Have you recently woken up, realized you are no longer in your 20’s or 30’s, and decided it’s time to get serious about your retirement planning? If so, here are a few suggestions for how to get yourself on the right track.

1. Give Yourself a Checkup

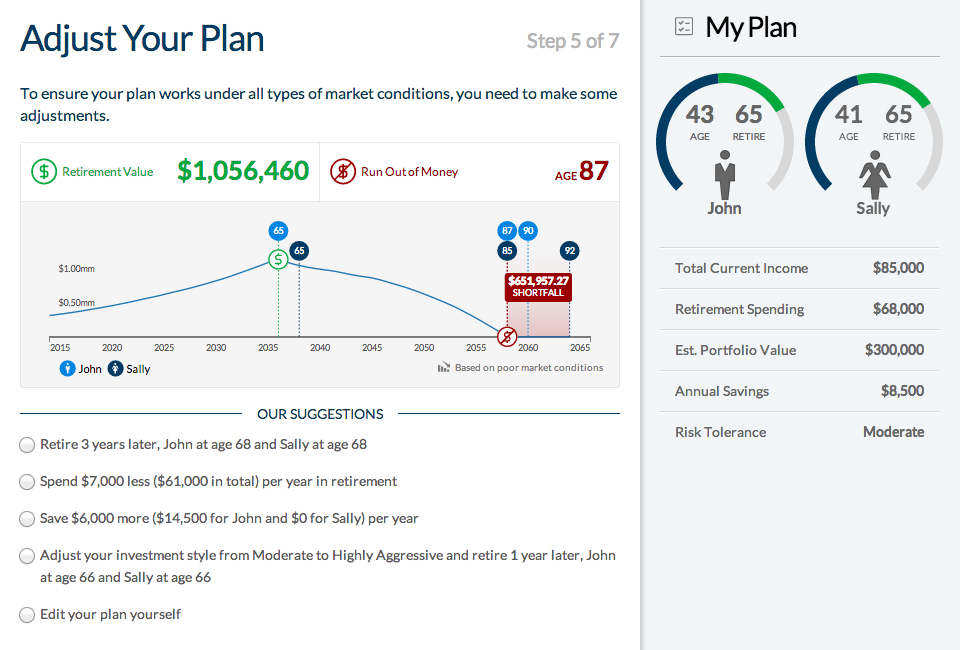

The first thing you should do is understand your current situation. There are many retirement planners available online that can help you with this. You just enter some basic details about your age, income, savings, and your retirement target date, and the tool will tell you if you are on track. If you aren’t, it will provide recommendations on what to do next.

2. Review Your Expenses

If you’re like most people, over time you’ve started to accumulate a fair amount of discretionary spending. Whether it’s eating out more often than you used to, outsourcing every project around the house, subscriptions to services you rarely use or even just Starbucks 3 times a week, there are probably plenty of places where you could find some extra savings. Try tracking where every dollar goes for a couple of months. You’ll be surprised just how many opportunities you have to cut costs.

3. Maximize Your Tax Advantaged Savings

One easy way to enforce the discipline of savings is to max out your 401k. By taking the money out of your paycheck, you eliminate the temptation to spend it. If you don’t have access to a 401k, have your bank do automatic monthly withdrawals to an IRA to accomplish the same thing. If you live until 90, you still have over half your life to take advantage of the power of tax deferred compounding.

4. Save More in Taxable Accounts

Don’t stop with simply contributing to tax advantaged accounts. Because there are limits on both the amount you can contribute and potentially the investment options available to you, you will likely need a taxable account to meet your goals. A financial advisor can work with you to identify your retirement needs and advise you on the most appropriate options to help you meet those goals. Wealthminder’s proposal request tools allows you to identify your needs and connect with the right financial advisor for you.

5. Don’t Get too Conservative

A big mistake many investors make is becoming too conservative in their 40’s. You still have a couple of decades until you retire and likely a couple more decades in retirement. Your portfolio should probably have a decided tilt towards equities and be well diversified across a range of domestic and international stocks and bonds. Your financial advisor can recommend an allocation and investment approach that fits your specific situation.

5. Put Yourself First

One retirement planning challenge people often face in their 40’s is called the “sandwich problem”. With aging parents on one end and college/young adult children on the other, people are often caught in the middle with the need/desire to help both from a financial perspective. It is very common for people to put their dependents first and ignore their own needs, especially retirement. You need to resist that urge. No one is suggesting you abandon your family, but you need to look for realistic ways to manage the costs.

For parents, that might mean downsizing their housing to a more senior-friendly environment or having them move in with you to reduce overhead costs. For kids, it might mean a less expensive college, 2 years at a community college before transferring or student work/loan programs. The bottom line, especially with college, is there are plenty of options to reduce costs or place more of the burden on your child (in a manageable way). On the other hand, no one is going to loan you money for your retirement.

Stay Healthy

One of the biggest expenses in retirement, healthcare is a retirement planning wildcard. While there isn’t a whole lot you can do about genetic issues, there are plenty of preventable health problems that are completely in your control. Keeping your weight in check, exercising regularly and not smoking are just a few of the things you can do to put the odds more squarely in your favor. While not exactly rocket science, perhaps money will serve as a better motivation to take preventative action than traditional means.

Conclusion

Even if you’ve been asleep at the wheel until now, you still have time to recover and get on track for a happy and prosperous retirement. But you need to get started. And even if you have done a good job so far, there’s still a long way to go to the finish line. The good news is you have the ability to influence the outcome, particularly if you are working with a licensed financial advisor who can help you plan and achieve your retirement goals.