The chasm. It’s a giant gap on the uphill swing of a distribution line popularized by high-tech marketer Geoffrey Moore in 1991.

The chasm. It’s a giant gap on the uphill swing of a distribution line popularized by high-tech marketer Geoffrey Moore in 1991.

Crossing that chasm is a high wire bridge between technology enthusiasts and the majority of the market. It required a certain shift to happen: for early adopters to prefer performance while the majority of the market prefers convenience. Achieving this meant we had arrived.

Moore, I believe, reflected on this topic in the context of a single technology or product, the leap that would put a technology company on a path to growth or push a niche concept into an industry: think cloud computing. However, social media as a whole is much larger than any single technology or platform, even if you have 900 million users.

So has social media become easier to use?

It might be hard to tell over Facebook’s latest noise, but generally speaking, yes, I think it has. A whole industry has mushroomed around this idea – all providing algorithmic recommendations, automation and scalability. There’s another factor: the buying cycle has changed, perhaps crossing a chasm of its own, and business from Wall Street to Main Street must and are in fact adapting accordingly.

Here’s a look at three surveys of the SMB market and its adoption of social media:

1. Main Street Goes Social. Borrell Associates surveyed 4,000 small- and medium-sized businesses (SMBs) between January and August 2011 and published the results of their study in January 2012. The study found that the majority of SMBs had a least some social presence, with an average of 63.4% of SMBs maintaining a social network site or page.

SMBs are finding good reason to maintain social presence too since 58% of these businesses said that new customers was the top way to measure results. Several indicators followed as measurement benchmarks: 1) fans and followers (46%) 2) traffic to social pages (44%) 3) Web traffic (44%) and 4) new email contacts (43%).

For all the success, social media ranked third in the top three areas of marketing SMBs said they would invest in during 2012 including: 1) email (17%) 2) search and PPC (15%) and 3) social media marketing (14%).

The full report costs $1,000, which I was unwilling to pay for the purpose of this blog post, so the exact demographics of the SMB in this survey are not discernible.

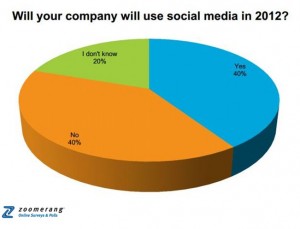

However, what really stood out for me was the dichotomy between the 40% planning to use social media and the other 40% with no plans. For those with plans, 66% cited affordability as the primary reason, with another 56% saying they used it because their customers used it. For those without plans, 41% said they could not see the value, which I understand, because in 2007, I thought Twitter was a waste of time too.

While the survey reports taking the pulse of 1,000 SMBs, a look at the demographics says 64% of respondents worked at businesses employing between 1 to 10 people. This means the answers probably more closely reflect a small-business perspective than a medium-sized business perspective. In my mind, this explains the differences in social media’s penetration between the Zoomerang survey and the Borrell survey; the resources available to a $30 million company vastly outmatch those of a $1 million dollar company.

3. The 2011 Inc. 500 Social Media Update. Of the three surveys in this post, this survey is the only one that is statistically valid. Researchers at UMASS Dartmouth conducted a telephone survey of 170 respondents belonging to the Inc. 500 between September and November of 2011. This survey made the rounds in the blogosphere because it found blogging has fallen in popularity from 50% in 2010 to 37% in 2011. What was lost in the headlines, among the fact the demographics of the Inc. 500 had changed, was a 14% jump in those Inc. 500 companies that had plans to begin blogging.

That aside, this survey of Inc. 500 companies, which in my professional judgment neatly fits the market persona for the SMB market, demonstrated substantial interest in social media:

- 90% said social media was “important for brand awareness and company reputation.”

- 80% view social media “as important for generating web traffic” and 81% “for lead generation.”

- 74% were using Facebook while 73% were using LinkedIn.

- 73% said “social media tools are important for customer support programs.”

At a recent social media networking event, an acquaintance said that we (marketers) were two years ahead of the average user on social media. He meant of course, we are part of Moore’s early adopter group. Perhaps that’s true, but it’s not giving credit to what the research is telling us: social media is more widely adopted today that we might instinctively believe and further, it promises to gain more this year.

Photo credit: Zoomerang and Marketing Charts