Omnichannel Consumers and Retail of the Future

Retail is continually evolving to embrace new technology, the rise of ecommerce and changing consumer shopping trends. With these continual changes, the tactics used by retail marketers are also adapting.

The Rise of Ecommerce

eCommerce continues to grow at an unprecedented pace. In 2017 it reached around $2.3 trillion and is expected to hit $4.5 trillion in 2021 (according to a Statista report). In the US alone, ecommerce represents almost 10 percent of retail sales — a figure that is growing by nearly 15 percent each year.

Retailers can’t expect to remain competitive unless they are present on their customers’ preferred channels. Investments in online, digital and mobile channels is a necessity. In fact, eCommerce/digital influences up to 56% of in-store purchases. Many consumers are also shopping online via their mobile devices. As much as 11 percent of online shoppers now shop online via their smartphone on a weekly basis, and 35 percent say it will become their main purchasing tool. (source – Shopify)

Amazon continues to be a major player. According to a report by Walker Sands, a third of consumers (32%) now receive one or more Amazon packages per week, and one in ten (10%) consumers receive three or more Amazon packages per week. Millennial consumers ages 18-35 are even more likely to receive multiple Amazon packages regularly — in fact, nearly half (43%) report they receive at least one Amazon package per week.

The Personalized Experience

Personalization is a top priority for marketers – consumers are in control and want and expect a personalized experience. However, as new concerns over privacy emerge, brands are beginning to take a new look to balance personalization with data privacy.

Despite the many studies that cite consumers want personalized messages, studies also exist stating that consumers only want personalization if it’s done right – meaning not overly creepy or overly invasive. Personalization on their times. This can be challenging for brands – knowing how far to take it and what may be crossing the line.

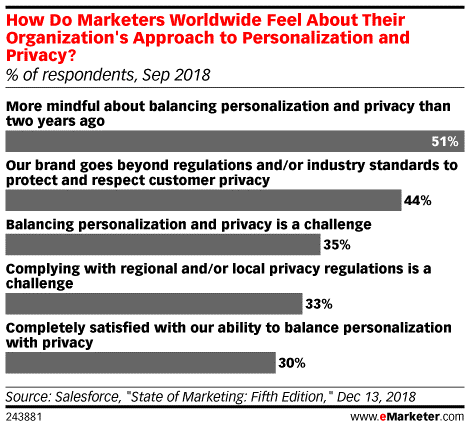

In a study by Salesforce, 51% of respondents stated that they were more mindful of balancing personalization and privacy than they were two years ago.

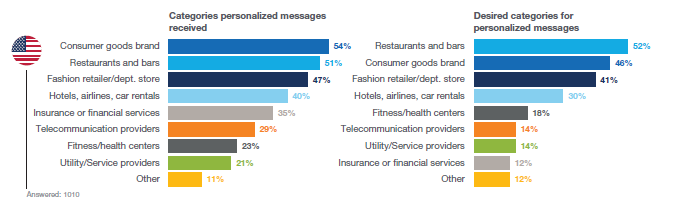

McKinsey recently performed a study to better understand consumers’ reactions to privacy. In looking at industries that consumers receive personalized offers from, the industries they receive personalized communications from and those they wish they did are fairly in sync. Topping the list are consumer goods brands, restaurants and bars, and fashion retailers and department stores.

The In-Store Experience

Despite the rapid growth of ecommerce, more brands are looking to establish a physical presence in 2019 and beyond. Brands with a strong online presence can see even greater benefits by establishing physical stores. Benefits include the ability to better engage with their customers, the ability to provide better experiences, and more flexible purchasing options for customers.

- The top reason consumers prefer to shop in-store versus online is to see, feel and experience the product in person. (KPMG)

- Physical stores account for roughly 90% of all retail sales (at least in North America). Five years from now, by most estimates, that number is still likely to be well over 80%. (Forbes)

- According to Google, 61% of consumers would rather shop with brands that have a physical location than with brands that are online only. Also, nearly 80% of shoppers go in-store when there is an item they need or want immediately. (Google)

- 57% of consumers say that the closing of many department stores has negatively impacted their perception of ecommerce. (Avionos)

While many consumers enjoy shopping at brick-and-mortar locations, brands must continually work to provide exceptional in-store experiences. First and foremost, consumers are looking for omnichannel experiences. Shoppers might make a purchase online but opt to pick up the item in-store. When shopping in-store, many consumers use their phone to look at product photos on social media, compare prices, or check customer reviews. Consumers switch between shopping channels, and they expect a consistent experience no matter how they are interacting with a brand.

In research by Boston Retail Partners, 79% of consumer respondents said personalized service from a sales associate is an important factor in determining at which store they choose to shop. Another 56% of consumers responded they are more likely to shop at a retailer that allows them to have a shared cart across channels, while 50% said they are likely to allow retailers to save purchase history, personal preferences and personal details if it eases the checkout process and allows for more personalized offers.

Social Shopping

Social media channels are a way of life – your consumers are using these channels and they want to purchase on them as well. Social commerce is going to continue to grain traction in the future. Already, 60% of Instagram users say they find new products on Instagram and 30% of online shoppers say they would be likely to make a purchase from a social media network like Facebook, Pinterest, Instagram, Twitter or Snapchat. (Big Commerce)

Some of the most common social commerce features include:

- Buy buttons within social media posts

- Shoppable posts and stories

- Ads on social networks including calls to action redirecting to e-commerce sites

- Peer-to-peer buying and selling

- Social commerce plugins and apps

Social commerce is still a relatively new area that many retailers are continuing to explore but the opportunities and potential are well worth taking the time to learn.

Every shopper takes a unique path to purchase. With more options, devices and channels on which to shop, there are numerous variations before a consumer decides to make a purchase. Today’s brick-and-mortar and ecommerce players a like must take every step to continually optimize every step along the omnichannel path to purchase.