Knowing your customer churn and taking action to keep it under control are crucial to the success of any SaaS organization.

Some customers will always come and go, that’s a given. However, the reason customer churn gets so much attention is that it can make or break a business.

If you provide a recurring or subscription service, your chances of surviving, growing, and leading in the market rely on how well you can attract and keep customers. Gaining new customers can cost 5 to 25 times more than keeping the ones you already have. Churn is an important number to track, watch, and reduce.

Defining Customer Churn

Churn is basically the loss of a customer, which can happen for a variety of reasons. They may no longer need your services, for example.

Churn rate is the rate of customer churn over a given period of time. For example, the loss of 20 customers per month. Churn rate tends to increase as subscriber numbers go up.

High churn rates are bad news as they slow down your overall growth. The more customers leave you, the harder you have to work to increase your customer base, or even just to keep it stable.

How to Calculate Customer Churn

Churn is relative to the period of time. Monthly churn rate is the number of cancellations in a month-long period; annual is over a year. SaaS organizations tend to calculate churn over the average time period of their product or platform subscription.

Subscriber/Customer Churn Rate

This simple formula calculates the percentage of customers lost over a set period of time:

If you had 500 subscribers at the beginning of a month, but lost 50 of them by the end of the month, the monthly subscriber churn = 50 / 500 = 0.1 or 10%.

Note that any new customers gained during the same month are not part of the calculation.

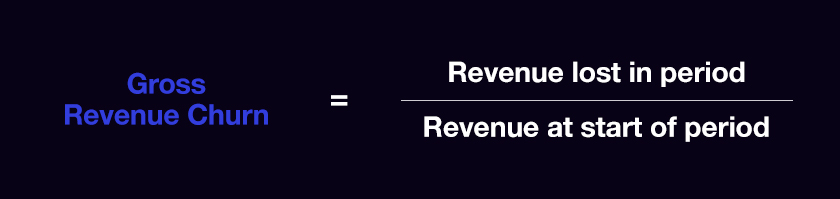

Gross Revenue Churn Rate

This calculates the percentage of revenue lost due to cancellations over a set period of time:

If you had 500 subscribers worth $100 each at the beginning of the month, but lost 50 of them by the end of the month, the gross revenue churn rate = $5,000 / $50,000 = 0.1 or 10%.

Note that revenue earned from new customers in the month is not part of the calculation.

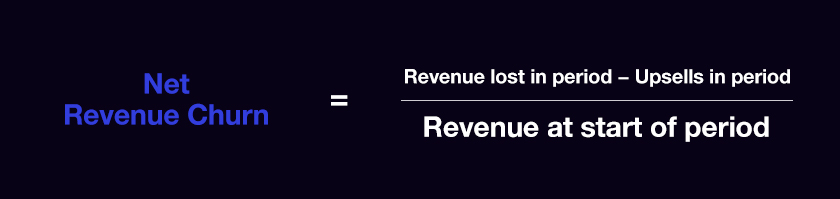

Net Revenue Churn Rate

This formula takes into account additional revenue (upsells) from existing customers, as well as lost revenue from departing customers. This means it calculates whether you are growing or shrinking overall in terms of customer revenue.

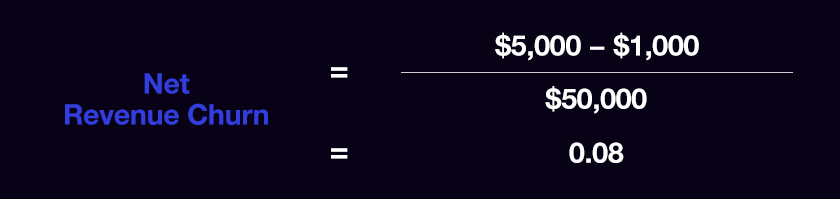

So if you had 500 subscribers worth $100 each at the beginning of the month, lost 50 of them by the end of the month, but also managed to upsell services worth $1000 to your remaining customers,

This is a positive net revenue churn rate (i.e. more than zero)—this is actually not ideal as it means more revenue is being lost through leaving customers than earned from existing customers.

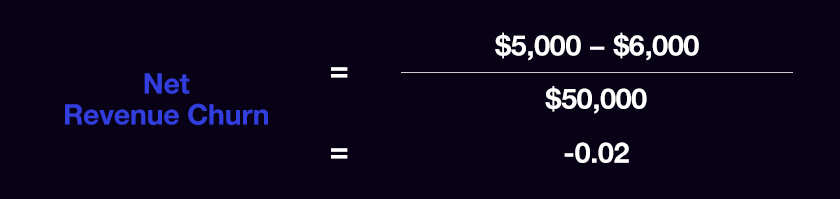

Using the same subscriber numbers, but assuming you had instead managed to upsell services worth $6000 to your remaining customers,

This is a negative net revenue churn rate (i.e. less than zero)—this actually is good as it means more revenue is being earned from existing customers than lost through leaving customers.

How to Improve Customer Churn Rates

It’s no wonder that SaaS businesses are so keen to keep churn down. Increasing customer retention rates by just 5% can increase profits by 25% or more. Here are some key steps to take to limit your churn rate and increase customer retention:

Increase Customer Engagement

The more engaged your customers are with the product, the less likely they are to drop off the radar. That’s why investing time and effort into making the customer experience ‘sticky’ bears dividends.

The goal should be to make your product a regular, useful, and positive part of their routine. Staying front-of-mind with regular, timely contact such as notifications or reminder emails is part of that, but optimizing the in-product experience is number one.

Optimize the Onboarding Process

The first three months are very important as studies show that 80% of app users are likely to churn within 90 days of sign-up. Effective onboarding plays a vital role in getting the customer happy and comfortable using the product, and integrating it into their regular routine.

Collect Subscription Fees Up Front

While rolling subscriptions offer greater flexibility, they can also reduce the incentive to engage and commit to a product on the part of the customer. Asking for a bigger up-front commitment gives the customer more impetus to start using the product regularly and realize some ROI. It also ties them in for a longer period of time, giving you more opportunity to build a relationship with them.

Target Inactive Users Before it’s Too Late

Activity churn is another important metric, as it’s often the warning sign ahead of actual churn. Simply put, how many customers are becoming inactive each month? These customers are at greater risk of losing interest completely and going on to cancel further down the line. After all, why pay for something you’re not using, right?

Reduce activity churn by sending reengagement emails to inactive users, offering them help, guidance, or a personalized message giving them a reason to come back.

Get Feedback From Quitters

It’s very useful to understand why customers who unsubscribe choose to do so. You can offer them an opportunity to provide some feedback by setting up a quick poll or just inviting them to reply to your email.

Use these insights to identify areas for improvement and to build a better picture of your different customer types and their motivations and frustrations. Implementing your learnings will reduce the churn rate.

Grow Your Revenue Per Customer

Back to net revenue churn rate, the formula that takes into account additional revenue (upsells) from existing customers, as well as lost revenue from departing customers.

If you increase your average spend per customer by enough, you will achieve a negative net revenue churn rate. This is a number less than zero, and it means you are earning more revenue from existing customers than you are losing through leaving customers. Effectively, it means you are growing, despite churn.

The good news is, existing customers are easy to reach, and already have a relationship with your product. So offering them upsells and more features is a good strategy to both reduce revenue loss and engage them further, again reducing the risk of churn.

Conclusion and key takeaways

Monitoring, measuring, and minimising customer churn should be top priorities for any SaaS, product-led or platform-centred organization. If more revenue is being lost from departing customers than earned from existing customers, the business will quickly plateau or shrink. Growth and success depends on limiting churn, or to put it another way, maximising customer retention.

- Subscriber/Customer Churn Rate calculates the percentage of customers lost over a set period of time

- Gross Revenue Churn Rate calculates the percentage of revenue lost due to cancellations over a set period of time

- Net Revenue Churn Rate calculates whether you are growing or shrinking overall in terms of customer revenue.

- Actions to improve customer churn rates include:

- Increase customer engagement

- Optimize the onboarding process

- Collect subscription fees up front

- Target inactive users before it’s too late

- Get feedback from quitters

- Grow your revenue per customer