Crypto tracking website Coingecko have written an NFT market analysis report for 2022, including crowdsourced insights and poll data statistics.

View the eleven page .pdf NFT report here.

Coingecko NFT Survey

The main methodology used was a survey in the form of a Twitter poll – most of those interested in or actively investing in NFTs also use Twitter as their preferred social media platform, alongside Discord.

Around 400 – 900 Twitter users took part in the NFT survey. In terms of NFT ownership its findings were that:

- 72.1% of respondents owned non-fungible tokens

- 26.8% owned fewer than five NFTs

- 11.5% owned more than five but no more than ten NFTs

- 33.9% owned more than ten NFTs

Representing a sample of the NFT market, those respondents were aged:

- Under 18 – 3.5%

- 18 to 30 – 43.6%

- 30 to 50 – 45.2%

- Over 50 – 7.8%

In terms of geographical region, the NFT survey recorded participants were located in the:

- Asia Pacific – 38.8%

- Americas – 18.3%

- Africa – 11.2%

- Europe – 31.7%

That Asian Pacific dominance matched a previous NFT market analysis Coingecko carried out related to the Axie Infinity game, and a Finder.com NFT data survey that found the Philippines, Thailand and Malaysia dominate in NFT adoption.

European NFT holders were not far behind however. In terms of when respondents first got into buying or trading NFTs, the figures were:

- Over a year ago – 40.4%

- 6-12 months ago – 26.9%

- 3-6 months ago – 16.3%

- Within the last 3 months – 16.4%

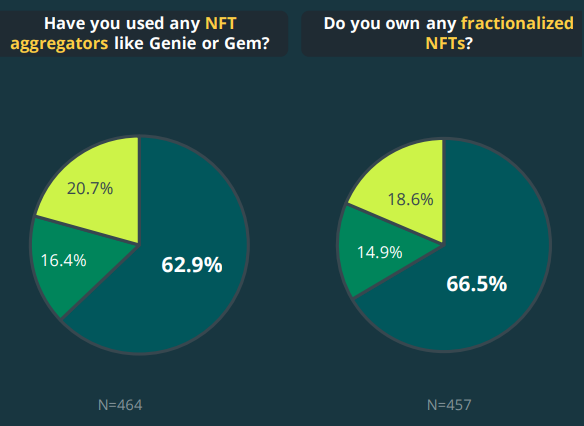

Slide from the NFT report. Yellow = Yes, Green = Not Sure, Dark Green = No

Some other interesting market insights were that:

- 88.1% of those polled were already into cryptocurrency before NFTs

- 46.3% used Ethereum the most for NFTs

- 49.6% had participated in the metaverse in some way

- 30.5% also owned NFT real estate i.e. metaverse lands or items of some kind

- 58.7% used Opensea as their preferred NFT marketplace

- 43.3% were sure they were in profit from NFTs (22.9% didn’t care, just ‘hodl’ their digital assets)

- 8.8% had put 75-100% of their crypto portfolio into NFTs

- 52.8% would take out an NFT loan

In total there were 23 questions on the NFT survey, and the last one asked about their reasons for owning NFTs:

- Artistic value / attachment – 21.8%

- Current / future utility – 50.9%

- Strong community – 23%

- Other – 4.4%

A main discovery was that NFT games and tokens related to the metaverse were the most sought-after collectibles. The biggest portion, 42.2%, aimed to eventually ‘flip’ their NFTs for profit instead of keeping them permanently or for their usefulness. However, 51% of NFT owners were in those two latter categories combined.

Floor price was the main factor 38.5% considered when buying NFTs, followed by 29.7% considering rarity (rare traits and attributes).

Unfortunately the NFT poll was bombarded with spam bots, which crypto fan Elon Musk who just bought Twitter has vowed to ‘defeat or die trying’. So there weren’t many replies that went into more detail when asked to do so. The sample size was also low for an NFT market analysis.

The information collected was interesting though. Another metric to analyze the NFT market activity is to track Opensea volume on Dune Analytics, which increased about 30% in April 2022 versus March to hit $3.2 billion.

Earlier in the month Nansen.ai an NFT market analytics website reported that the overall year to date change for NFTs showed 28% growth.

Many blue chip NFT collections have also recently hit new all time high valuations, such as BAYC, MAYC, BAKC, Doodles, Azuki and Moonbirds.

NFT Articles

Cryptoassets are a highly volatile unregulated investment product.