Unfortunately, the law makers at the European Union do not understand the struggles of professional bloggers. They think we’re having it too easy. So they’ve passed a new law that’ll completely change the way we, the bloggers and digital marketers, approach digital product selling.

The European Union VAT-MOSS for Digital Products

From 01 January 2015, the EU VAT-MOSS for digital products will come in to effect. This new law makes it extremely hard for bloggers and digital sellers to sell eBooks, tutorials and any other form of digital products to the buyers in any of the 28 EU member states.

Simply put, the new EU VAT requires YOU, the seller, to pay a value added tax on every sale you make to the buyers in the European Union (EU). The tax will be calculated based on the buyer’s location, NOT the seller. This law is applicable to sellers even outside the EU.

So if you’re a blogger or a digital marketer in the United States, and a buyer from Greece, or any other EU state, purchases an eBook from your blog, YOU will be required to pay the EU VAT on this sale.

What’s more, you need to submit a tax return for this VAT every quarter to the relevant EU state (28 EU member states, 75 tax rates). To make this process simpler, you can register with the “Mini One Stop Shop” (or MOSS) in any of the EU member states (UK or Ireland are the most convenient). The MOSS will then distribute your taxes to the relevant EU states.

Along with the returns, you need to submit at least two pieces of evidence that verify your buyers’ location. This is mostly done on the basis of the buyer’s IP address or credit card information. You will also need to preserve this evidence for at least 10 years.

All of this is pretty dry legal stuff but, as a digital seller, you need to be aware of it and how it will impact your blogging income. I’m not a legal expert and this post should not be considered as legal advice. You can study these laws in more detail here.

What Should You Do To Handle EU VAT-MOSS

There’s already outrage in the blogging community on these new developments. Many digital sellers have raised concerns over the apparent lack of understanding on the part of EU law makers. There’s even an active online petition to reconsider these laws.

The biggest challenge that you face, as a result of VAT-MOSS, is that you now need to accommodate the additional tax in your product price. This would obviously make the price a little unattractive for the buyers. But at the same time, you also need to collect evidence of your sales for the EU and submit the returns every quarter. This can result in significant administrative costs over the long run.

Another apparent challenge is that the majority of ecommerce software providers are yet to make any changes to their software to accommodate these law changes. For example, you’ll need your software provider to detect the buyer’s location, IP address and credit card location so that you can use it as evidence for your VAT-MOSS submission. PayPal have announced that they can provide the buyer’s location through its API, but there’s no update from them on the other evidence requirements.

Until now, the only ecommerce solution, in my knowledge, that has features to accommodate EU VAT-MOSS, is Selz.

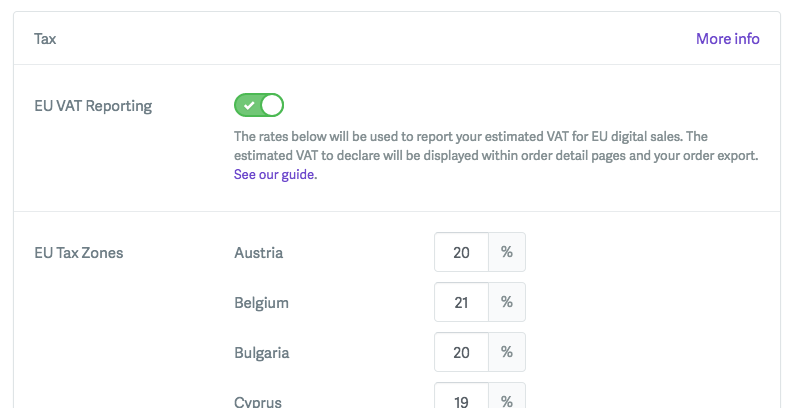

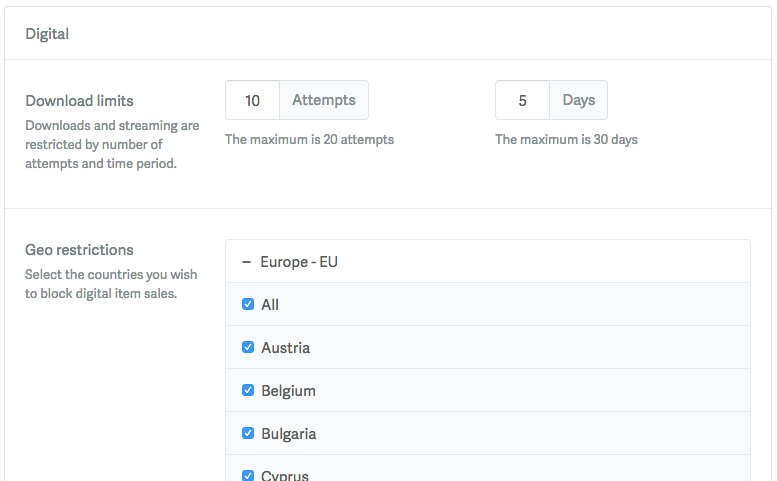

They have a couple of features that will allow you to automatically calculate VAT on every sale, detect the buyer’s location on the basis of IP address and credit card, and report the standard VAT applicable in that country. They will also store your sales evidence for up to 10 years, as required by the EU VAT laws.

In case you want to completely block off your sales to buyers from the EU (507,000,000 potential customers), you can apply country based restrictions in Selz.

Conclusion

The EU VAT-MOSS has taken the blogging community by surprise. There’s been widespread outrage on these laws and there have been attemts to convince the lawmakers to change these laws. However, if you’re a blogger, selling digital products like eBook, eCourses, tutorials or any other form of digital products, you need to prepare yourself for the likely implementation of this law from 01-Jan-2015. For this, make sure you the right tools at your disposal that can collect the required information on your behalf and save you from any potential legal complexities.