In addition to the many headlines about Donald Trump being the likely nominee for the Republican Party, another trend in Europe has the continent buzzing. The term Brexit, which stands for British Exit, is similar to the term Grexit. It refers to the chance that Britain might leave the European Union (EU).

Leading the effort against this initiative is Conservative Party leader and Prime Minister David Cameron. The push for a referendum on Britain’s EU membership goes back to 2013, with a vote set for June 23, 2016. A recent report from the Pew Research Center (PRC) shows that many people have a positive view of the EU and believe that a United Kingdom (U.K.) exit would be a negative outcome.

Based on the PEC research, 51 percent hold a positive outlook of the EU versus 47 percent unfavorable view. In addition, just 16 percent hold the UK´s departure as a Good Thing whereas 70 percent consider UK leaving a bad outcome.

Nevertheless, the EU favorability varies widely across Europe. Below is a list of the countries with percentage distribution with a favorable view of the EU:

- Poland 72 Percent Favorable

- Hungary 61 Percent Favorable

- Italy 58 Percent Favorable

- Sweden 54 Percent Favorable

- Netherlands 51 Percent Favorable

- Germany 50 Percent Favorable

On the other hand, here are the following list of countries that hold a larger unfavorable view of the EU:

- Spain 49 Percent Unfavorable

- UK 48 Percent Unfavorable

- France 61 Percent Unfavorable

- Greece 71 Percent Unfavorable

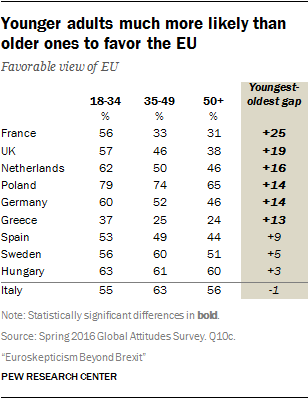

So if the perceptions vary by country do they vary by age? The PRC findings suggest there are differences. Conforming to the data younger adults it is much more likely than their older counterparts to favor the EU.

Overall, the overwhelming sentiment for Europeans is if the UK leaves it will hurt the EU, conforming to the PEC analysis. This campaign has been pushed by PM Cameron, party affiliates and proponents in favor of it. What may have added fuel to this debate is the surge of migrants coming from Syrian as a result of the civil war.

In addition to the Syrian refugee crisis add the terrorist attacks in Paris and Brussels. Combine all of these recent events it is a call for concern for the UK´s safety.

Insights, trends and EU Happenings

It is safe to say that the Brexit has gathered plenty of attention across Europe and the supposed market panic it may bring with it. In a separate yet related event as reported by Global Research Switzerland recently withdrew its application to join the EU, which will invalidate the 1992 petition to join the European bloc of countries.

If the vote clears the UK exit from the EU it will not necessarily translate into complete sovereignty for the nation. In a detailed analysis by Swissinfo.ch it highlights in spite of Switzerland not being part of Eurozone and having a degree or a certain type of sovereignty it still has to abide to the rules imposed by Brussels. These rule can be anything related to tax, financial and immigration services.

There are no indicators to prove that the UK is following the Swiss model. However, how the immigration policies will shift or change the rights of Brits leaving abroad in places like in Switzerland or elsewhere remain unknown for now.

For example, Geneva like London has become an important financial center in Europe. You can find diversified financial services, a list of solid private equity firms (Partners Group, Index Ventures, CapVis Equity, Manixer, etc). The city of London alone is an important financial centre not just for the EU, but for the global economy so the repercussions of this Brexit could affect the country´s economy in the long haul.

American economist, Paul Krugman, explained in his post that in spite of the dysfunctional dynamics within the EU Britain should remain. The country has its own currency and has performed better than countries that use the Euro currency.

Furthermore, Krugman explains this departure will have an immediate impact on the country´s gross domestic product (GDP), and the privileges exercised by British expatriates. Whatever side of the argument you are on it is clear Britain’s influence and position in the EU remains valuable, not to mention essential.

Takeaways and Conclusions

As a vote looms and markets brace for a potential Brexit there are other risks worth mentioning. In a Marketwatch.com news story there are other factors that elected officials should be paying close attention to. In this scenario overvalued markets are a cause for concern and locating the next bubble is paramount. Did the real estate and housing bubble cause enough financial havoc? Of course, they did and the remnants still live on even today.

Britain and the rest of Europe share an intimate relationship and centuries of history together. It has definitely gone through many ups and downs, especially the two World Wars, and settling the differences is needed at a time of many evolving crises plaguing the continent.

The campaign for Brexit will not just create financial setbacks, but certainly add additional layers of complication and lots of red tape. It will make relations much more ineffective at a time when streamlining cooperation and unifying efforts is needed unlike any other time in its history.

Finally, “cross-border commercial relations stand to be greatly destabilized as exchange rate will experience important variations”, explained Marwan Naja, CEO of Manixer.