Like any popular business term, “customer centricity” is often abused by businesses that shoehorn it into their core values. Unsurprisingly, this doesn’t cut it. It’s actually better not to claim customer centricity if you can’t get people across your business to really care about your customers.

To be customer-focused, you need to talk to your customers, learn about their wants and needs, and use data to guide your ideas and decisions. After that, you should begin to take action based on what you find and hear—trying out new products and methods to enhance the customer experience.

This is no one-off project. It’s a fundamental way of operating your business. So what does that look like?

Here are 10 takeaways you can apply to your business from three customer-centric brands.

Monzo

Monzo is a digital-first bank that was backed by future customers. They recorded the fastest crowdfund in history, hitting a pledge of £1 million in just 96 seconds. Subsequent rounds of crowdfunding raised millions more:

Clearly, the proposition of “building a bank, together” hit a chord. But how do they fulfill that promise for customers?

1. Throw out established processes.

Traditional banks take an average of 26 days to onboard a new customer. There is a standard process for opening a new bank account—visiting branches, waiting for your PIN to arrive in the mail, and so on. This process hasn’t changed in years, and most people would agree that setting up a bank account is a hassle.

But Monzo did what none of the established banks seemed able or willing to do. They took a 26-day process and condensed it down to 5 minutes. I verified my details and opened an account while I waited on a platform for my train home.

Monzo stripped out all unnecessary questions and removed the need to visit a physical location to show an ID. Instead, I just sent them a picture of my ID and took a quick selfie video.

Takeaway: What established processes that cause friction could you rip up and redefine?

2. Find new ways to fix old customer pains points.

Most of us have lost a bank card and had to wait for a replacement. Or worried about inputting our card details on a sketchy website. But traditional banks haven’t done anything to make customers’ lives easier.

Instead, I’ve seen the odd campaign warning people about the dangers of online shopping—but that doesn’t solve customers’ problems. It’s just unrealistic.

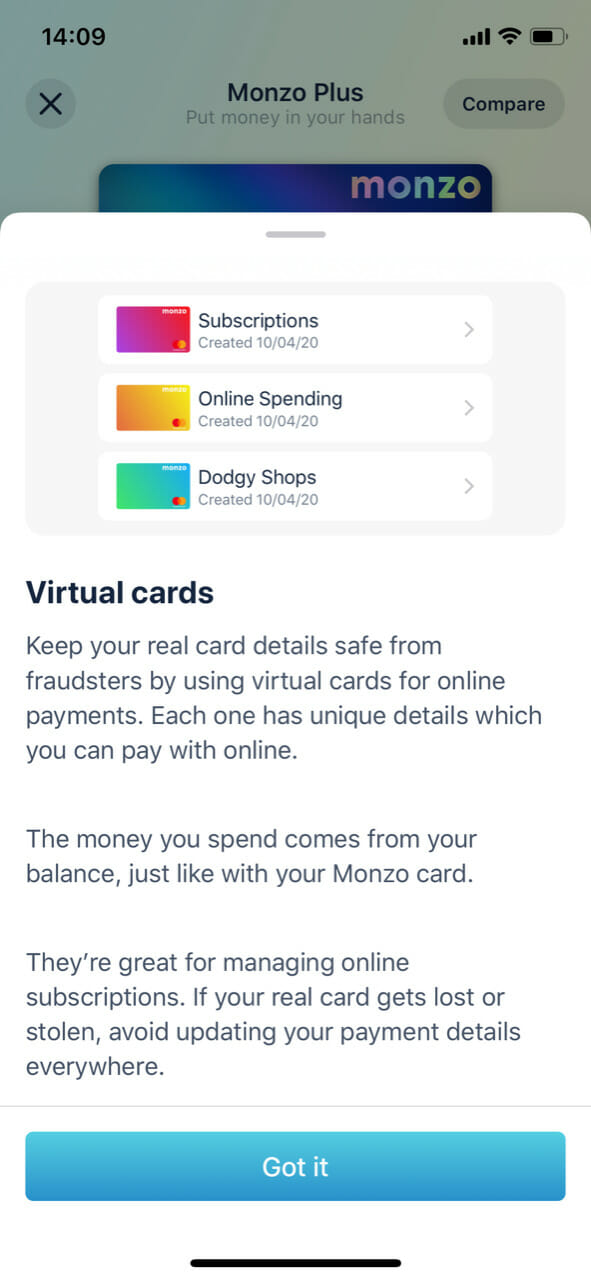

Monzo understood that customers want—and during COVID, need—to shop online. So rather than prattle on about the potential dangers, they gave users disposable virtual cards. Each time you shop online, you can create a new virtual card number that you “destroy” after using–so your card details can’t be cloned.

They also allow customers to “freeze” a card so it can’t be used if you lose it—and the ability to “defrost” it when you inevitably find it down the back of the sofa.

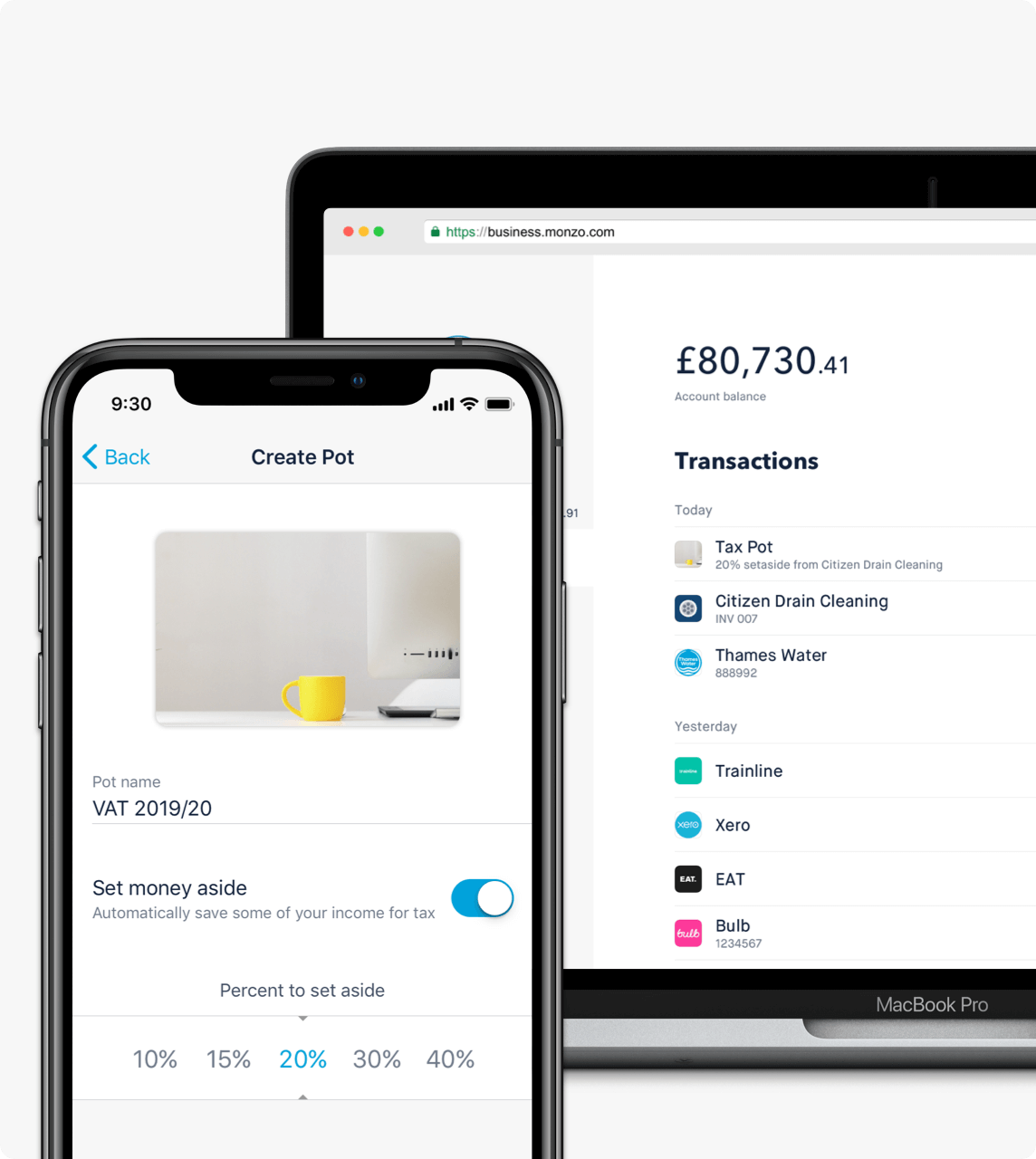

For their business customers, they created features such as separate “pots” to set aside tax payments. Previously, I had to open up new accounts (with the same bank) to save my tax payments. It’s likely a common behavior in the small business banking world.

Monzo gives business customers this feature at the click of a button, with a simple automation to add your tax percentage automatically to the pot.

Takeaway: There are many ways to solve the same problem, but aligning your solution with user behavior (i.e. virtual cards) makes more sense than trying to change behavior (i.e. campaign about the dangers of online shopping). Test novel ways of solving the same problem.

3. Do what’s best for the customer—even if it doesn’t grow revenue.

Retail banks make their money in two ways:

- Interest on personal loans, mortgages, and credit cards;

- Fees.

A few of the features Monzo built, however, go against revenue generation in favor of doing what’s best for customers.

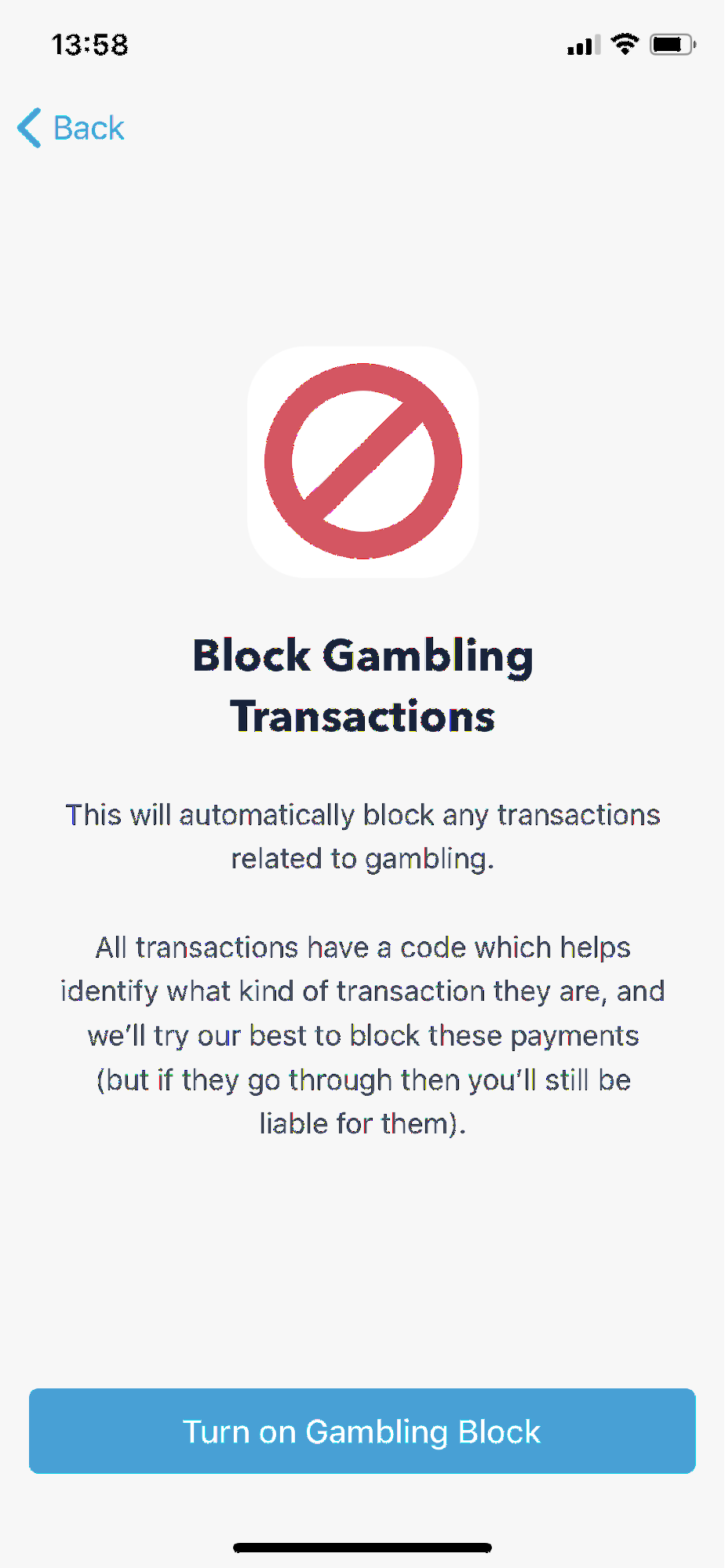

Their Self-Exclude from Gambling feature aims to prevent people from racking up debts from gambling addictions. They developed the first version of the feature after speaking with customers on their forum.

Customers can block gambling transactions from their account. To remove the block, they have to chat with customer support, where the Monzo team asks questions like, “Has your situation changed since you first switched the restrictions on?”

Alternatively, customers can turn off the block themselves in the app but have to wait 48 hours before it lifts. These measures add positive friction to safeguard people with gambling addictions.

Monzo built this feature even though it affected only about 5,000 customers at the time. But their focus on doing right by each and every customer motivated them to go ahead.

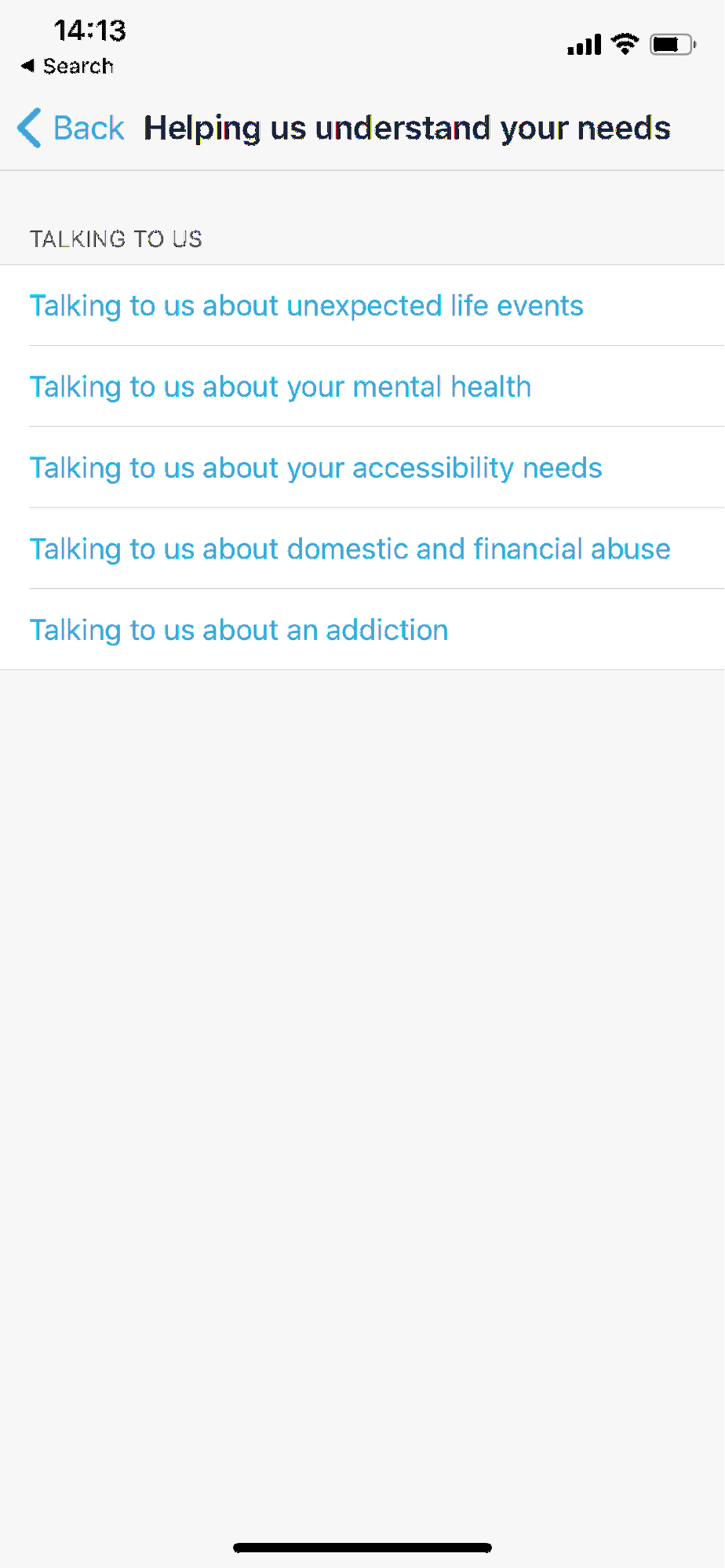

It’s not the only example of Monzo serving customers at the expense of potential revenue. Their “Recovery Space” allows people with mental health issues to focus on getting better without incurring fees, charges, or being chased by creditors.

They encourage customers suffering from mental health problems to get in touch so that they can give them space to recover.

Monzo uses its own forum to understand how their business impacts customers’ lives and to inform customer-driven initiatives like those above. It’s likely why 86% of their customers would recommend them—the UK’s four largest banks score 27–32% lower.

Takeaway: Doing what’s right—even for a small group of customers—can have an impact that goes beyond those it directly affects. Look to do things that serve even small groups of your customers.

giffgaff

giffgaff positioned itself as David vs. Goliath, fighting against established telecoms by offering customers an alternative to expensive pay-as-you-go (PAYG) or long-contract offers.

They applied a community-powered business model to the mobile sector, similar to that of Wikipedia, hence the name “giffgaff,” which means “mutual giving.”

Here’s what made giffgaff stand out in the customer-centricity stakes.

4. Let customers help answer big business questions.

giffgaff kicked things off by building an online forum. Vincent Boon, Chief of Community at the time, described what it was like:

Doing this at the start was incredibly hard, with our members showing a clear interest in wanting to be involved with us on many more decisions than initially expected—which meant a lot of heated discussions around what information we could share (traditionally nothing, until after the fact), what members should be able to influence (again, traditionally nothing), and what was ring-fenced (everything).

Changing that dynamic was hard, not just within the business but also for our community. There was a lot of distrust and skepticism that we wouldn’t actually listen, get people involved, or change depending on the feedback we’d receive, and that we would be just like any other company—great brand message, but no substance.

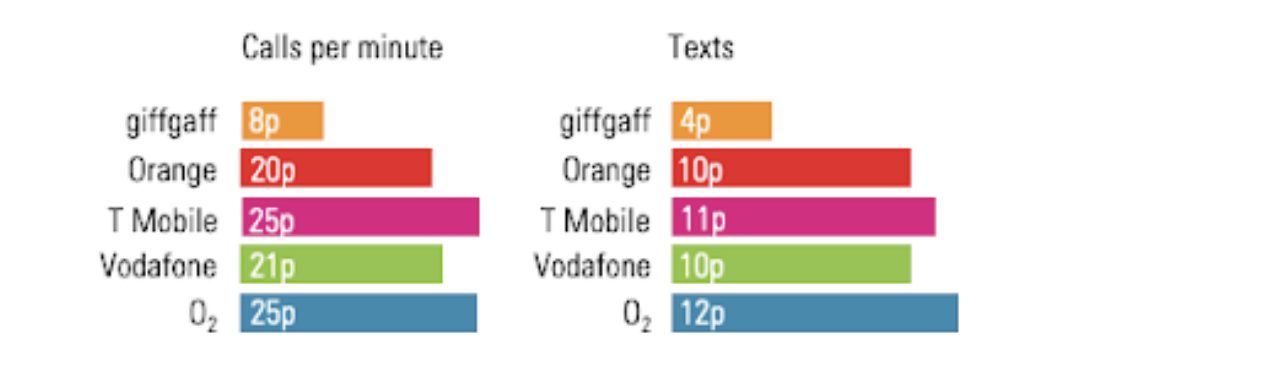

They set about building that trust by asking, listening, and acting on feedback. One of the first things the giffgaff community helped with was the pricing.

Traditionally, researchers say that you can’t get accurate customer input on pricing: People won’t be able to tell you how much they’re willing to pay until you ask them to hand over the cash. But giffgaff produced a pricing structure and “giffgaff goodybag” (a time-limited bundle of text, voice, and data) that incorporated ideas and votes of thousands of giffgaff members—and worked for the business.

The end result was “the only truly unlimited package” on the market (at that time), with no small print or hidden fees. From the forum discussions, it was clear that customers loathed “fair usage” policies and wanted unlimited to mean unlimited. So that’s what giffgaff offered.

The pricing structure itself was a hybrid of existing market offerings. It combined bundles of data, calls, and messages–which you’d usually get only with a long-term contract–with the flexibility of a contractless PAYG model. At the time, PAYG pricing was done with a credit top-up, and data, calls, and messages were charged at a fixed per minute/text rate.

giffgaff goodybags started at £5 per goodybag, had no contract, and if you ran out before the end of the month, you could start another goodybag right away, rather than having to wait until the following month. Or if you’d prefer you could use the credit top-up and pay per minute.

This contractless model means giffgaff has to work “bloody hard” on retention, according to Sophie Wheater, giffgaff’s current CMO. It’s also the reason why NPS is a board-level metric—happy customers stay with giffgaff even without the contractual obligation.

Takeaway: Customer feedback may impact more areas than you expect (or are comfortable with). But your customers can often hold the answers to big business questions. If you listen to and respond to customers, they’ll give their time and ideas freely.

5. Build genuine relationships with your customers.

giffgaff has built an active forum where community managers speak with customers every day—not just about giffgaff but their everyday lives, too. More recently, they created a “pioneer group” using Qualtrics (a panel management tool) to get more structured, regular feedback from members who opt-in to help test new ideas.

Building relationships with customers can go beyond ideas and feedback. As the giffgaff community developed, members started to help the business in a number of unexpected ways:

- Community member Ian built a Windows version of the giffgaff app. The app is updated regularly by Ian, who now works full time for giffgaff, managing a group of community members who help test it.

- When rival network 3 claimed that “no other network gives you more for £10,” community members launched (and had upheld) a complaint against 3 with the Advertising Standards Authority.

- Pownum, a customer review website, tweeted about giffgaff’s score of “2 out of 10.” This led giffgaffs’ social media and PR manager, Heather Taylor, to blog about the unfair practice of allowing consumers to comment for free on Pownum but charge companies to reply. giffgaff’s community members agreed and began leaving their own comments, pushing giffgaff’s score up to 9.47—and pushing down Pownum’s own score to 7.29. Pownum then decided to allow companies to reply for free.

- When Apple changed the size of its SIM card slots, there was no prior warning. Overnight, giffgaff SIM cards become incompatible with the latest Apple device, and it was going to take three months to produce SIM cards that fit. Within a couple of days, members found a stamp cutter that converted old SIM card sizes into the new micro size and shape. Members set up a website to cut and ship giffgaff SIMs manually, producing more than 100,000 micro SIM cards—all managed by members.

- Members produced banner ads that beat giffgaff’s own ad performance.

Takeaway: Speak to your customers every day—get to know them by name, understand their lives, what’s important to them, and how your business impacts them. Don’t be afraid to accept their help, and consider how far you want to enforce brand protection over user-generated content that can help members feel ownership over your brand.

6. Co-create the experience.

giffgaff community members co-create the giffgaff product alongside giffgaff staff. Anyone can see new feature ideas in development in a public Trello board as well as a dedicated “Labs” part of their website.

As giffgaff doesn’t have a call center, intuitive self-help tools are critical. When the giffgaff team noticed members were contacting online support agents about closing their accounts, they invited six members of their pioneer community to their office to discuss the topic in more detail.

That meeting led the team to send an open-ended survey to all pioneers to get their thoughts on closing accounts. By working alongside their customers, the team could confidently design a feature to add clarity in direct response to customer apprehensions:

The solution for closing your account.

Takeaway: Find ways to work alongside your customers, whether that’s online voting on ideas to UX sketching workshops in person. Share updates (through forums, emails, blog posts, etc.), including the reasons behind business decisions. View customers as members of your team.

7. Help customers help customers.

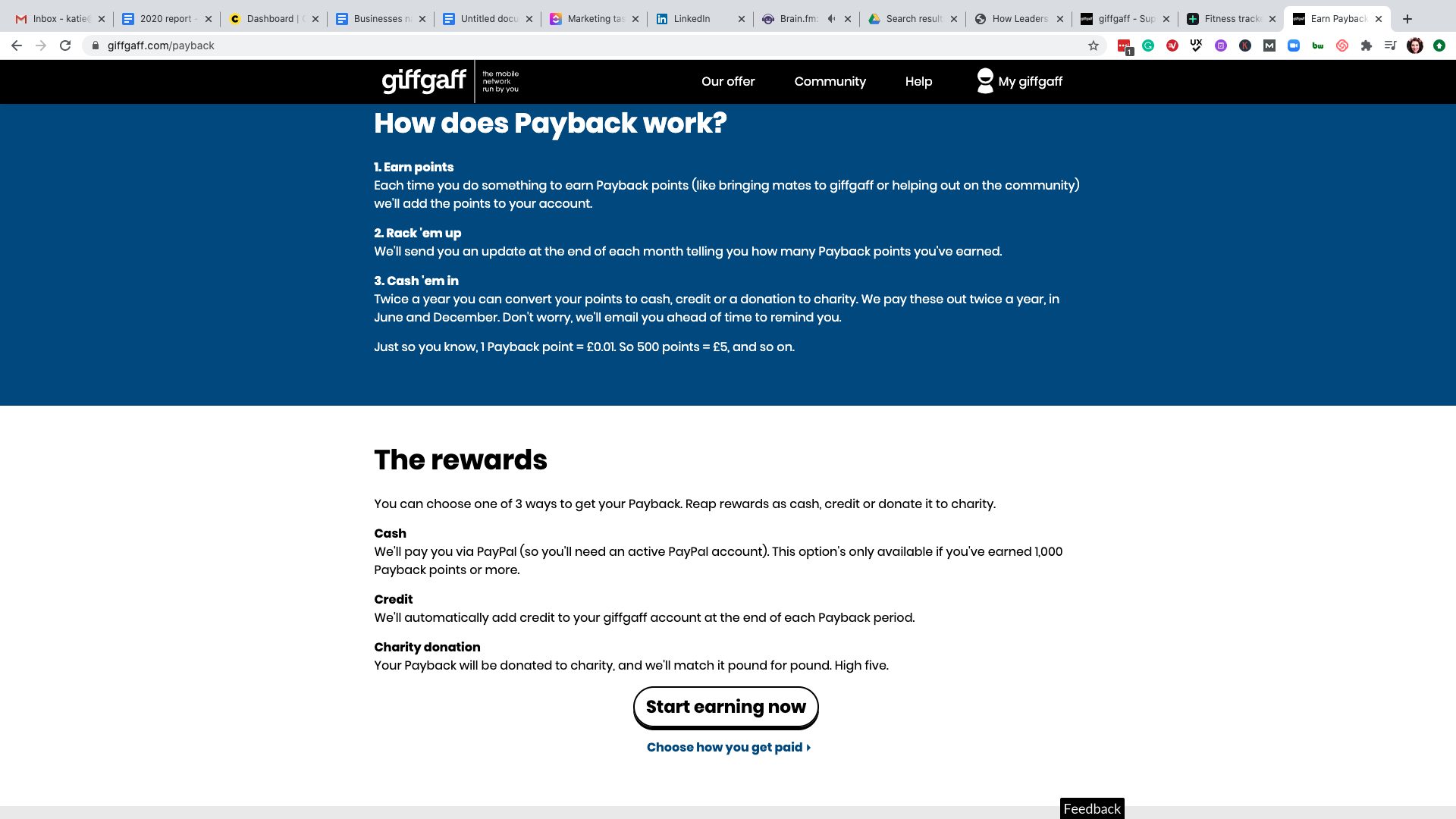

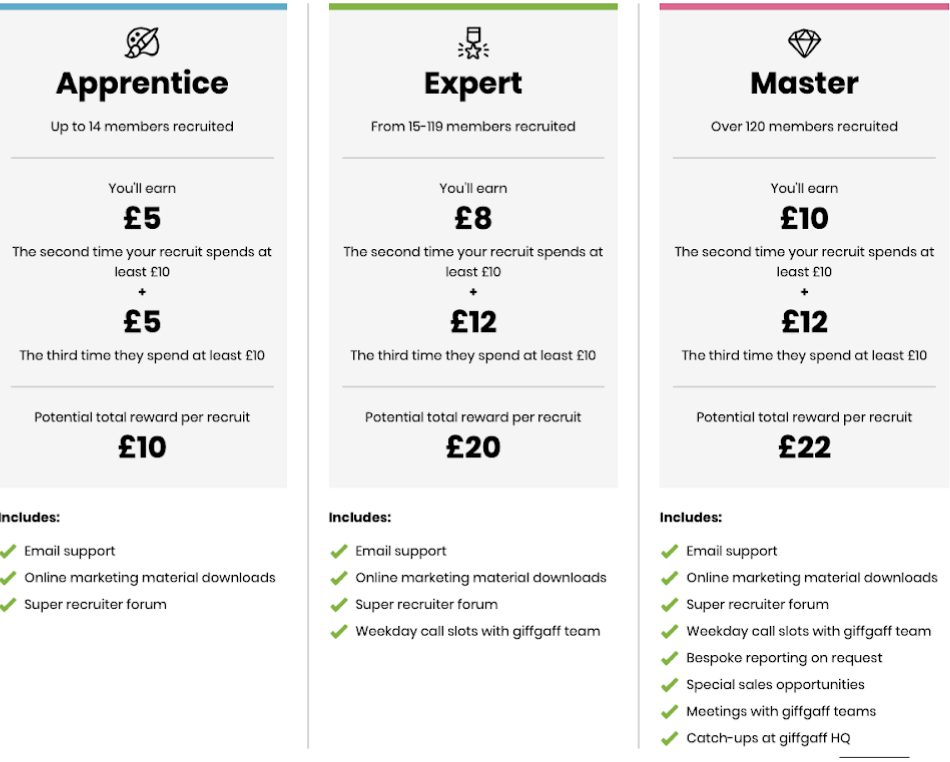

Thanks to the success of its online community, giffgaff has a program to reward its own customers for solving issues–they don’t need a call center. Official online giffgaff agents handle only a fraction of users’ questions.

After visiting the help and support board, only 1.59% of users get in touch with an agent. (giffgaff reports these figures monthly within the forum itself, too.)

Their members have helped solve 38,648 cases on the community forum (around 3,000 a month), and questions were answered within an average of three minutes, compared to the industry standard of 15.

From a customer’s point of view, there’s nothing more powerful than being helped by someone who’s been in your situation. Members receive “payback” by answering questions, giving ideas, and referring new members. Some members have reported making large sums of money, paying for weddings, or supporting themselves alongside a full- or part-time salary.

The initiative has built additional brand advocacy among members like Chris:

It’s truly an incredible feeling, it’s like the perfect world. Every time you see someone responding to a giffgaff message is always a happy, positive experience. The word “community” to me is under-rated where giffgaff is concerned, it’s more like a family.

There isn’t another company out there I can say that about. More and more as time goes by, it’s affirmed—I know I’m on the right network. It’s my giffgaff, our giffgaff.

Takeaway: Customer-powered business models—where customers fulfill roles traditionally held by employees—can work. Consult your users/customers on which financial or emotional rewards would incentivize them and split test the ideas.

Ocado

Ocado, a premium, digital-first supermarket, has become the biggest grocery retailer of its kind in the world. They even created a B2B technology agency called Ocado Solutions to help build other online supermarkets.

So what have they done to become so successful?

8. Show you get it with little touches.

Sometimes, it’s the small things that matter—like their delivery date picker. It looks great and is easy to use but also shows that Ocado has really thought about what’s important to their customers.

They highlight delivery slots when they’re already delivering in your area. That helps customers feel good about reducing the emissions of delivering their food, while also increasing efficiency and reducing costs.

Takeaway: Work out what really matters to your customers—beyond their use of your product or service. Are they worried about their kids leaving for university? About their environmental impact on the planet? Customize your offering so that it matters more.

9. Make the most of one-on-one experiences.

Ocado has focused on maximizing the value for the limited interactions with its staff.

The email I received on the morning of my first delivery was written as if it were from the driver himself (to my husband, whose name was on the account):

When the delivery driver arrived, he already knew it was my first order and made a point of talking me through things. He explained how the shopping bags were color-coded depending on whether the food was for the fridge, freezer, or cupboard, then told me there was a little welcome gift, too.

I know most people wouldn’t be that impressed with a free tea towel, but it wasn’t expected at all. I really valued the gesture.

Takeaway: Even if you’re an online brand, make any one-on-one experiences in the customer journey as personable and memorable as possible.

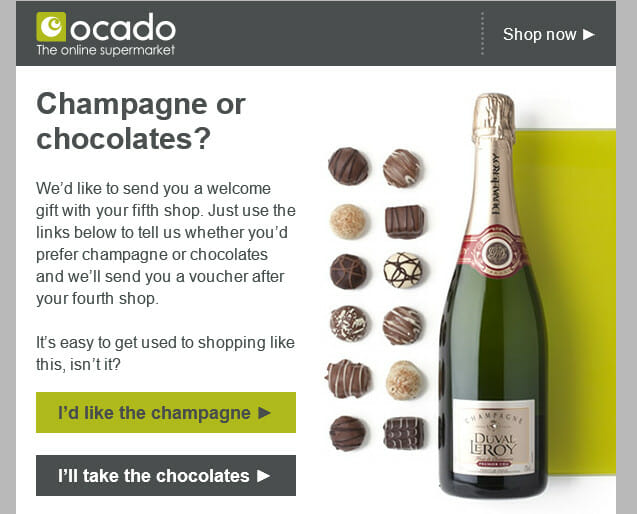

10. Surprise and delight.

My first shopping experience was really easy, and the little surprise meant that I had started telling friends how good Ocado was.

But the service comes at a premium, and I walk past the local supermarket every day. I wasn’t sure whether I’d shop again. Then this happened:

Free champagne or chocolates if I shop with them four more times? I don’t get that from Tesco. I counted each order I made after that point, looking forward to the shop when my bottle of champagne would arrive.

There are some subtle psychological techniques at play here—user delight, the “power of free,” loss aversion, and priming about the value of shopping with Ocado. But it also wasn’t a simple email I read and filed away. I had to engage with it to choose which gift I wanted. I spent time thinking about it and reacting to it.

Neuroscience research shows that humans are hardwired to crave the unexpected. Surprises can influence consumer behavior, encouraging word of mouth, loyalty (craving the next surprise), and increased spend. There are positive effects even if the gesture is small.

This initiative also helps customers create new routines. Habits help put the decision-making part of the brain in sleep mode. You’ve probably noticed this yourself—if you drive the same route home every day, sometimes you arrive home without remembering driving at all.

Ocado does this by letting customers reserve the same delivery slot each week and adding frequently purchased items straight to your basket to help you shop on autopilot.

Takeaway: Use psychological principles to help understand how your customers think and what you can do to enhance the business and experience you offer.

Conclusion

These three businesses offer a ton of ideas to help you focus on your customers. From ways to get feedback consistently to doing what’s truly best for them (even when it seems counterintuitive) to techniques that surprise and delight.

Here’s a recap:

- Throw out established processes.

- Find new ways to fix old customer pains points.

- Do what’s best for the customer—even if it doesn’t grow revenue.

- Let customers help answer big business questions.

- Build genuine relationships by speaking with your customers daily.

- Co-create the experience.

- Help customers help customers.

- Show you get it with little touches.

- Make the most of one-on-one experiences.

- Surprise and delight.

Now the question is—what will you work on first?