The insurance industry walks an often-challenging line. It’s a fast-moving and competitive industry with limited customer touchpoints. That means every interaction your policyholders have with your organization — and the technology your organization uses — needs to contribute to a positive experience.

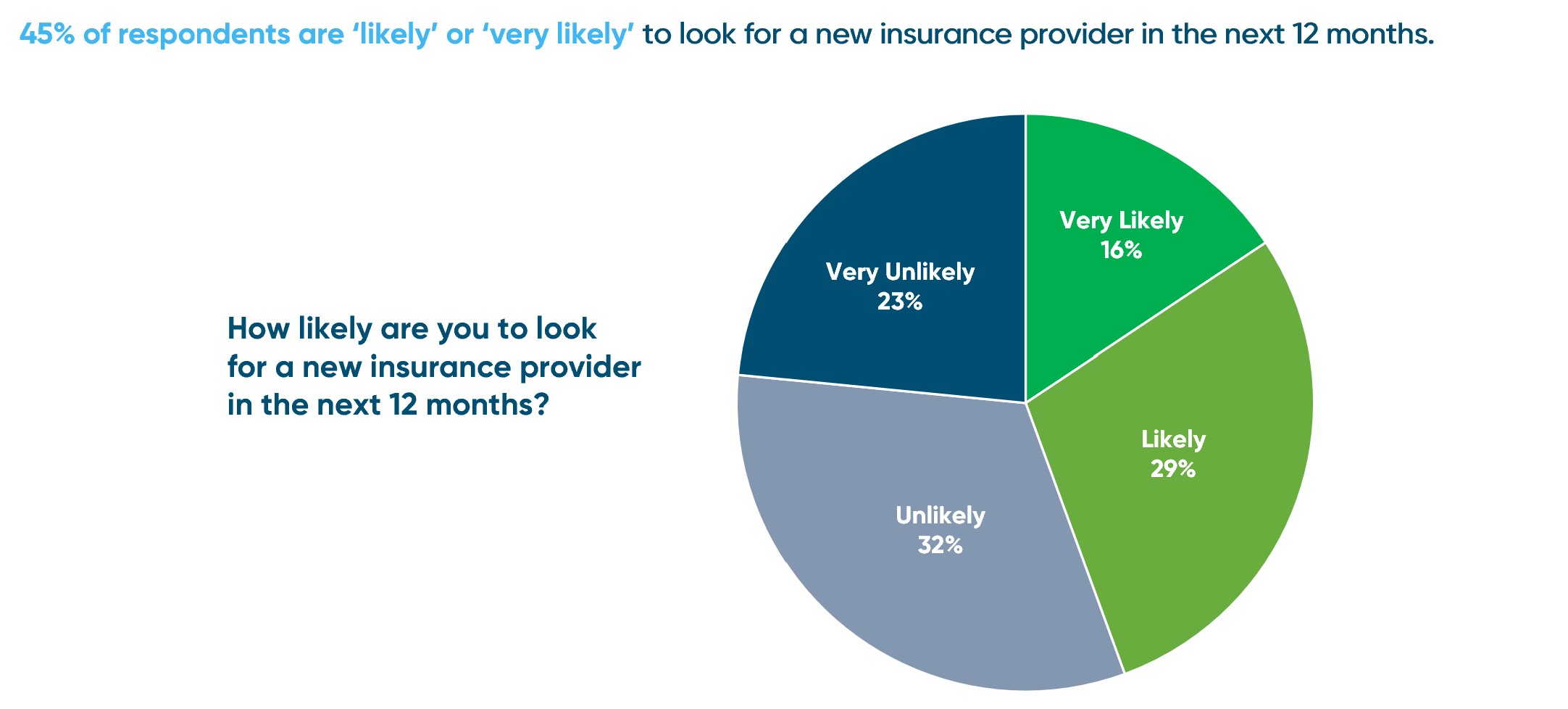

Improving policyholder experience is so critical in a competitive industry like insurance, because turnover is a constant challenge. In fact, data from a recent Invoice Cloud survey shows that 45% of insurance policyholders are “likely” or “very likely” to look for a new insurance provider in the next 12 months. Policyholder churn costs organizations both time and money. According to Harvard Business Review, “acquiring a new customer is anywhere from 5 to 25 times more expensive than retaining an existing one.”

[Source: Invoice Cloud data and imagery]

To better understand the policyholder experience and uncover insights about how to reduce policyholder churn, Invoice Cloud conducted an online consumer survey, collecting over 1,000 responses from policyholders across the United States. The takeaways from this research revealed some key insights about how insurance organizations can improve online payment experience to retain more customers.

Tip #1: Focus on the Online Payment Experience

Based on research by Bain & Company, over the course of 12 months only half of insureds have any kind of interaction with their insurance organization. Annual renewal payments and premium payments are the most frequent interaction touchpoint – making it the most effective way to capitalize on policyholder engagement to reduce churn.

Payments are a critical piece of the customer experience puzzle. Beyond getting good insurance coverage for their specific needs, insureds care about one thing: how easily they can pay what they owe each month. Getting the payment experience right could mean the different between retaining or losing a policy.

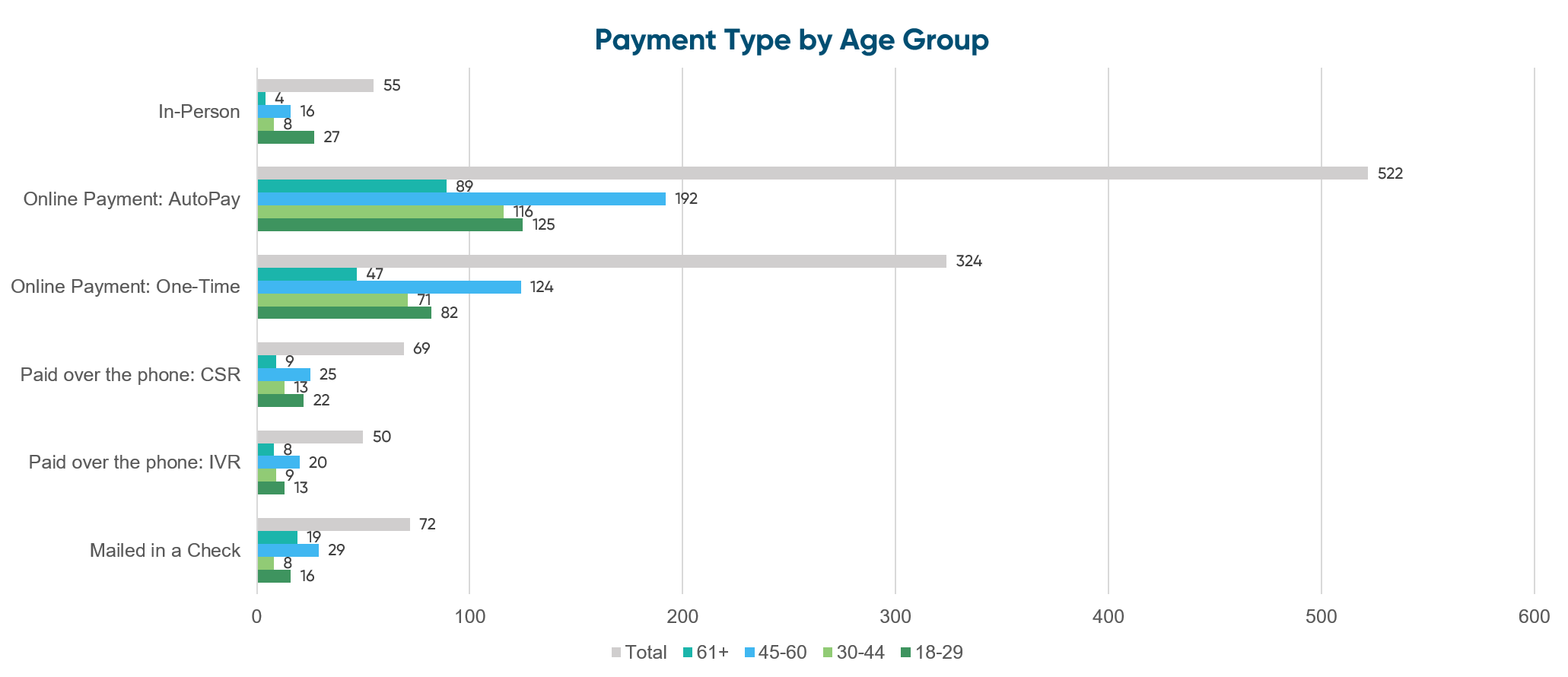

The importance of online payments is further supported by our research. For their most recent insurance payment, 77% of respondents made an online payment, either through a one-time checkout route or automatic payment. This number grows when we look at respondents under the age of 45, 87% of whom made their most recent insurance payment online. Clearly, online payments are the channel that insurance organizations need to focus on to meet current policyholder expectations.

[Source: Invoice Cloud data and imagery]

Tip #2: Find a Solution that’s Simple and Easy for Payers to Use

Simply having an online payment option, however, does not mean your organization is providing a positive user experience. The solution also has to be simple, convenient, and easy to use.

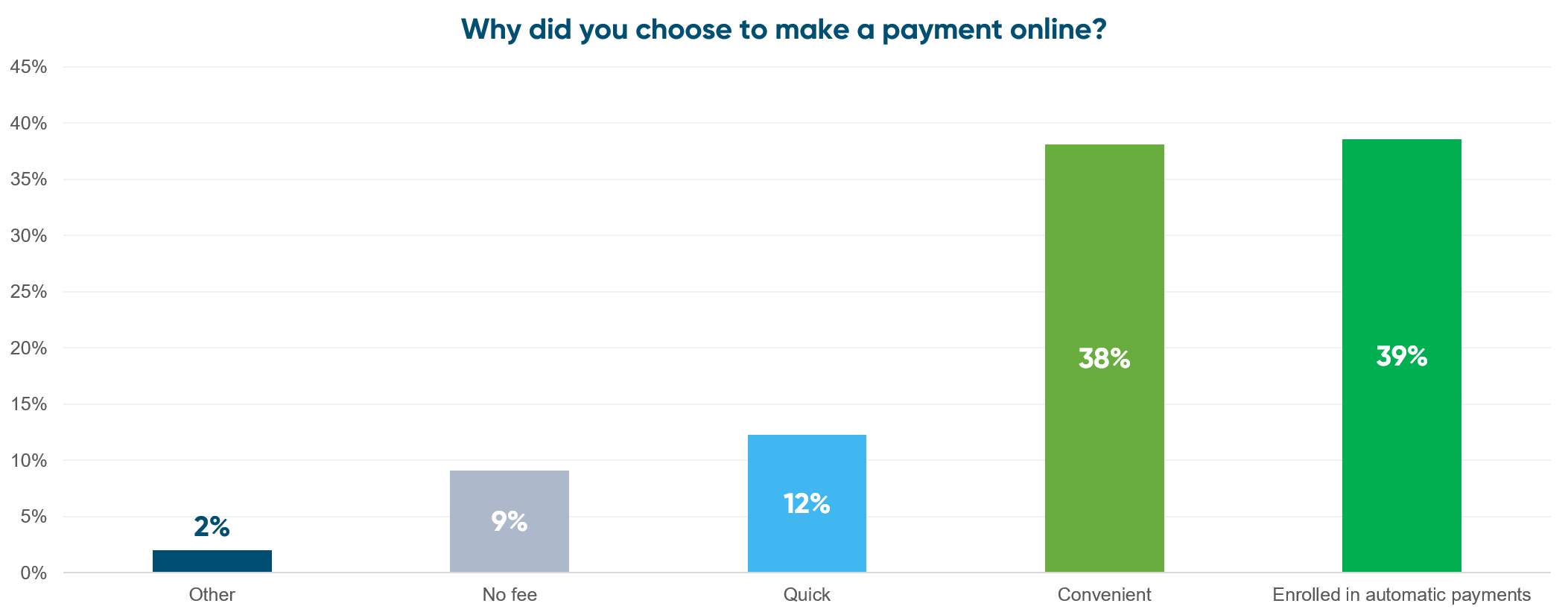

When asked why they chose to make their most recent payment online, 38% of respondents felt that this was the most convenient option, while 39% were already enrolled in an automatic payment option (AutoPay).

[Source: Invoice Cloud data and imagery]

Looking at the reverse of this question, when respondents who did not make their most recent payment online were asked why they used another channel, 28% cited that the online system used by their current insurance provider was too difficult to use.

Logically, these results make sense. If your online payment system is too difficult to use, policyholders won’t make payments online. This low electronic adoption, in turn, will prohibit your organization from realizing any real efficiencies or cost savings that come with increased online payments. This is why it’s so important to evaluate online payment solutions based on their ease of use and ability to engage customers.

Tip #3: Make it Easy to Enroll in Automatic Payments and Paperless Billing

As the results we have already discussed show, many insureds opt for automatic payments when it comes to premium and policy renewal payments. In fact, when asked to rank the factors that contribute to a good online experience, the top three results were:

- The online system is easy to use

- Easy to enroll in automatic payments

- Easy to enroll in paperless billing

By connecting automatic payments (AutoPay) to automatic renewals, carriers can reduce churn by allowing policyholders to “set it and forget it.” Once a policyholder enrolls in AutoPay, with the terms and conditions clearly stating that premium payments made through AutoPay will automatically reinstate insurance at the premium posted in the emailed AutoPay notification, he or she is no longer thinking about switching. Policyholder retention soars, costs decrease and your renewal game is won.

It’s important, then, to partner with an online payment solution that optimizes the user experience to make it easy (and even encourages payers) to enroll in automatic payments and paperless billing. This not only creates a better policyholder experience, it also saves time and money for your organization through reduced print and mail expenses, reduced staff workloads and accelerated collections.

Tip #4: Optimize Omni-channel Payment Options

When asked how satisfied they were with their insurance provider’s payment offerings (i.e. omni-channel capabilities, where you can pay a bill on your phone as easily as you can on your laptop), policyholders are generally satisfied with their options.

Based on these results, it’s clear that omni-channel offerings aren’t optional anymore. Your policyholders, regardless of age or demographic, expect these options.

To improve the policyholder experience, however, your organization needs to go beyond just offering omni-channel options. A great policyholder experience requires optimized payment channels. This means that your payment platform retains context across channels, remembers customer information, and creates a seamless and easy payment experience.

Tip #5: Eliminate the ‘I forgot’ Excuse

When asked whether they had ever made a late payment to an insurance carrier or had their policy canceled, nearly 30% of respondents said yes. Beyond that, when asked why they missed a payment or had their policy unwillingly canceled, about 50% said that they forgot their payment was due.

If you work in billing or collections for your organization, you’re all too familiar with the “I forgot” excuse when it comes to late payments. The key to eliminating this issue is making online, self-service options – like scheduling a payment, calendar reminders, and easy to enroll in AutoPay services – available at every step of the payment experience.

What this means for your organization

So what does this data mean for your organization, and how can you put these tips into practice? It starts with evaluating your current online payment process, since this is one of the most critical channels you have when it comes to policyholder experience.

Ask the following questions:

- Is your current online payment process simple and convenient?

- Do you offer fully optimized, omni-channel payment options?

- Can your policyholders easily enroll in services like automatic payments and paperless billing?

- Are you doing everything you can to remind insureds about upcoming payments?

In a low touch industry like insurance, every customer touchpoint is critical. Optimizing the online payment channel is one of the most effective ways to improve policyholder experience and, ultimately, reduce overall customer churn.

If you’re interested in learning more about this research, download the full report here.