What are the benefits of market research for professional services firms? Is it worth the cost? And does it really matter?

These are some of the questions we get from our clients when we recommend researching their current clients and target markets. While on some level we all know that market research is a good thing, these are legitimate questions. What exactly are the costs and benefits of market research?

Why Market Research?

Let’s start with why your professional services firm should consider using market research in the first place. There are a number of occasions where market research is appropriate. Here are some of the most typical situations where you’d use it:

- When your firm is launching a new service

- When you’re looking to select verticals to concentrate on and specialize in

- When you’re developing your organizational strategy

- When your firm is seeing a diminishing market share

- When your industry environment is changing

- When your firm needs to accelerate growth

The Benefits of Market Research

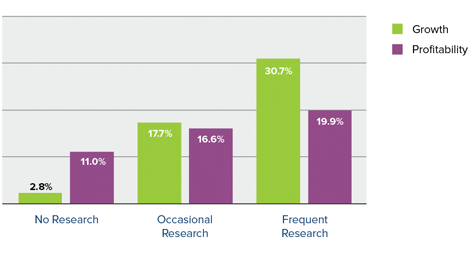

While market research offers many unseen advantages for understanding your current and potential clients, like improved targeting and a clearer picture of your firm’s reputation, there is also a clearer, direct way to measure its benefits. In a study of high-growth professional services firms, we discovered that firms that conduct organized, structured research on their target clients tend to be more profitable and experience faster growth.

This relationship is documented in the figure below.

This figure shows the growth rate and profitability of professional services firms that do no research, occasional research or frequent research (at least quarterly) on their target client group.

Because of the specificity of these findings we are in a position to project the true economic benefits of market research for services firms. But first let’s consider the cost side of the equation.

The Cost of Market Research

The price of a certain market research program depends on the research method chosen (for instance, face-to-face interviews cost more than phone interviews) and the necessary sample size. Bigger companies usually need a larger sample. Considering these differences, we have estimated the usual costs for market research done occasionally (once a year) and for regular research (quarterly).

Below are estimated costs for a single round of research for three sizes of firms:

- Small ($ 5M revenue): $10,000

- Medium ($20M revenue): $20,000

- Large ($200M revenue): $40,000

For a program of frequent research (quarterly) you can simply quadruple these estimates. And keep in mind that the average duration of a market research project ranges from about 2 to 8 weeks.

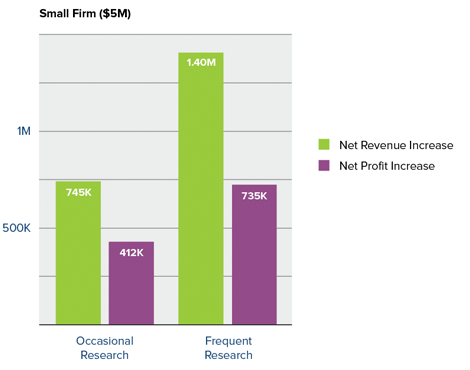

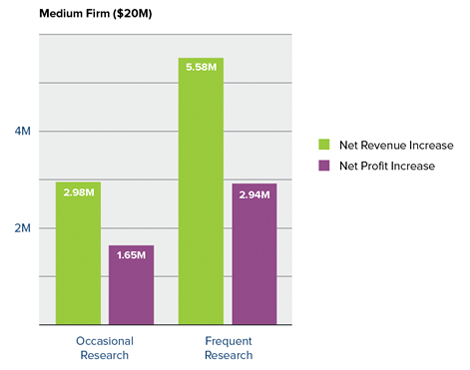

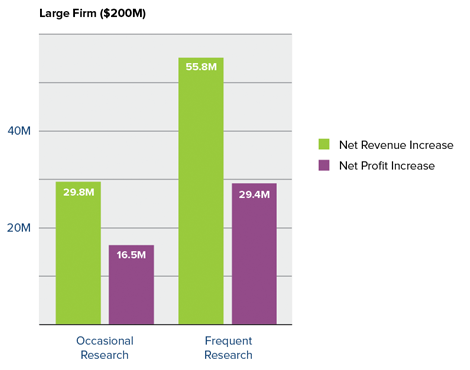

The Return on Investment of Market Research

With estimates for the costs and economic benefits, we can now calculate the return on an investment in a program of market research for a professional services firm. For each of the three firm sizes, we’ll subtract the total research cost from the economic gain. This shows the net increase to top line revenue and bottom line profitability over a one year period.

Two things are immediately apparent from this analysis. First, the net return on invested research dollar is very sizable. If your firm realizes even a small fraction of the documented benefits of market research, you are well advised to make the investment.

The second observation is that the larger the firm, the greater the return on invested dollars. This is a very straightforward relationship arising from the observation that the expense of market research does not rise in lockstep with firm size. Put another way, market research is a relative bargain for larger firms.

Putting Research to Work in Your Firm

Sadly, market research is not magic. To enjoy the generous benefits it can provide, you need to take it seriously and systematically use it to adjust strategy and shape staff behavior. As it turns out, well-conducted and well-presented market research is often a powerful catalyst for change.

Historically, professional services marketing has been driven by hunches and habits. But most professionals are pretty logical and fact based in their work. Consequently, they are often refreshingly open to new data on their clients’ behavior and perceptions. Perhaps that is why it works so well.