Starting a small business or a company with high growth potential is a heady time; with lots of demands of your time, energy, and money. There’s also a lot of risk as up to 90% of startups don’t survive the first 5 years in business, according to the U.S. Small Business Administration (SBA), with 21% failing in the first year, 30% of the remaining fail by year 2, and 50% of those remaining fail by year 5. Even more concerning are 10-year stats showing another 70% fail to survive their first 10 years of business. Much of this failure, as you’ll see in later sections, comes from cash flow problems. Hence, developing sound finance strategies for startups helps these businesses survive beyond 10 years.

Image courtesy of Profit from Tech

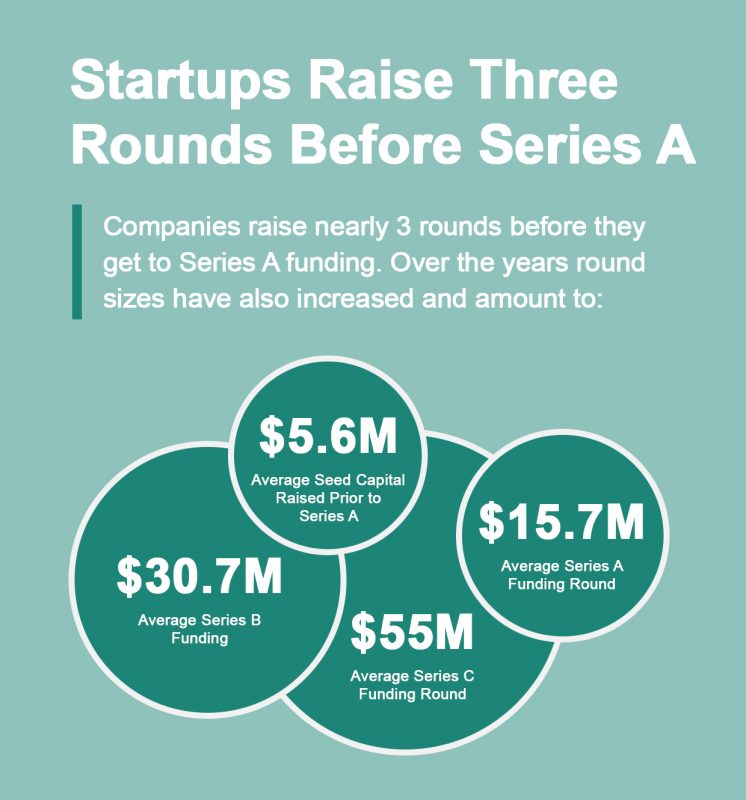

A startup requires substantial financing and the financial resources needed to start a business get larger every year. As you see in the above graphic, the average startup needs $5.6 million before Series A financing.

This early money comes from a variety of sources including friends and family, the founder’s financial resources (such as remortgaging property, saving, and even debt financing using personal credit cards). Another source of initial funding comes from angel investors, although that means giving up a lot of control and equity. Commonly, venture capital firms wait until Series A and beyond to make investments. The SBA, formerly a significant source of early finding, now lacks the resources necessary to meet the needs of startups.

According to Techcrunch, many founders go through 3 rounds of early financing before they’re ready for Series A funds. This means you need sound finance strategies for startups to succeed.

Main stumbling blocks for emerging business

Startups fail for a number of reasons. The most significant reason for failure is an idea that doesn’t fit the market or isn’t implemented effectively. That’s kind of a no brainer. For instance, I belong to a startup group where members share their MVPs (minimum viable products) or even fully fleshed out ideas. Unfortunately, many of these are based on what the founder CAN do rather than what the market needs. I saw many variations on the Grubhub model with limited differentiation from this industry leader. Wading into a market such as this, where leaders already exist, requires a substantial advantage for users over existing products, differentiators that take time and skill to copy, and a lot of money to blast your product across user markets. That’s not for the faint of heart. Less than 1% of startups evolve into a unicorn to dominate a new industry, such as Airbnb, Uber, or Grubhub.

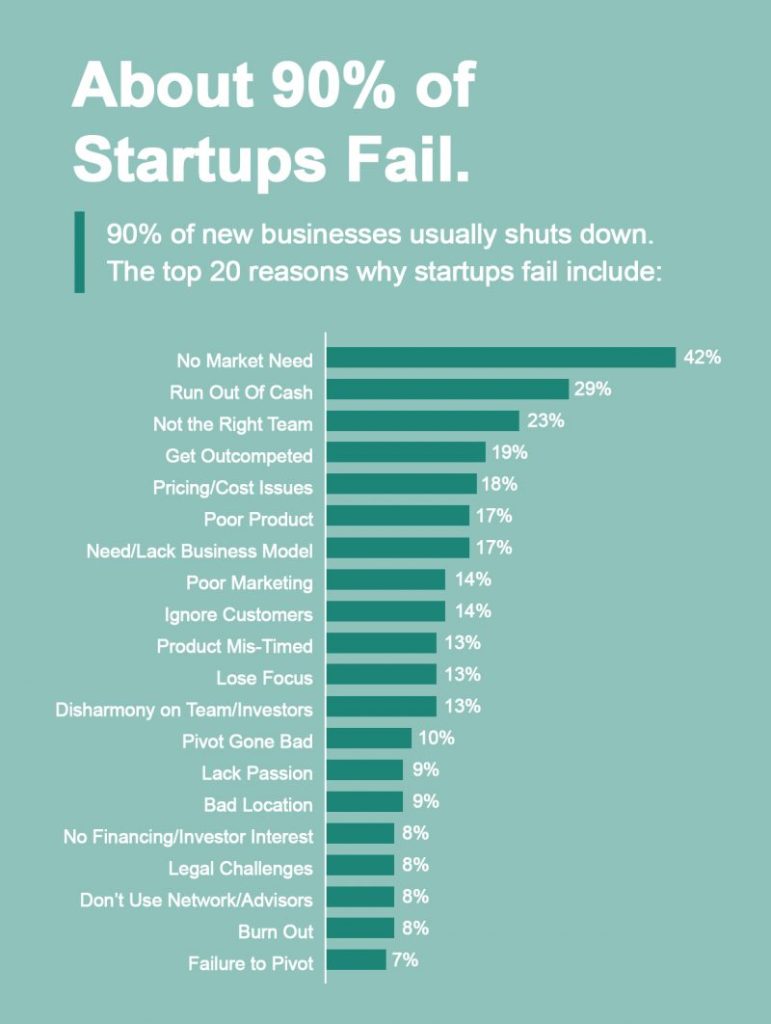

The second largest reason for failure is not having finance strategies for startups to succeed, as you can see in the graphic below.

Image courtesy of Profit from Tech

As you can see, nearly 30% of failures came from financial issues — especially cash flow reflecting a match between the timing of cash inflows and outflows. Thus, cash flow is the primary stumbling block for small and emerging businesses and successful businesses must develop sound finance strategies for startups that succeed.

Building sound finance strategies for startups

What can you do to build better finance strategies for startup success?

As a small business or entrepreneur, you must ensure you manage your money efficiently and professionally. Cash flow doesn’t mean you aren’t making sufficient sales, although improving sales likely improves cash flow. Instead, cash flow represents a mismatch between cash inflows and outflows, as mentioned above. Fixing the problem relies on building finance strategies for startup success, including:

- Better planning

- Improved debt collection

- Invoice factoring

Better planning

Part of better financial planning involves avoiding problems by knowing what factors contribute to the problem, when factors are aligned in such a way that the problem is likely to occur, putting proactive strategies in place for eventualities when cash problems arise.

You can also develop predictive models based on prior collection efforts to better predict when you might experience a cash flow problem. With careful planning, you’re in a better position to negotiate with your creditors and prioritize payments to stay cash positive. Another tool is to establish a fund against cash shortfalls, either internally by setting aside a portion of your revenue in cash against cash flow problems or arranging a line of credit with a bank to see you through shortfalls. Remember, however, that lines of credit aren’t traditional loans and often face higher interest rates. These credit options are designed as a short term bridge until cash inflows catch up with outflows. at which point, the loan is returned to the bank with interest.

Debt collection

Outstanding invoices and long paying customers often cause businesses to fail as the business must pay for goods and services they receive while waiting to collect from customers. As far back as 2016, as much as $825 billion was owed to US small businesses about $84,000 per small business.

All this debt means your business is unable to grow, unable to pay their staff or vendors, and unable to use what is essentially their own money to meet financial demands. The growth in unpaid invoices is a global trend, although the bigger, more established businesses can always approach the big banks and use various forms of collateral to access funds needed to maintain positive cash flow. Smaller businesses or startups and entrepreneurs don’t have the equity, proven track record, or banking relationships necessary to make this strategy work. Businesses can easily fold and close down, even if their initial business concept ( product or service) is brilliant, simply because the business model (financial management/ payment collections) is flawed.

Previous advice revolved around using a collection service as a last resort and then preparing for the client or customer to go elsewhere, since using a debt collection service or lawyer only sours the relationship.

However, using negative strategies to collect on debts isn’t your only option. Be upfront with customers so they understand payment expectations and, as is common in most B2B sales, offer discounts for prompt payment of invoices. Common discounts are 2% for payments received within 10 days with the balance due in 30 days and no discount. Many firms make a firm plan to avail themselves of these discounts, which improves your cash flow.

Invoice factoring?

There are two methods of accessing money using invoice finance. There is invoice factoring where the organization hands the entire process over to a third-party. The third-party advances the needed cash, less a handling fee to cover financing costs, providing necessary cash flow. Then there is invoice discounting where the business can keep the collection of invoices in house, yet access the associated cash, as long as they can provide the invoices and show that collection is ongoing.

Both are common means for small businesses to raise and generate funds without losing the equity built in the business, with the financial institution providing you the cash upfront to continue to run your business. This is not a debt collection service, it is the normal collection of invoices, simply done by a third-party who specializes in this type of work. The third-party takes the risk and possible write-off of the invoice, hence the fee charged is commensurate with the risk.

If your business never used invoice finance before, you’re advised to try it before you buy it, compare invoice finance options to determine where you can get your invoices paid, and also have access to them when you need the money most.

Whatever you do, when it comes to money and your business, make sure that you do your research and only go with a business approved by recognized banks.

Remember, specialize.

You have a lot to do as a business to meet customer needs. Hence, focus on what you know, those aspects of the business with the greatest impact on customers and let others do what they do best by outsourcing. Outsourcing is a great option to extend your business processes, especially important when outsourced functions allow you to optimize your resources. When it comes to financing business growth, paying your monthly bills, or actually staying cash positive, it may be best to use factoring to improve your cash flow and avoid defaulting on your own debt. No one can run a business when vendors refuse to accept orders or utility companies shut them off.

Final thoughts

I hope you found this article helpful. I know it’s a little outside our normal wheelhouse, but developing sound finance strategies for startups is critical for success. Meanwhile, I’d love your comments on this post or suggestions for future posts. Please enter them in the comments.