTC could hit $100k per coin ‘within the next five years’ as a byproduct of broader adoption of digital assets.

That would make the current 2022 crypto market correction a good buy the dip opportunity with a long-term investment plan in mind, similar to buying stocks.

In March 2022 Goldman Sachs made its first OTC (over the counter) Bitcoin trade and it followed that in April 2022 with its first Bitcoin-backed loan.

We recently covered DEFC (DeFi Coin) that spiked over 150% in price despite the current retrace in BTC and ETH.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.